Top FAQs

Getting Started

How do I get started with MyExpatTaxes?

MyExpatTaxes is a tax software that helps you file your US taxes, no matter where you live. Getting started takes less than 5 minutes. To make the process faster, ensure you have the required documents needed to file your return.

Set Up your Account

- Create an Account. Create an account in under 3 minutes! Answer simple questions about yourself.

- Activate your account. A link will be sent to your inbox to activate your account. Make sure to check your spam!

- Quickly answer simple questions. Our intuitive software adapts to the answers you give, which saves you time. For many expats, this takes under 15 minutes!

- Optional: Unlock Expert Tax Support

We can make your tax process even easier. Upgrade and be able to meet with your personal tax professional via video call. More Information … - Complete your payment

This will unlock your tax package draft! Your payment is always secure, using rigorous European Security Standards. - We will e-File!

Give feedback on your tax package draft, or proceed to authorize MyExpatTaxes to instantly e-file your return!

Documents to get Started | Required for all taxpayers:

Your foreign version of a W-2 (a document from your employer that provides you with an overview of your total salary and taxes paid)

Documents to get Started | Other common documents taxpayers need:

| Did you? | Documents you might need: |

| Sell stocks, get dividends, earn interest income | 1099 or foreign equivalent |

| Pay off student loans | 1098-E |

| Pay off a mortgage | 1098 |

| Move recently | Receipts for moving related expenses |

| Donate to charity | Receipts for charitable donations |

| Pay un-reimbursed medical, dental or business expenses | Receipts for relevant expenses |

You can always save your progress & return to your account if you don’t have all the information handy. So no worries!

Was this Article helpful?

How long does it take to file my US tax return?

For customers with standard tax cases, their return can take anywhere between 15-30 minutes. With the option to save and go back, those with more complex cases or filing for multiple years can take their time without feeling rushed.

Was this Article helpful?

What would be the process and how long will it take to review my tax return?

If you opt for a professional review, then our tax review team would start looking into your case as soon as possible. We might need more information and, if so, will reach out to you. If all is well, we'll upload your final tax return to the site. We average around 3-5 business days per review; so it may take a bit longer, though, depending on your tax situation's complexity.

Was this Article helpful?

Features

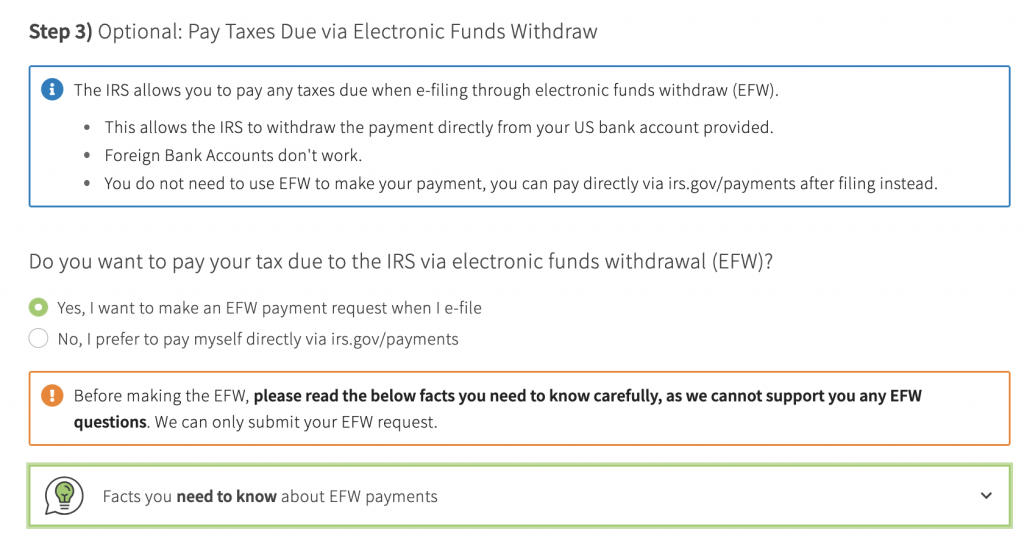

Can I submit an (EFW) payment to the IRS?

Yes, you can submit an Electronic Funds Withdrawal Payment directly to the IRS using your US Bank when e-filing through our platform.

The option is available on both e-filing submission methods (Self-Select Pin and 8879)

We only facilitate the submission of your payment request and cannot support you in the processing of the payment by the IRS.

Once submitted, we cannot cancel your payment request. Instead call IRS e-file Payment Services 24/7 at 888-353-4537 to inquire about or cancel your payment, but please wait 7 to 10 days after your return was accepted before calling.

You are solely responsible for checking your bank records for the payment transaction. Again, you can call IRS e-file Payment Services 24/7 at 888-353-4537 to inquire about your payment.

