MyExpatTaxes Marketing Resources

All your expat tax marketing needs in one place.

#1 Use the Power of Videos

Let your audience know about the most important US Expat Tax information and services through video.

What are the filing requirements, and what the heck is an FBAR? Easily view and share your favorite tax videos with your followers.

| Download | Download | Download |

|---|---|---|

| How To Use MyExpatTaxes | File US Expat Taxes https://youtu.be/P2qxgK0L7g8 |

| |

| The IRS Streamlined Procedure Living Abroad | File US Expat Taxes https://youtu.be/-DRZwWocmHE |

| |

| IRAs & Roth IRAs as a US Expat | Tax deductions & eligibility Americans Abroad | Taxes with Nathalie https://youtu.be/-mhP8u4GTAA |

| |

| Do You Need To File a US Tax Return Abroad? (Probably) https://youtu.be/uMe0NrvXYH8 |

| |

| Everything About The FBAR | File US Taxes From Abroad https://youtu.be/PgiMdHRixi0 |

| |

| FATCA? What the Heck Is It? | File US Taxes From Abroad https://youtu.be/vwHb5CWlyLk |

| |

| Filing US T**es as an American Living Abroad | US Taxes Abroad https://youtu.be/WEIJc-eZy4A |

| |

| US Tax Return Deadlines for Expats | How To Taxes for US Expats https://youtu.be/lAH56KQqimo |

|

#2 The Most Needed Images

Make sure to use these images and logos when promoting MyExpatTaxes, to ensure they recognize the brand.

Tip: To download one of our infographics expand the graphic & choose ‘Save image as …’ by clicking on the image with a right mouse click. You can also download all images shown below in .zip format here.

| Download | Download | Download |

|---|---|---|

| MyExpatTaxes Logo, 500 x 106px, transparent, png | Download |

| MyExpatTaxes Logo, 1000 x 213px, transparent, png | Download |

| MyExpatTaxes Logo, 2000 x 426px, transparent, png | Download |

| Logo Inverse Blue, 500 x 106px, transparent, png | Download |

| Logo Inverse Blue, 1000 x 213px, transparent, png | Download |

| Logo Inverse Blue, 2000 x 426px, transparent, png | Download |

| Logo Inverse Green, 500 x 106px, transparent, png | Download |

| Logo Inverse Green, 1000 x 213px, transparent, png | Download |

| Logo Inverse green, 2000 x 426px, transparent, png | Download |

| Round Logo Green, 500 x 500px, png | Download |

| Round Logo Green, 1000 x 1000px, png | Download |

| Round Logo White, 500 x 500px, png | Download |

| Round Logo White, 1000 x 1000px, png | Download |

| Round Logo White, 1000 x 1000px, png | Download |

| Block Logo, 500 x 305px, transparent, png | Download |

| Nathalie Goldstein, CEO and Co-Founder 600 x 573 px, png | Download |

| Nathalie Goldstein, CEO and Co-Founder 1366 x 2048 px, png | Download |

#3 US Expat Tax Information

Promoting the best US Expat Taxes software only means you need the best US Expat Tax Information.

The top 5 most important points Americans abroad need to know about US taxes:

- June 15: The deadline for expats to file US taxes, which comes from the automated 2-month extension date the IRS grants to expats. You’re only eligible to file US taxes if you reach the filing thresholds.

. - Can’t file by the June deadline? File a free extension through MyExpatTaxes software before June 15. Expats then have time to file their US taxes by October 15.

. - Keep a good eye on your bank statements! If you have had $10,000 or more total in all foreign financial accounts at any one time during the year, you need to file an FBAR. The FBAR is due October 15 and you can file it easily through our software.

. - If you haven’t filed US taxes in a long time: You can use the Streamlined Procedure, a tax amnesty program to make up missed years of tax returns, penalty-free.

. - Most expats don’t have to pay US taxes: But if they do, they need to pay by April 15.

