Not Filing Taxes While Living Abroad? Here’s What to Do

April 26, 2018 | Blog | 3 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

All blogs are verified by IRS Enrolled Agents and CPAs

All blogs are verified by IRS Enrolled Agents and CPAs

”The IRS will easily forget about me….So what if I miss a year or two…or more filing my taxes?’’ These may be typical thoughts from an American who is not filing taxes while living abroad. Or, who may not know the importance of filing expat taxes. However, you can still get in some problems (ie: tax penalties) if you ignore your US tax obligation duty.

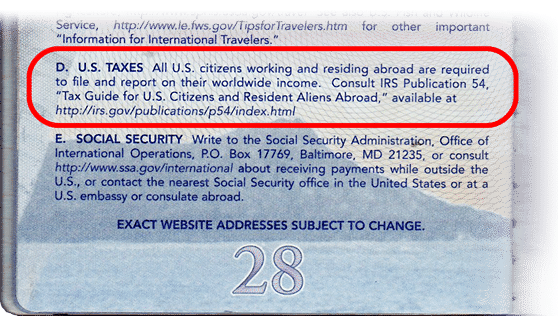

If you make over the tax filing threshold, the IRS requires you to file annually, whether or not you live in the US. The reason can be found in your US passport. In there it explicitly states a requirement to report your worldwide income to the United States IRS.

A Duty for US Citizens Abroad

That’s why we at MyExpatTaxes want to assure you that we got your back when it comes to getting all your tax nightmares and obligations in order. With our specialized expat tax software solution, we’ll make it easy for you filing US taxes abroad. If we can give you, our fellow American expats, peace of mind, then we’ve accomplished our goal.

If you’re not filing taxes while living abroad, this can send a negative message to the IRS. Why? Being caught and labeled in the “failure to file” and/or ”failure to pay” aspect are seen as criminal behaviors.

The penalties and tax fines for not filing taxes abroad depend on a lot of factors. It can range from 5% of unpaid taxes and escalate up to $25,000 and jail time (if the IRS determines that you’re involved in offshore money laundering and tax evasion.)

This is why we want to encourage you to file your taxes on time. We are also doing our part in educating Americans abroad on their citizenship obligations through these tax guides at MyExpatTaxes.

Therefore, knowing where you are within the filing statuses is the first step to getting tax compliant. The second step is – once you do see you need to file a federal tax return, go onto our app and be guided in completing all the tax forms necessary.

Penalties for Not Filing Abroad

- FBAR – Americans abroad may not know they are supposed to file the FBAR, which we wrote about in our Expat Filing Requirements post. FBAR penalties can happen if are willfully not filing the form. The fee can be as high as $100,000. Even despite forgetting or not knowing, there is a chance the IRS can charge you. Within that case, it can get up to $10,000 per year. Yet, the IRS is typically forgiving though if you file before they contact you.

- Form 8938 – This form is on reporting your interest in certain foreign financial assets, financial accounts, foreign securities, and interests in foreign entities. Failing to file all or any one of these forms may place you in a position of being fined $10,000 or more. Think of it as the FBAR for the IRS. We don’t want you get there, so definitely come to us so we can help you get back on track.

- What Else? Generally speaking – filing a false return (omitting foreign income), willfully not filing the FBAR, and/or an income tax return can lead you (up to) 5 years in prison and thousands of dollars of penalties.

How to Stop Hiding From the IRS

In a world where our technology is quickly upgrading and evolving, it will only get harder to hide from the IRS. They have a software called the Information Returns Program (IRP) that checks and re-checks your tax reports and files, so if you’re not filing taxes while living abroad, the software can alert the IRS to start an investigation on you.

Due to the seriousness of your status, the IRS can contact you in a couple ways – for example, by post and you will be asked to file/report within 30 days of the request.

Keep in mind, the IRS will never demand you to give them your credit card information over the phone, penalize you without an opportunity to appeal or threaten to bring in the local police. If someone does this to you, they are likely trying to scam you by pretending to be the IRS!

The Streamlined Procedure

We’ll stop with the information about penalties and explain that there is an amnesty program. It’s specifically for Americans abroad who forgot or did not know they had to file and missed more than a year doing so.

The Streamlined Procedure, created by the IRS is a pardon for American expats. It allows you to catch up on forms within the tax year with no penalties and double taxation. It’s a tax preparation process that is very helpful.

However, this pardon will NOT apply to Americans abroad who willfully refuse to file taxes.

So, even if you’re not filing taxes while living abroad, it’s not too late to correct your filing status. Whether you are filing separate, single or beyond, there is hope for Americans living abroad!

Affordable Expat Tax Software

We can assure you that our affordable expat tax software solution will bring you much relief when it comes to filing taxes from abroad. Not filing taxes while living abroad can be a dangerous thing to get into.