Make the right decisions now

Plan Next Year's US Expat Taxes Without the Stress

See what’s coming. Make the right tax moves.

Get expert guidance on demand.

Plan Next Year's US Expat Taxes Without the Stress

See what’s coming. Make the right tax moves. Get expert guidance on demand.

Your Tax Roadmap Starts Here -

Simple, Smart, Personalized

Includes tax forecasting calculators, and expert access... all verified by Enrolled Agents!

Moving Abroad

What to consider before you relocate internationally

Investing

US and foreign investment planning and taxation rules

Property

Understand the tax impact of buying, renting, and selling

Retirement

Comprehensive retirement planning: IRAs, international pensions, and US benefits

Foreign Corporations

Own a business abroad? Know your tax obligations

Family Changes

How changes like marriage or kids affect your taxes

Gifts & Inheritances

How cross-border gifts and inheritances are taxed

And more ...

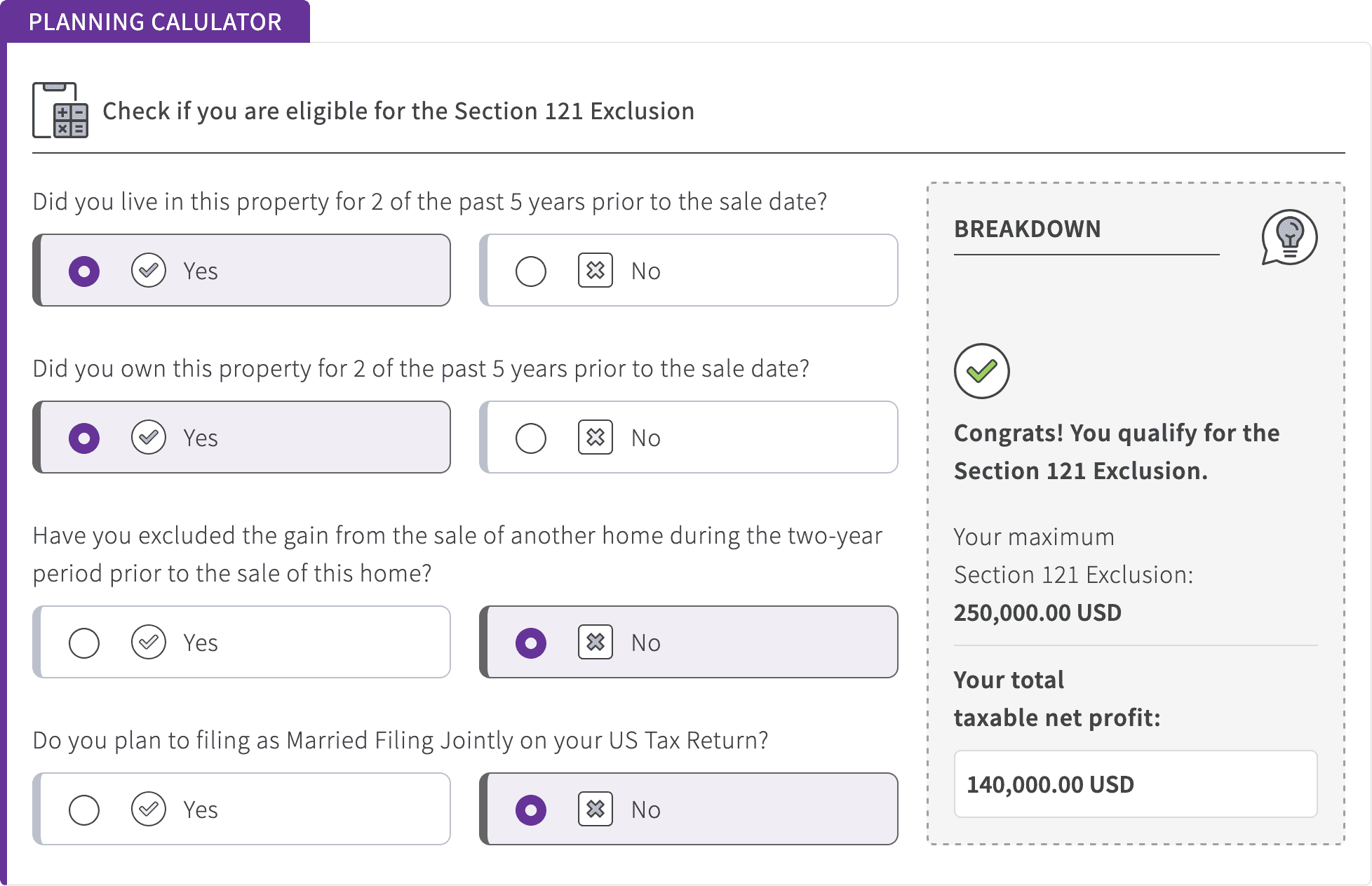

Know What You'll Owe

Estimate your US tax obligations with ease - make the right moves when they count

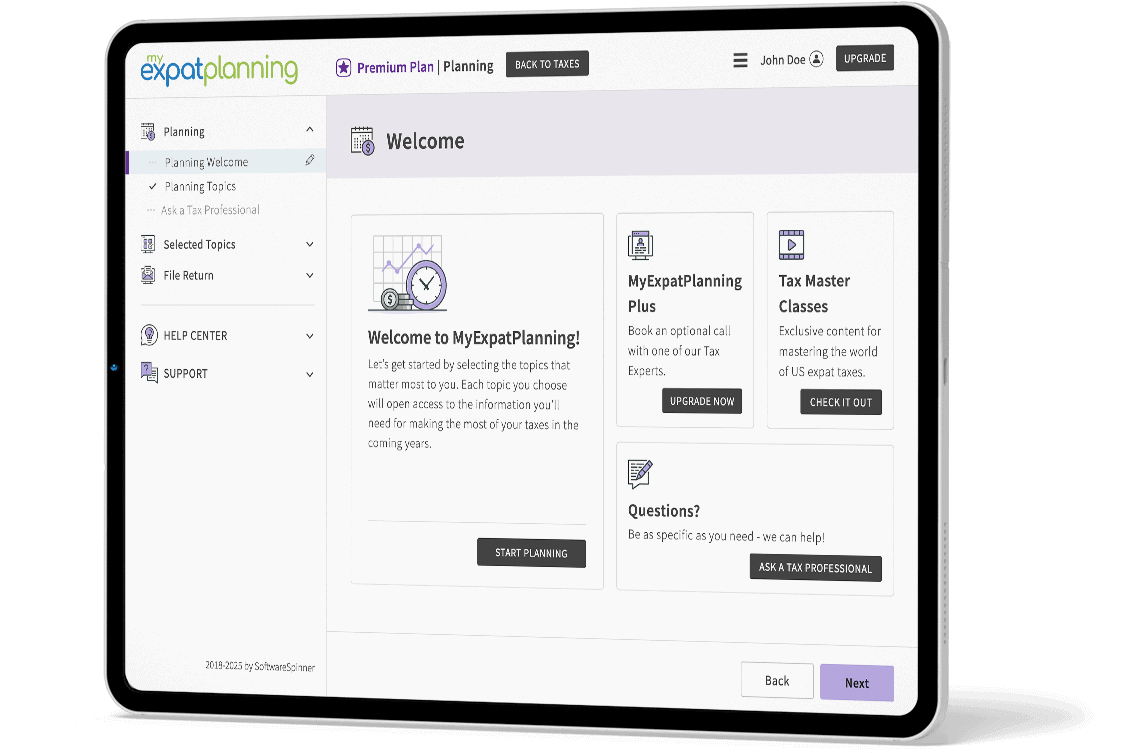

Built-In Calculators

Use our interactive dashboard to confidently plan your next steps

- Real-time estimates

- Tailor-made tax scenarios

- Transparent calculations

Built-In Calculators

Use our interactive dashboard to confidently plan your next steps

Real-time estimates

Tailor-made tax scenarios

Transparent calculations

Expat Life is Complicated. Your Taxes Don't Have to Be.