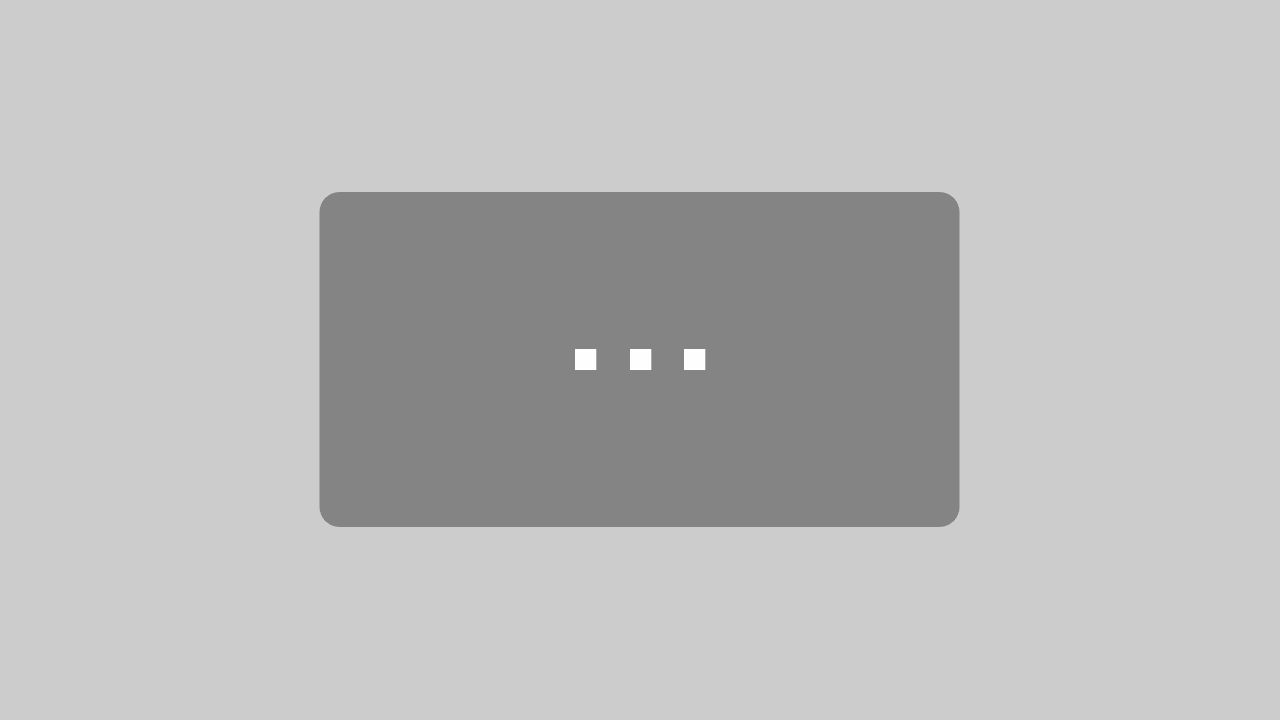

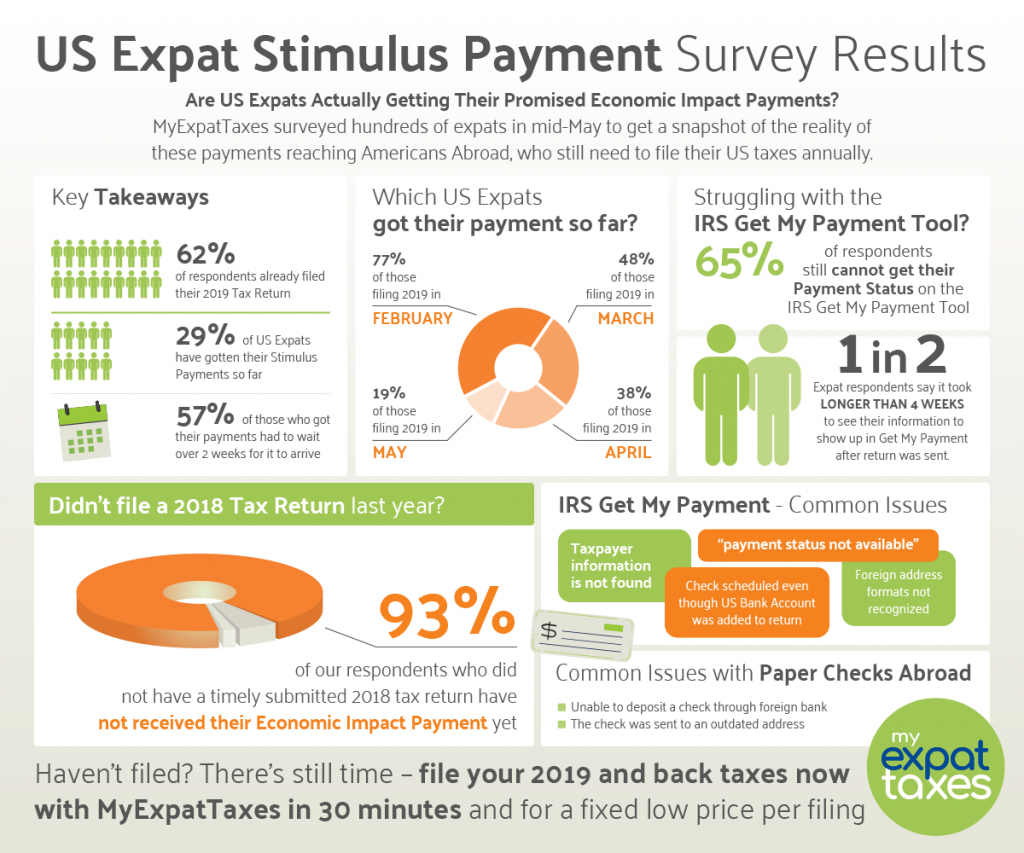

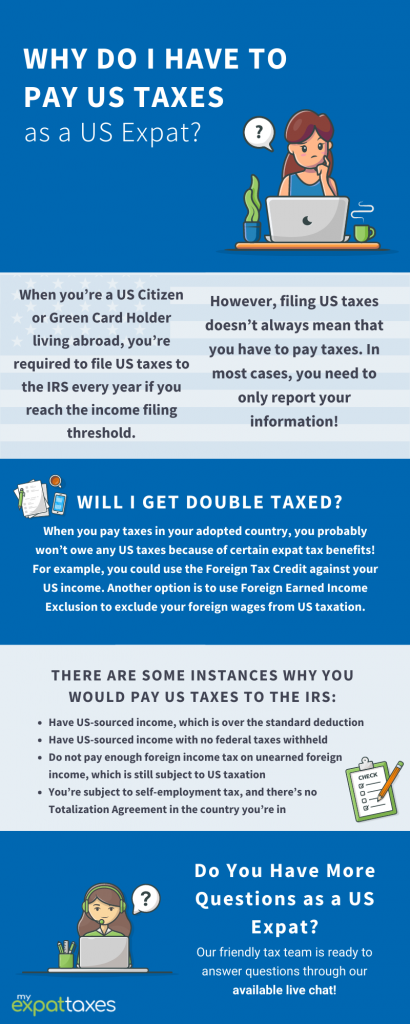

#5 Eye-Catching Infographics

Let your audience know about the most important US Expat Tax information and services through video.

Tip: To download one of our infographics expand the graphic & choose ‘Save image as …’ by clicking on the image with a right mouse click. You can also download all images shown below in .zip format here.

#6 Downloadable US Expat Tax Guides

Provide US Expat Tax Guides to your audience to ofer a more in-depth educational experience.

It’s essential expats know what to expect about US taxes.

Here are our top expat guides:

- Do You Need to File Expat Taxes?

- What forms do you need to file?

- Stimulus Checks for Americans Abroad

- Self-Employment Taxes

- How to avoid double taxation

- Child Tax Credit for American Families

- Foreign Bank Account Tips

- Got Unfiled Tax Returns?

Our PDF Guides

#7 Our Best Marketing Tips

We know, making taxes cool can be hard.

Here are the most important things to know in order to make people interested in what you need to say.

MyExpatTaxes was created to help other expats with a stressful and yearly task. Our main goal is always to use our marketing channels as a means to share correct and helpful expat tax information with our audience to make our users confident about their tax return. We are always up-to-date with the latest IRS tax information, and have become thought leaders in our industry.

MyExpatTaxes Story

MyExpatTaxes is the leading US expat tax software, guiding Americans living abroad through the US expatariate tax filing process faster and more affordable than any other competitor in the industry.

Incorporating international tax treaties and expat tax benefits, MyExpatTaxes helps expats claim thousands of dollars in refunds they otherwise wouldn’t know they were entitled to. Whether you have a simple and straightforward tax profile or require the IRS Amnesty Streamlined Procedure, MyExpatTaxes can make your tax filing accurate, efficient, and affordable.

Plus, the software offers a solution that didn’t exist in the expat tax market: a DIY system that can take on any US expat tax case.