More information here: https://www.irs.gov/payments/pay-taxes-by-electronic-funds-withdrawal

Was this Article helpful?

Can you e-file my return for me?

Yes, you can e-file your tax return with us, but do note that the IRS requires a paper-mailed tax return in certain situations (like the Streamlined Procedure). If that would apply to you, we'll guide you step-by-step through the process to submit your return via post.

Was this Article helpful?

Does MyExpatTaxes have a referral program?

Yes, of course! With your first purchase, you'll receive a unique referral link to share that with your friends! They'll receive 20% off their first return and you'll get €20 in credit towards your next tax return with us.

In addition, all returning customers starting from 2021, will automatically get 25 credits added to their account for next year's filing. This way, we offer users 2 ways to save when filing with MyExpatTaxes.

Learn more about our referral program.

Was this Article helpful?

Do you support taxes for other countries as well?

This is definitely on our roadmap. Please email us here and we’ll update you if we can support you!

Was this Article helpful?

Can I also file my state tax return with MyExpatTaxes?

Short answer: Yes!

At the moment, we cannot guarantee that we can cover your state return in the flat fee pricing for our app as each state is different and has different tax laws (to be fair, a handful of states are bigger than some European countries, so we get it).

Most expats don't need to file a state return. However, if it is determined that you do need a state return, we'll let you know immediately and the additional fee for preparation. In the meantime, read about state taxes as an expat and how to avoid having to file a state return.

Was this Article helpful?

Pricing

What does your flat fee pricing include?

We don’t agree with the common pricing schemes in the market, where customers are charged per form and don’t see the total bill until the end. We won’t ever do that to you!

Therefore we developed a flat fee pricing structure which includes the most common US Expat Forms:

- Schedule 1040 with common Expat Tax attachments: Form 2555 (2555-EZ), and 1116

- Schedules A, B, C, E, D & even SE as needed based on your tax situation

- FBAR and Form 8938

If you want to look for a specific form, please refer to our list of supported forms.

Was this Article helpful?

When and how do I pay on MyExpatTaxes?

Have no fear, you’ll be able to use our service for free up until we are ready to provide you with your draft tax return (after you complete the deductions section). We use Mollie as our payment system, which supports direct bank transfer, credit card and PayPal transactions (options may vary based on the country you live in).

All prices are quoted in EUR and includes VAT already (how about that for transparent pricing).

Was this Article helpful?

What Payment Methods on MyExpatTaxes Can I Use?

We support direct bank transfer, credit card, and Paypal transactions. We fully adhere to the European PSD2 directive, which requires two-factor authentication for all online payments. We don't store your credit card information at all.

Was this Article helpful?

Can I refer my friends and get a discount in return?

Yes, of course! With your first purchase, you'll receive a unique referral link (to be found in your invoice). Share that link with your friends! They'll receive 20% off their first return with us and you'll get €20 in credit towards your next tax return with us. Learn more about our rewards program.

Was this Article helpful?

Security

Can you tell me about your security measures?

Of course - we're dealing with sensitive data, so we've taken several steps to make MyExpatTaxes/MyExpatFBAR as secure as possible:

- Rather than trying to re-invent the wheel, we rely on well-proven and established industry standards.

- All the libraries we use have built-in security features out-of-the-box.

- Our lead developers have years of security experience, having worked in banking, payment, insurance and the networking industry.

- Our front-end and back-end systems are loosely coupled and we vigorously scrutinize every call to the back-end - i.e., we do not trust any client-side security measures.

Was this Article helpful?

How is the data I enter secure?

We take data privacy very seriously. All your data is stored encrypted on our servers and we collect only what we need to prepare your tax returns.

We are fully compliant with all strict GDPR measures. We also fully adhere to the European PSD2 directive requiring two-factor authentication for all online payments. We don't store your credit card information.

If you ever want to delete your account, all data that is associated with you will be deleted without a chance for recovery. We will have to retain the tax forms that were provided to the IRS to comply with the US tax law for the necessary period though.

For more details, please check out our privacy policy right here.

Was this Article helpful?

Can I pay in a secure way?

We're using Mollie as our Payment Gateway and allow for a variety of payment methods (based on your location, different options might be available).

Through Mollie, we fully adhere to the European PSD2 directive. PSD2 is the latest set of rules set by the EU to help regulate payments in Europe. PSD2 transforms the way payments and e-commerce work by requiring two-factor authentication (2FA) for all online payments which increases the security of your checkout.

We don't store your credit card or other payment information, so we do require you to re-enter that with every purchase you make.

Was this Article helpful?

Log In to get in touch with our Support Team

Help Center Topics

LogIn & get in touch

with our Support Team