The Most Trusted US Expat Tax Service

Navigate US taxes abroad with ease — expert support or do-it-yourself simplicity

$12.3m

in tax

refunds

50+

supported

tax forms

100K

returns

prepared

The Most Trusted US Expat Tax Service

For US

For US

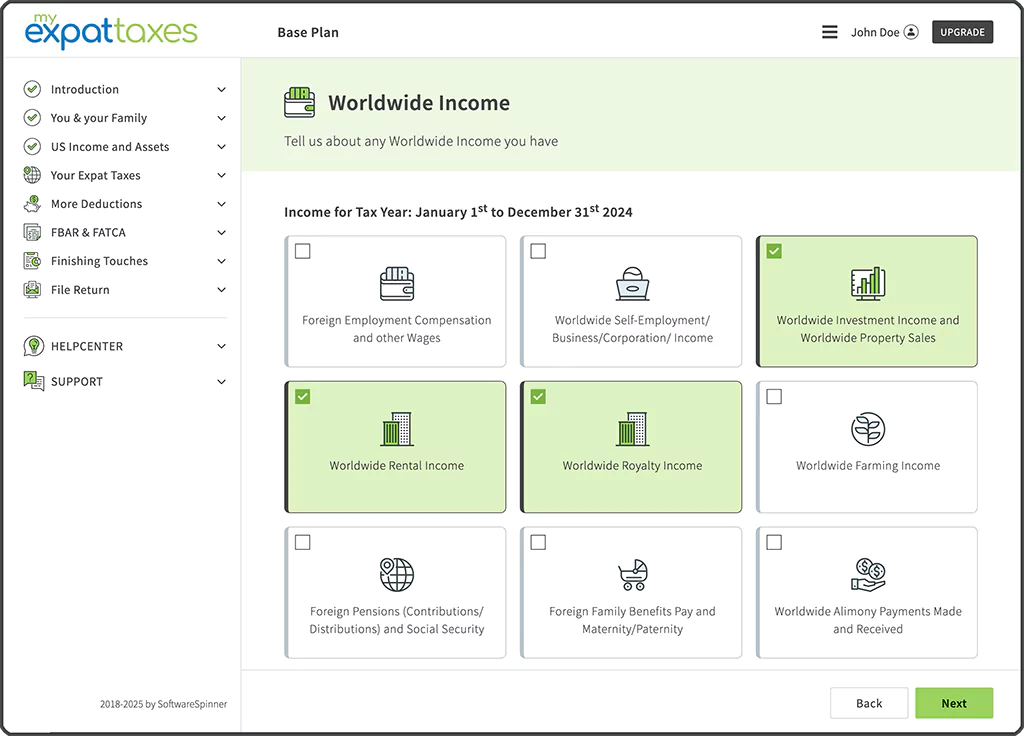

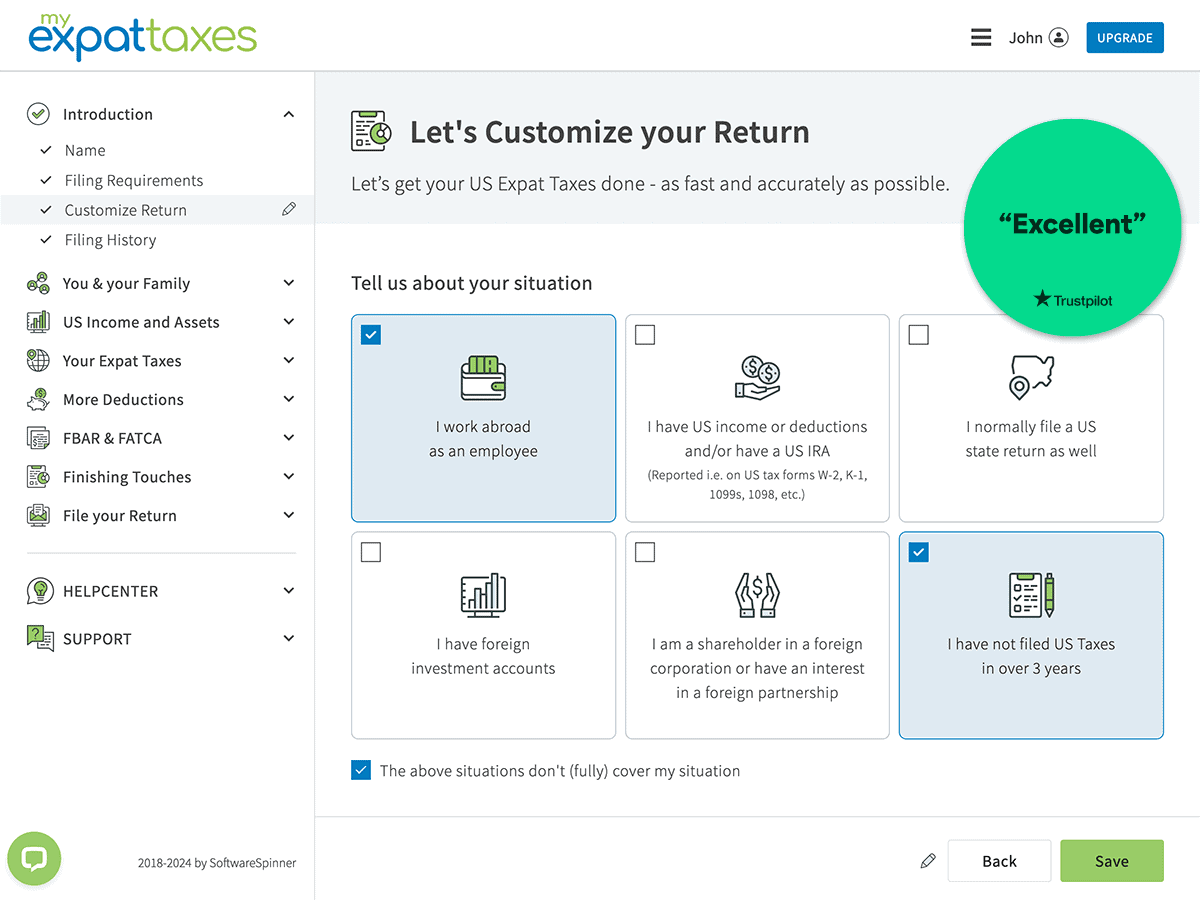

Easily file regardless of how complex your US expat tax situation is.

File early for an early refund! 🎉

100% Human Support On All of Our Plans

$12.3m

in tax refunds

In refunds secured for our users every year

03:29

less than 4 minutes

Fastest tax return submitted in 2025

50+

supported tax forms

Most comprehensive US Expat Tax software

100K

returns prepared

for US Expats from 165+ countries

We don't charge extra for essential tax forms.

All plans have a flat fee (starting at $175)* and include:

Federal tax return

FBAR

All required FATCA forms

Instant IRS e-filing**

* €149, actual non-Euro-prices are dependent on the recent exchange rate.

** when eligible, some returns cannot be e-filed per IRS regulation

"I use MyExpatTaxes (and recommend it to all my clients!) because it gives me back my autonomy! Once I’ve plugged in my information, the system gives me a great overview of what I made and where I might be able to save some more money!"

Vanessa M.W.

Founder & CEO, Wander Onwards LLC

Recent Reviews

Plans

Base

Use the MyExpatTaxes software.

$175

Reviewed

Your tax return reviewed and signed by a Tax Professional.

$315

Premium

Get Tax Professional guidance.

$575

Federal Tax Return & FBAR included

All plans and prices

User-Friendly Software

Made by expats for expats.

MyExpatTaxes is THE software I needed when I moved abroad in 2015.

