Do I Need to File an FBAR?

September 21, 2021 | Foreign Bank Account | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

All blogs are verified by IRS Enrolled Agents and CPAs

All blogs are verified by IRS Enrolled Agents and CPAs

Perhaps as an American abroad, a few thoughts have streamed through your head like “What is FBAR filing” or “do I need to file an FBAR?” Here at MyExpatTaxes, we encounter questions like these on a weekly basis from expats in need of tax understanding and support.

The FBAR is an extremely important form if you’re an American abroad – but you may not need to fill it out. This is because it all depends on how much is in your bank account. That’s right, it’s all about the money.

In today’s post, we’re going to walk you through everything you need to know about FinCEN form 114.

What is the FBAR

The FBAR gets its name from its original title, the Foreign Bank Account Report. Today it’s actually called the Report of Foreign Bank and Financial Accounts. According to the IRS, a US American expat who is living and working abroad must file an FBAR if you meet these two requirements:

1. the United States person had a financial interest in or signature authority over at least one financial account located outside of the United States; and

2. the aggregate (total) value of all foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

”United States person” includes U.S. citizens; U.S. residents; entities, including but not limited to, corporations, partnerships, or limited liability companies, created or organized in the United States or under the laws of the United States; and trusts or estates formed under the laws of the United States.

IRS

This can be complicated for the average American expat to understand, so we’ll break everything down in the next paragraphs:

What is FBAR Filing?

To determine whether you need to file is based on how much is and has been in your foreign financial accounts within a full year.

What is a foreign financial account? It’s any of the following:

- Any bank account located outside of the US: Even American banks using a foreign branch (i.e. HSBC UK) is still a foreign bank account.

- Pension funds from working abroad: Most companies will set up a pension for you while you’re working for them. So if you’re working abroad, you probably have a foreign pension with money that you can withdraw at some point. If you are uncertain, speak with your employer for more information.

- Foreign life insurance policies with a cash value: Most US expats don’t realize this… but remember that foreign life insurance policy you pay premiums on in hopes of getting a nice annuity later during retirement? Yeah, that’s a foreign financial account too! (Term life insurance policies with no expected cash flow (investment) don’t count)

- Foreign mutual funds: Decided to use an EU broker instead of a US one? This means you have a foreign financial account.

Secondly, once you establish that you have at least one foreign financial account, you need to check if the aggregate value/total value in your accounts exceeded $10,000 at any time. This is the total (over $10,000) from ALL your foreign financial accounts at any time in the year. It DOES NOT mean if any ONE of the above foreign financial accounts has over $10,000.

As an example, let’s say:

You are a US expat living in Copenhagen, Denmark with an open account for less than a year. This open account is a foreign bank account because it’s located in Copenhagen. On July 3rd, 2019 your account hit the $10,001 mark, but then after paying your credit card bill the week after, you went down to $9,000.

You still need to report an FBAR because you exceeded $10,000 one time within the year. It’s a reporting threshold all Americans abroad need to take responsibility for.

It’s especially important to know that you must convert foreign money into USD when reporting the amounts. So if the value of your money is in a currency stronger than USD, then you might unwillingly cross this $10,000 threshold sooner than expected.

How to Calculate the Total Value for the FBAR

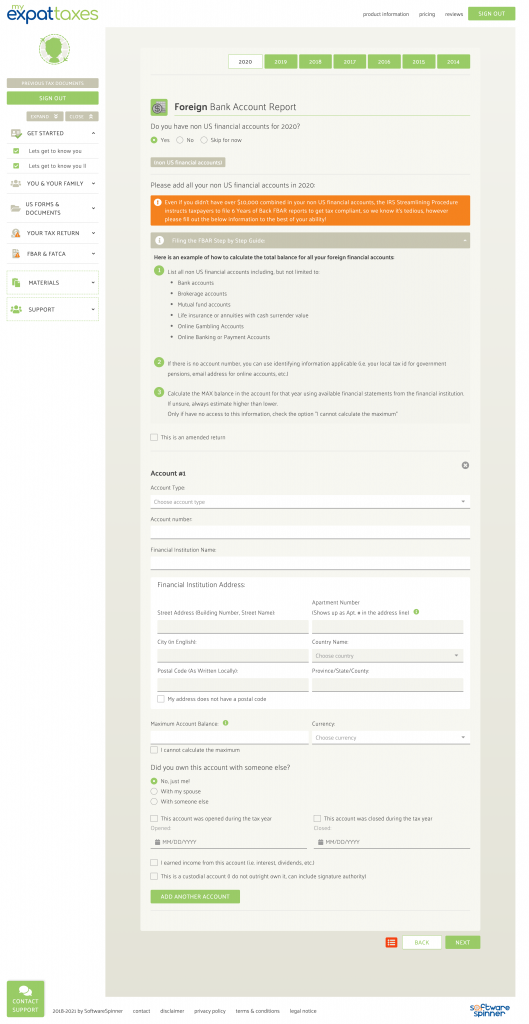

Here is an example of how to calculate the total balance for all your foreign financial accounts:

- You have 3 bank accounts: 1 in the US, 2 in Germany

- You’re working in Germany, and have a pension set up there by your employer

- You’ve also bought a life insurance policy from a German company and have been funding it for the last 10 years

Follow these steps:

- Calculate the maximum (not ending) balance in the year for ALL accounts.

- Ignore any US accounts and instead only sum up total foreign financial accounts

- Convert foreign money to USD to determine if they exceed $10,000.

Remember: Once the total sum of all your accounts goes over $10,000 at any one time during the tax year – you’ll have to file an FBAR. You’ll need to use FinCEN Form 114.

Preventing Filing Penalties

As we report in this blog here, penalties can happen if Americans citizens abroad accidentally don’t know they have to file. The good news is if the IRS did not contact you yet and charged up to $10,000 penalty, then you can make it up penalty-free. You can use the Streamlined Procedure, which we at MyExpatTaxes can gladly assist you with.

For more information about the amnesty program – the Streamlined Procedure – you can read about it here or just come to us at MyExpatTaxes. We can help you answer your expat taxes questions and explain a foreign earned income exclusion.

MyExpatTaxes Can Help

Here at MyExpatTaxes we include the FBAR naturally in our software and helps you file income taxes from abroad in 30 minutes or less. See for yourself:

We are certain you will be satisfied with our software for the upcoming tax year. We can help any type of American abroad – from Green card holders, dual nationality people, to a US citizen parent, and more. If you reside in the United States you don’t need to use our expat tax software unless you are living or working abroad. You can utilize your department of state for tax support.

Our team can also answer any questions you have and make sure all your accounts reported get you tax compliant. Expat taxes are our expertise, so for any questions regarding opening offshore bank accounts, or other financial citizenship and immigration services we suggest you contact your nearest US Embassy.