This idea stemmed from CEO Nathalie Goldstein when she experienced firsthand the US expat tax headache when relocating to Austria. She wanted a system that would allow her to file her taxes online quickly without the hefty cost of an accountant’s help. This became the core thought process behind the software: “think like the user, not an accountant.”

This mindset has driven MyExpatTaxes to grow 10x year over year since incorporating in 2018. Since then, thousands of expats trust this company in over 170 countries. MyExpatTaxes has also been named one of the Best US Tax Software for Expatriates and The Best For Business Owners by The Balance.

Challenges Our Users Face

US expats simply not getting enough information about the constantly changing tax laws, since the IRS limits their support for international filers.

For starters, the majority of US expats are not aware that they are legally required to file an annual tax return to the IRS regardless of where they work or live. For example, the American who moves abroad for love usually ends up in the worst situation. Why? US expat married to a non-US citizen would normally need to file as Married Filing Separately. This means that the IRS filing threshold for them is a measly five US dollars. On top of that, they are not able to utilize common deductions like the student loan interest deduction.

A second challenge or misconception is understanding that US expats are not eligible for UStax benefits if they file a return. US expats should in fact file their annual taxes to claim their due refunds. MyExpatTaxes specializes in claiming thousands in refunds for US Expats. This includes the first and second stimulus payments (known as the Recovery Rebate Credit) and the Additional Child Tax Credit. The average US expat with children will get $1,400 in US refunds through MyExpatTaxes.

On top of this, expats often struggle with getting professional help with US expat tax laws. Often US based tax accountants or the tax software programs are not familiar with the complexity of international tax law. In turn, US expats need to look for a specialized expat tax firm, which comes at hefty fees, starting at $500 a return.

Our Audience

US citizens and Green Card Holders: They are living outside the United States, and meet the qualifications to report their worldwide income to the IRS.

Accidental Americans: An Accidental American is born abroad from at least one US parent, and will usually acquire American citizenship at birth. Additionally, Accidental Americans can be citizens born in the US to foreign parents OR were born outside the country to American parents and are unaware of their status as US citizens.

The 5 Main Selling Points for MyExpatTaxes

- We are the only US expat tax software on the market that can take on any US expat tax situation, no matter the complexity. We’ve never turned down an expat because they have a complicated tax case.

- We are the only US expat tax software that enables you to file an FBAR.

- We offer the streamlined procedure to anyone that needs to catch up on their US Expat taxes almost half the price of any other option.

- Depending on your tax situation, expats can file their US taxes in as little as 15 mintues.

#8 Some Do’s and Don’ts

This is a reminder of the the most important do’s and don’ts when promoting MyExpatTaxes.

How You Can Market MyExpatTaxes

Sharing Expat Tax Info: The best way to market MyExpatTaxes is to share accurate and meaningful information. Often, expats don’t know that they need to file a US tax return or the process is confusing for the expat. Giving people answers is the best way to grab attention.

Using the Marketing Assets Provided: As an affiliate, we make it easy to share expat tax information in an eye catching way by providing you with our top marketing assets. Use these posts, infographics, guides, and videos on your platform!

Following the MyExpatTaxes Branded Guidelines: In this guide we provide you with the correct brand colors, fonts, and logos. It is requirement that you use these when making your own assets and promoting MyExpatTaxes.

Inviting our Team to Tag Along: At MyExpatTaxes, we love our community! If you have an idea to have a chat with our tax team or our CEO about related topics, send us an email at partners@myexpattaxes.com and let’s set something up! In the past, we have done Instagram lives, webinars, and podcasts.

How You Can’t Market MyExpatTaxes

Paid Advertising: Affiliates are not allowed to bid on any keywords including any variations, misspellings or in sequence with any other keywords related to “MyExpatTaxes.” You may not use the brand name in an ad title, ad copy, display name or as the display URL. In addition, you may not redirect users from an ad to myexpattaxes.com. This applies for Google, Bing, Yahoo, Facebook or any other network which offers paid advertising. This means, we strongly encourage that “MyExpatTaxes” and similar keywords be an addition to the negative keywords, as not meeting these terms will lead to program removal.

Misinform Users: When promoting MyExpatTaxes, always ensure that the information you share is accurate by using the provided marketing assets.

Domain Names: We do not allow affiliates to purchase any domain with the name MyExpatTaxes or MyExpat.

#4 Social Media Posts that Work

Use social media as a way to spread information about US expat taxes. Here are some helpful posts.