File Your 1040-NR Tax Return

Stress-Free Tax Filing for Nonresident Aliens in the US

Who should file the form 1040-NR

International students

If you’re earning money on a student visa while in the US, or you received a scholarship you’ll need to file a 1040nr tax return.

J1 visa holders

You came to the US to work and travel? If you have US based income - you need to file.

Non-paid internship

You will not owe any taxes, but you will still need to file if you are a non-resident alien.

US-based investment income

Rental Income, Investments, or other Taxable Sources.

Why MyExpatTaxes

Fast & Accurate

We handle complex tax rules so you don’t have to.

Maximize Your Tax Refund

Claim the tax benefits available to you.

100% Tax compliant

File your return with confidence.

Expert Review

Your tax returned reviewed and signed by a Tax Professional.

Reviews

Thousands Choose MyExpatTaxes, Every Year.

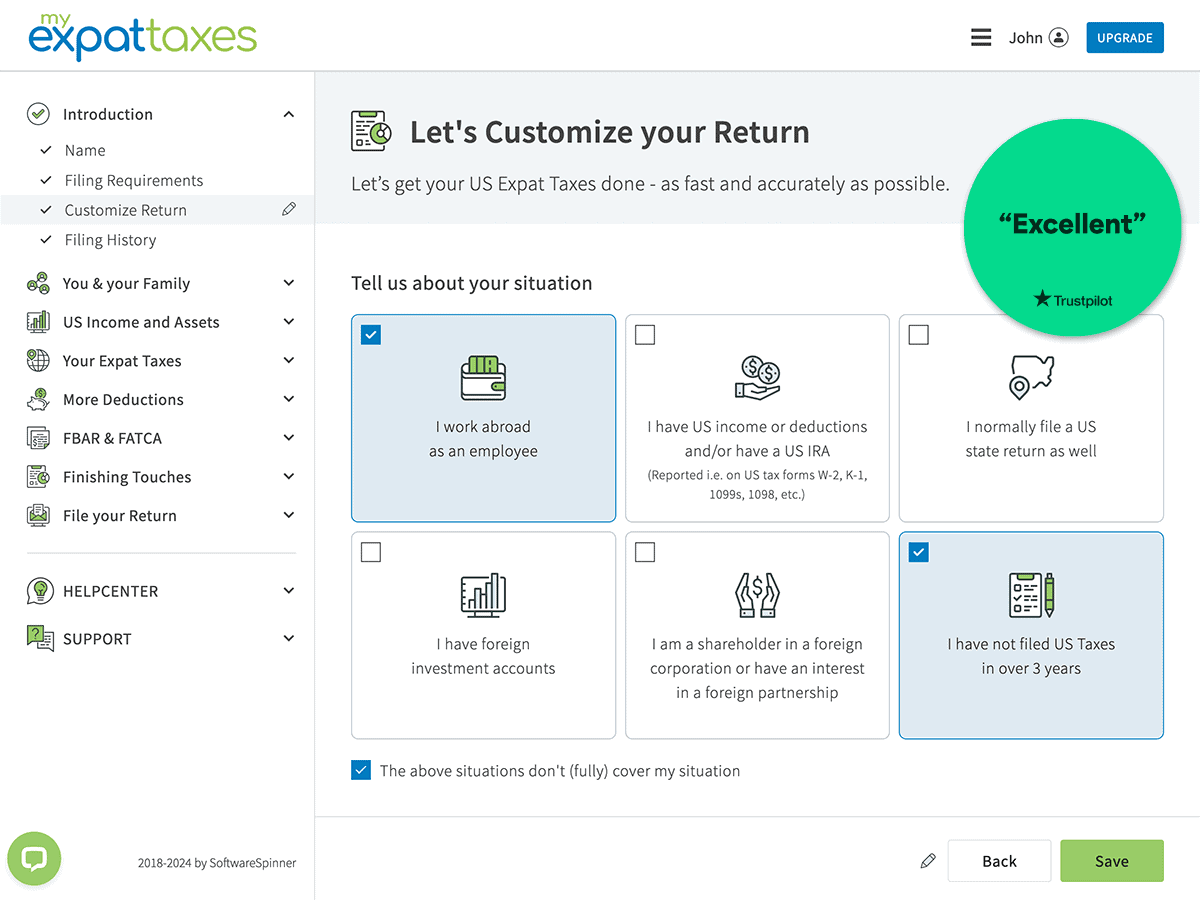

We maximize your return for a low price.

More US Expat Tax deductions than any other tax softwares guaranteed. We don’t charge extra for FBAR, FATCA or FEIE. All income types are welcome equally.

Human experts are there for you at every step.

No matter what plan you use, we give you free human support. If you upgrade, a tax expert will do it for you. Either way, you’re taken care of.

Frequently asked questions

A “nonresident alien” is a non-US citizen without a Green Card or qualifying for the “substantial presence test.” Commonly, these are students from abroad who are studying in the US on a student visa, for example. Seasonal workers, visiting professors, visiting business people, and so on may also fall under the nonresident alien status.

If you don’t file your 1040-NR form on time (and haven’t applied for an extension), you risk getting fines or penalties from the IRS.

If you are an employee and you receive wages subject to US income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to US income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.