EVERYTHING

you need to know about Expat Taxes in 2025

EVERYTHING

you need to know about Expat Taxes in 2025

"*" indicates required fields

What you'll learn from the guide

that will help you get and stay tax compliant!

Renouncing US Citizenship

Giving up your passport and US citizenship is possible as an American abroad, though not recommended.

Filing and Paying Taxes Support

Learn about foreign income and the exact forms you need to file your expat taxes.

Self-Employment Taxes

Find everything you need to know about filing expat taxes while being your own boss. Also, you'll learn how to pay for Social Security, Medicare taxes, and more.

Foreign Bank Account Information

Then if you have over $10,000 total from all of your foreign bank accounts at any one time during the year, you’ll need to fill out an FBAR.

Do You Need to File US Expat Taxes?

Learn who needs to file US taxes, your tax profile, filing thresholds, tax deadlines, and more.

Expat Tax Benefits

There are two expat tax benefits you can take advantage of as a US citizen abroad: Foreign Earned Income and the Foreign Tax Credit.

Retiree Support

If you are planning to move overseas and retire, there are a few steps you’ll need to take, which we outline in this section.

Unfiled Tax Returns

There is a solution to file US taxes for previous years, penalty-free, and affordable. We show you what that is here.

Save Even More Money with US Taxes

If you have a family, you can reduce US taxes through the child tax credit and foreign housing exclusion.

The webinar is now full.

Register to be added to the waitlist for the next one!

March 25, 2021 | 7 pm CET | Convert time to your time zone

Oops! We could not locate your form.

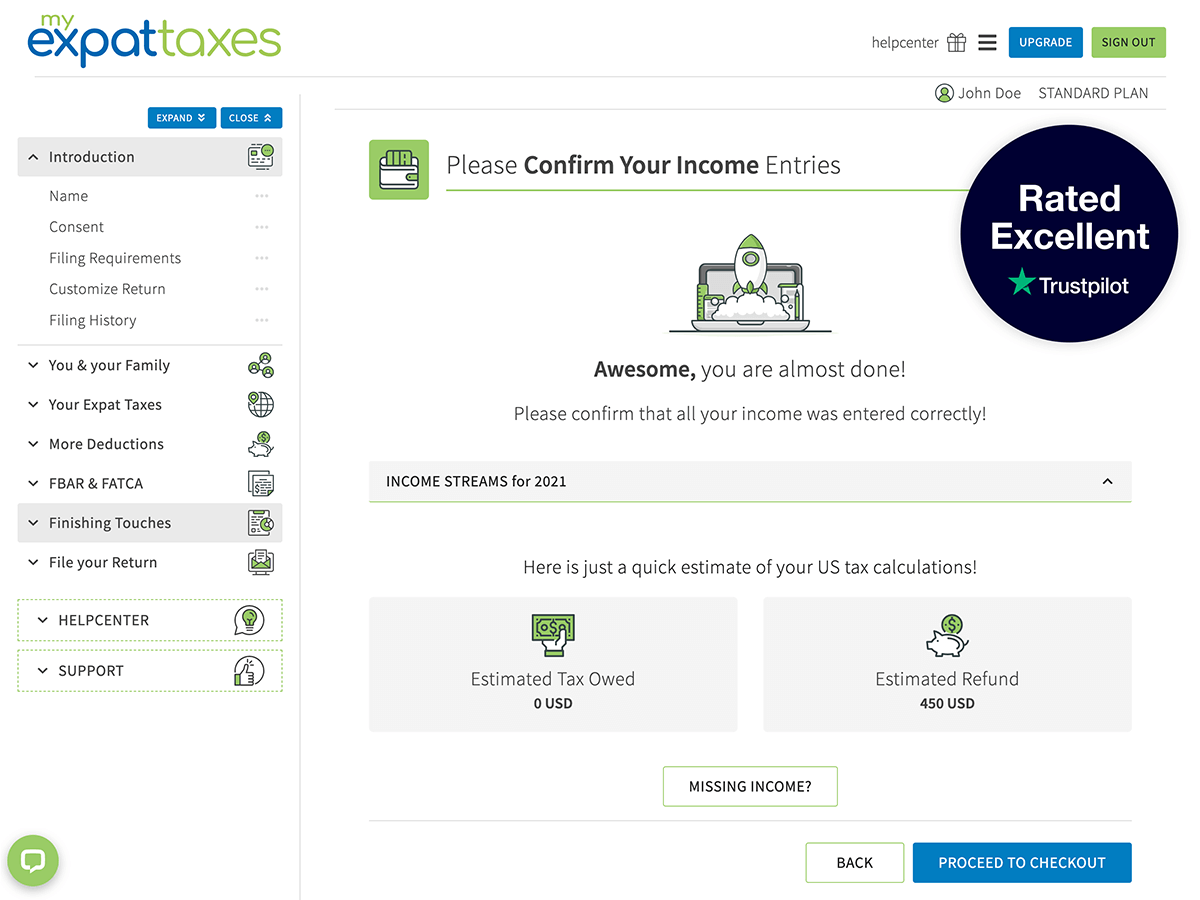

One stop shop for your US Expat Taxes

- Get 100% compliant and avoid IRS penalties

- It takes only 15 minutes

- We'll always maximise your tax refund

- Human expert support