If you're a US citizen living abroad, chances are:

- You're not sure how moving, selling property, or changing jobs affects your return

- You want peace of mind and expert guidance, not confusion

- You want to be able to plan ahead, without any surprises

You're not sure how moving, selling property, or changing jobs affects your return.

You want peace of mind and expert guidance, not confusion.

You want to be able to plan ahead, without any surprises.

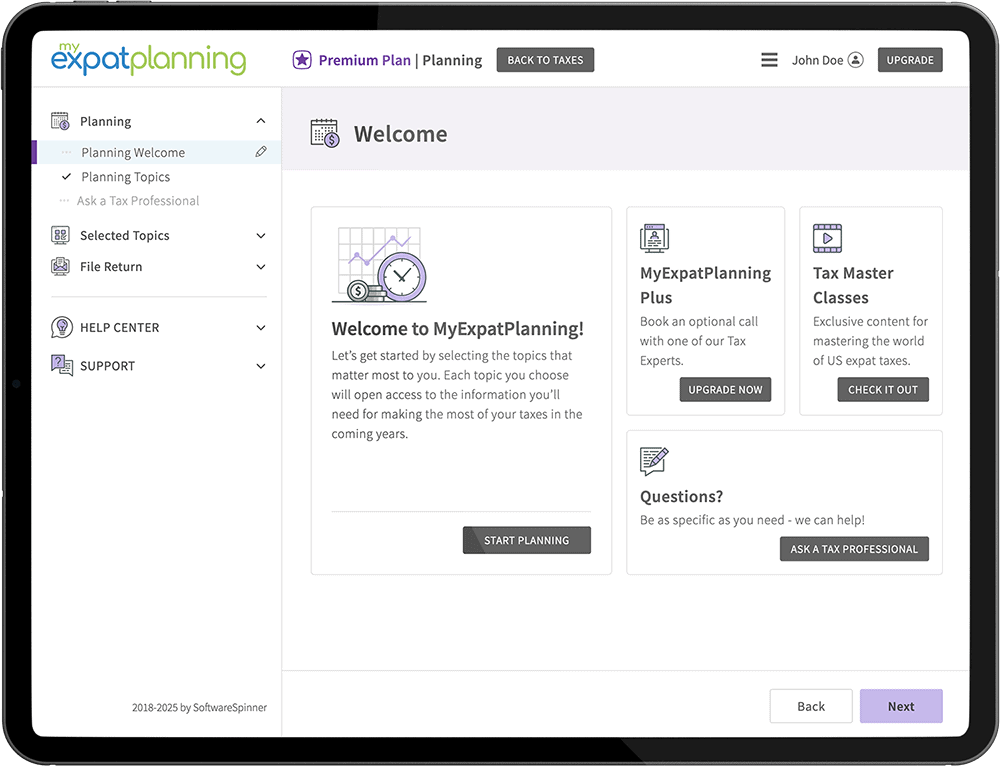

MyExpatPlanning Will Help!

From planning to filing - we simplify every step of your expat tax journey.

Understand Tax Implications of Big Decisions

Changing residency? Buying foreign real estate? Have foreign investments? We'll show you what it all means.

Ask a Real Tax Professional Anything

Submit questions or schedule a 1:1 video call with a licensed US Tax Professional.

Forecast Next Year's Return

See a smart projection based on your plans and avoid costly mistakes.

Learn & Explore As You Go

Explore built-in educational content & tools. We explain US expat tax rules clearly, with no IRS jargon.

Forecasting - Visualize Your Next Return

Knowing what to expect let's you:

- Move to another country with clarity

- Sell assets without surprise tax bills

- Make smarter financial decisions

*includes a 30-minute video call

Move to another country with clarity.

Sell assets without surprise tax bills.

Make smarter financial decisions.

*includes a 30-minute video call

Plan Smart. Live Free. Create Your Personalized Expat Tax Plan, Today!

No risk. No pressure. Just peace of mind.

