The Easy Way To File Your FBAR.

New! File your FBAR with MyExpatFBAR or file your taxes & FBAR together for more savings!

What is the FBAR?

The Foreign Bank Account Report is a form that needs to be filed with FinCEN (Financial Crimes Enforcement Network) once financial accounts have reached the FBAR filing threshold.

Do you need to file an FBAR?

Anyone who must file or pay US taxes from abroad is required to file the FBAR once the total value of all foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

File just your FBAR or File your US Expat Taxes Too! The choice is yours.

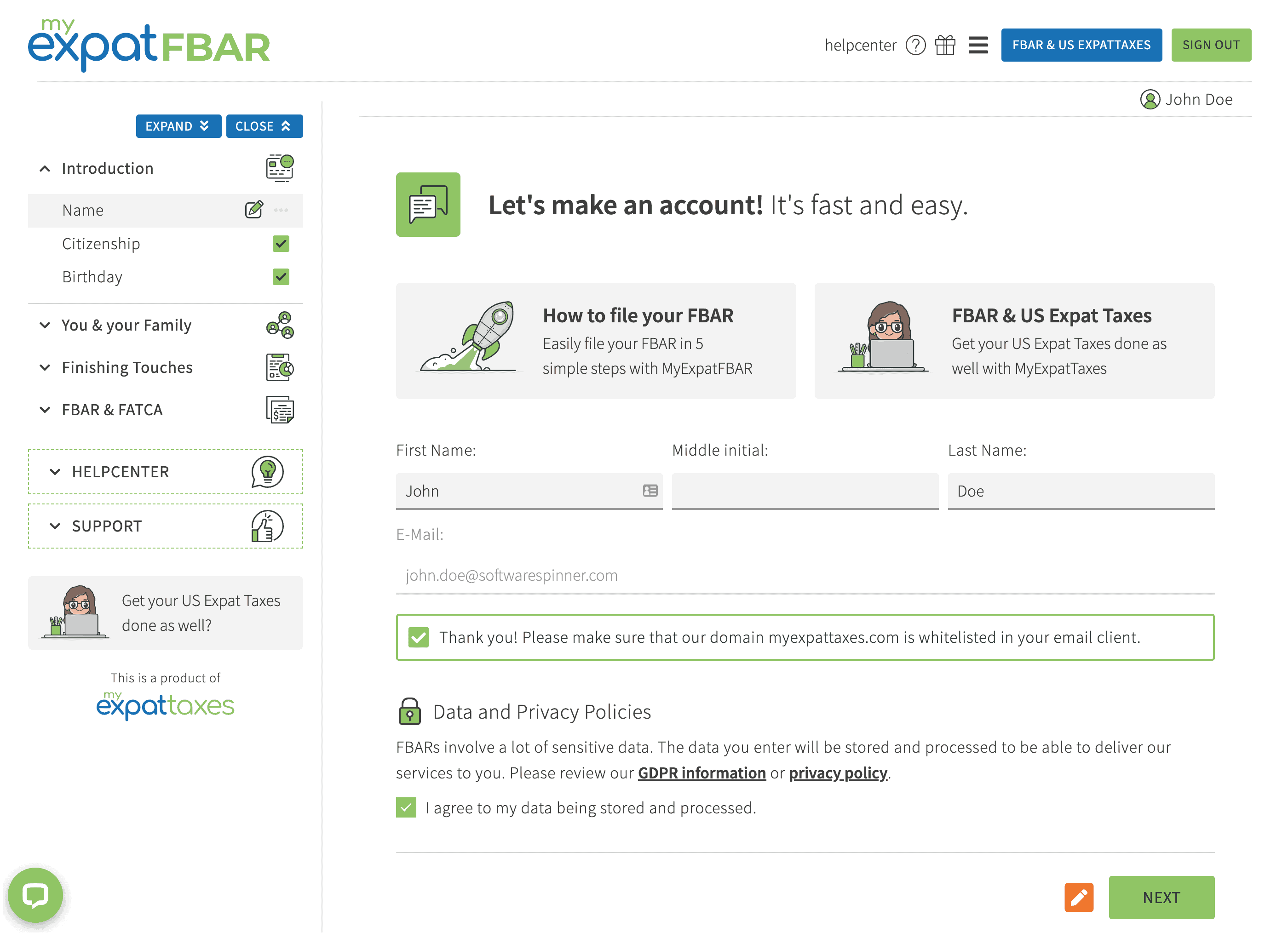

Quickly and easily file your FBAR online with MyExpatFBAR

- Log In or Create an Account

- Input your personal information

- Include information about your Foreign Bank Accounts and assets

- Confirm your FBAR is complete and accurate

- Digitally submit your finished FBAR to FinCEN

File your US Tax Return & your FBAR together with MyExpatTaxes!

- Log In or Create an Account

- Confirm your personal data or add it in

- Include income information, employment status, and more

- MyExpatTaxes uses that information plus the info about your Foreign Accounts to prepare your US Tax Return & FBAR

- FATCA forms like Form 8938 will also be created if necessary based on your FBAR

- Upgrade for even more professional Tax Support

- Review your Tax Return and FBAR and then eFile!

Actual USD prices are dependent on the recent exchange rate. We are using exchange rates as published on exchangeratesapi.io which are updated on a weekly basis, and include an exchange fee of 3%.

FBAR 101 - Frequently asked questions

Learn about the Foreign Bank and Financial Accounts Report

If the aggregate of your foreign bank and financial accounts exceeds $10 000 even for one day, you have to file the FBAR.

The deadline for filing the FBAR is October 15. For example, you can file your 2022 FBAR until October 15, 2023.

By filing the FBAR, you are informing the Treasury Department about your foreign accounts, this way you are helping them in preventing tax evasion.

Since FBARS are filed through FinCen and not the IRS, penalties can be as high as $10,000 a year for filing errors or not knowing you had to file.

Fortunately, there is an amnesty option for expats to make up this tax situation. However, you’ll need to use them before the IRS contacts you. The amnesty program is called the Delinquent FBAR Submission Procedures.

The fee (€49 / $59) is per year of FBAR filing, regardless how many accounts you have to report for any given year!

If you file and pay for your FBAR only at first, but later want to upgrade to file for a tax return in the same calendar, the FBAR payment will be credited towards the tax return fee!

Head over to our HelpCenter or check out our FBAR articles

Security is more than a priority, it’s built into the software.

Our software is compliant with European Union General Data Protection Regulation. Our database is secured with patent-pending manipulation protection technology.

from the makers of MyExpatTaxes