Nathalie Goldstein, CEO and founder of MyExpatTaxes, EA, MSc

Reviews

Thousands Choose MyExpatTaxes, Every Year.

filing options

One perfect tax return. A choice of filing options.

BASE

Do it Yourself with Award Winning Tax Software

Create an account.

Start for free, pay only when you're satisfied and ready to file.

Fill out your information.

Save your progress and come back anytime. Use our live human customer support for help.

You confirm & we e-file.

Confirm the results and calculations. We e-file your tax returns with the IRS. You will be notified along the way.

PREMIUM

File with help from US Tax Professionals

Upgrade your account.

Start for free by telling us the most important information for your return, then upgrade.

Talk with a Tax Professional.

Optional 30 minute video call with a Tax Agent to discuss the details of your situation.

Sit back & confirm e-file.

Our Tax Professionals will take care of everything. Once you authorize us, we will e-file the return for you.

US Expat Taxes

Designed by US Citizens Abroad, For US Citizens Abroad.

We maximize your return for a low price.

More US Expat Tax deductions than any other tax softwares guaranteed. We don’t charge extra for FBAR, FATCA or FEIE. All income types are welcome equally.

Human experts are there for you at every step.

No matter what plan you use, we give you free human support. If you upgrade, a tax expert will do it for you. Either way, you’re taken care of.

Security is more than a priority, it’s built into the software.

Our software is compliant with European Union General Data Protection Regulation. Our database is secured with patent-pending manipulation protection technology.