Filing Late FBARS as an American Abroad

November 5, 2021 | Blog, Foreign Bank Account, The Streamlined Procedure | 3 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

All blogs are verified by IRS Enrolled Agents and CPAs

All blogs are verified by IRS Enrolled Agents and CPAs

Are you in the process of filing lates FBARs as an American abroad? The FBAR is the Foreign Bank Account Report by FinCen – the Financial Crimes Enforcement Network. Penalties can accrue if you have not been filing them when you should have. Therefore, knowing if you need to file and catch up on filing late FBARs as an American abroad is important.

Who Files an FBAR?

Factually speaking, American citizens living abroad must report their worldwide income to the IRS if their worldwide gross income reaches the filing threshold. But along with a tax return, US expats may also have to file the FBAR.

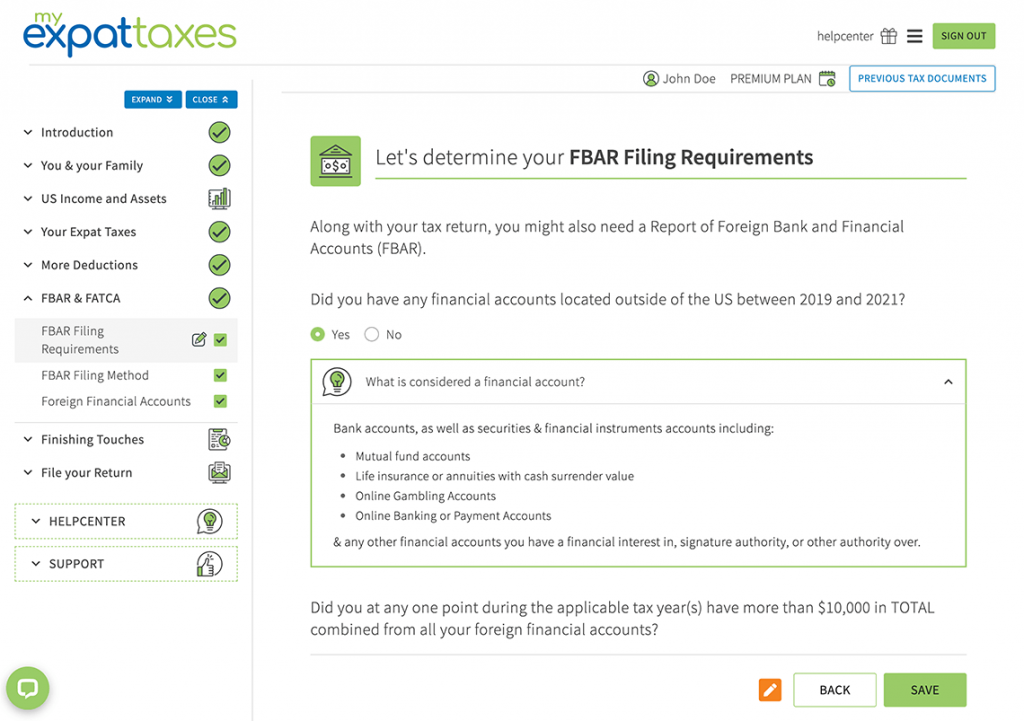

If you are a US citizen abroad and have had at least $10,000 combined from all foreign financial accounts at any one time during the year, you must file an FBAR. Financial accounts are like savings, checking, investment accounts, and accounts that you have signature authority over overseas. Signature authority accounts could be, for example, a business account you share with someone.

Keep in mind that the $10,000 must be converted from your foreign currency to US dollars. Therefore, it’s more important to check your bank account frequently and convert to US dollars to see if at any one time during the year you reached the $10,000 total.

The MyExpatTaxes tax software makes it super easy to file the FBAR electronically and for an affordable price. So you don’t have to worry about filling out paperwork and getting overwhelmed.

Deadline to File the FBAR

Americans overseas have an automatic extension to file their Foreign Bank Account Report for FinCen until October 15. This extension date is different from what Americans in the US have because their deadline is April 15.

Did you miss the deadline and thus need to start filing late FBARS as an American abroad? As long as you didn’t receive a notification or warning from the IRS, you can use a penalty-free amnesty program to catch up (see more below).

FBAR Penalties for Not Filing

The Internal Revenue Service currently has information about US bank holders from thousands of banks around the world. This information means that it will become harder to avoid filing the Foreign Bank Account Report. Furthermore, the IRS is using better technology and algorithms through artificial intelligence to track Americans who are not reporting.

If you should have filed an FBAR but didn’t and the IRS knows about it, you will be sent a letter and have to pay non-compliant fees. Forgetting to file an FBAR and being caught from it can lead you to paying around $1,000. However, the fees can be as large as $10,000 per year (sometimes per account) of non-willful filing. Plus, you may have your US citizenship revoked.

For more information about penalty fines from our blog post, FBAR for Beginners.

How Does the IRS Know You Didn’t File?

As an American abroad, forgetting or avoiding a single document can be costly. How would the IRS know you didn’t file an FBAR when required to do so?

When you sign up for a bank account as an American expat, you will need to sign additional forms because you are a US citizen. These forms ask you for your Social Security Number and that you grant the IRS access to your account information.

Your permission is how the US financial authorities get information from your foreign bank account. They easily cross-reference your records to see if you didn’t file an FBAR when you had an obligation to do so.

If the IRS has contacted you regarding late FBAR forms, we suggest you contact a US tax attorney to get out of the predicament as smoothly as possible.

Learn more about filing delinquent FBAR submissions through the IRS’ website.

How to File Late FBARs as a US Expat

If the IRS hasn’t contacted you yet about filing an FBAR, this is excellent news. You can start filing FBARs late without tax penalties.

Here are two ways you, as an American expat can catch up and file your late FBARs:

- If you already filed your tax return (either through us at MyExpatTaxes, another tax company, or on your own), you can back file your FBAR through our online portal or the FinCen portal. You can do this for any qualifying years and need to explain why you didn’t file them before (i.e., you were unaware you had to do them).

- If you have not filed your tax return yet, you can make up for lost years by using the Streamlined Procedure tax amnesty program. This program is exclusively for Americans abroad who didn’t know they had to file taxes from abroad without facing tax consequences and fees.

See more photos of how to file the FBAR via MyExpatTaxes.

Ready to Catch up on FBARs?

Our tax professionals and support team can guide you every step of the way when it comes to catching up on your FBARs and expat taxes. The MyExpatTaxes software is designed with you – an American abroad – in mind. That means, even with the most complicated tax profile, our prices will remain the same, and you’ll receive the support you need. Sign in to our app and work with a representative today!

Written by Michelle H.

November 5, 2021 | Blog, Foreign Bank Account, The Streamlined Procedure | 3 minute read