Verified by Enrolled Agents

Nathalie Goldstein: CEO and Enrolled Agent

Frequently Asked Questions

Curious how MyExpatPlanning works?

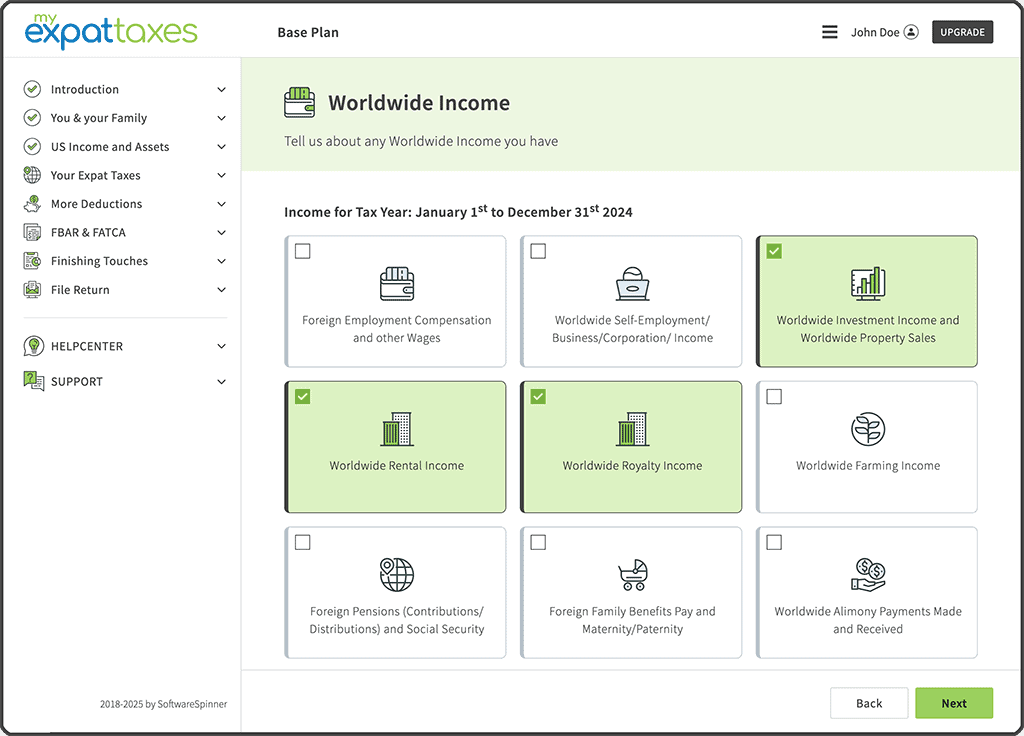

We have a planning service for everyone's needs and budget, similar to our tax services.

The planning dashboard with expert-reviewed planning topics and tax calculators will be included for free for MyExpatTaxes Premium clients.

Those not in the Premium Plan can easily add on this dashboard for $59.

If you want to go more in-depth, the initial planning questions bundle includes three questions and can be added for $149.

Our "Planning Plus" services, which include a video call and the ability to forecast and model your next year's tax return, can be added for $199. Planning Plus is only available when bundled with the planning questions bundle.

Actual USD prices are dependent on the recent exchange rate.

No, but we do recommend it as we may need your latest tax return during our review. You should also look to finish up your current-year taxes on MyExpatTaxes.

The video call included in your Premium plan purchase is only for reviewing your current year's taxes. However, you can upgrade to "Planning Plus" to get a second video call dedicated to future tax planning.

No. The call is restricted to tax advice only, and there is no investment advice. We do not provide tax advice for countries other than the US.

Investment and financial planning services are found at myexpatinvest.com

Yes! That's how we ensure top-quality service. Submit your questions in writing - you'll get written answers from our Tax Professional, plus the option for a follow-up video call.

There are two options. If you have the Premium plan of MyExpatTaxes, MyExpatPlanning is included with no extra cost. You can use the “Go to Planning” button in the header. Otherwise, log in to your MyExpatTaxes account, and select MyExpatPlanning at the checkout page.