2024 Election Survey: Would You Sacrifice Voting Rights to Avoid US Taxes?

September 27, 2024 | Featured | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 19, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 19, 2024

With a citizenship-based tax system, US citizens residing in another country face the complexities of the administrative system. As US expat tax issues remain constant, some Americans abroad have begun to question the value of their voting rights. Knowing this, MyExpatTaxes conducted the largest US expat survey in 2024 with 1,500 participants living in over 80 different countries.

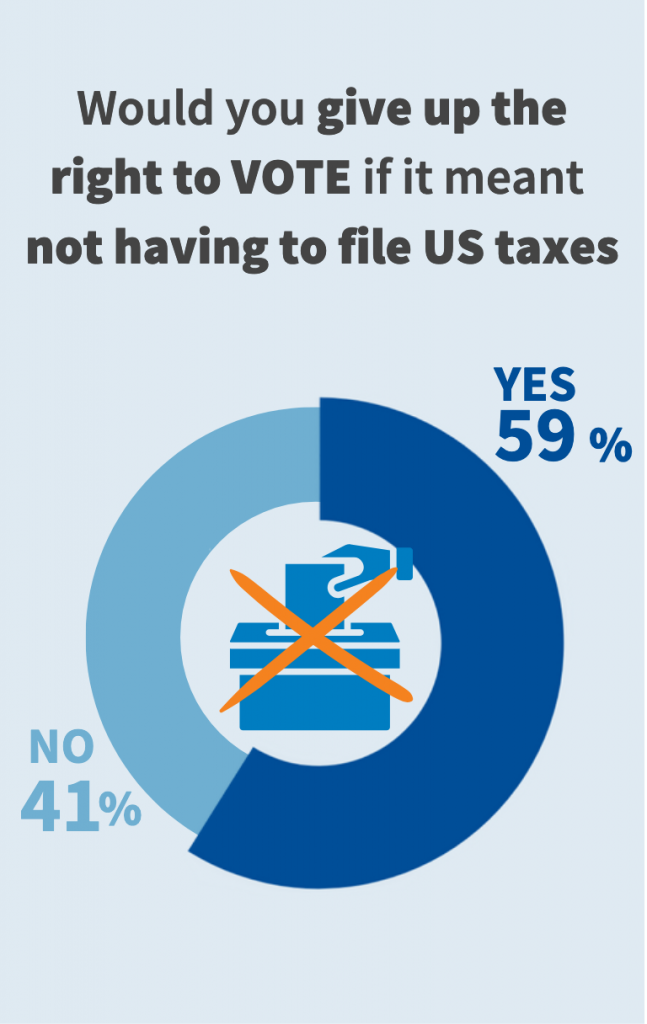

Giving Up the Right to Vote

The right to vote is a fundamental right as a US citizen, which is why this survey connects the frustrations of US expat taxation with absentee voting. The results indicate that over half of the respondents would relinquish their right to vote if that meant they could abandon their US tax responsibilities. Meanwhile, 41% of the respondents answered this question differently. These respondents would choose to face the bureaucratic challenges of US taxes than surrendering their fundamental right.

If the US taxation system allowed for a more straightforward process, the right to vote might hold a higher value among US expats. Navigating two tax systems annually leaves US expats feeling discontented and overburdened. As a result, for many, eliminating the US taxation requirement is more important than the ability to vote.

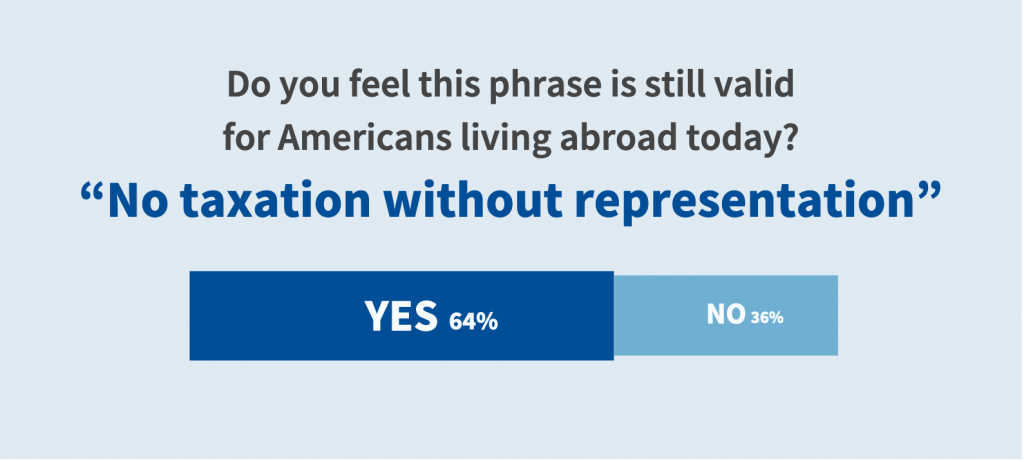

Dissatisfaction with Representation

The survey displays an apparent lack of regard for representation as a US expat. With the majority of 64%, US expats believe that the phrase “no taxation without representation” will remain steadfast in 2024. With that, it can be said that Americans living abroad feel disenfranchised by the high tax burdens without receiving direct benefits from the US. This result validates the expat concerns with political representation and fairness in the current tax system.

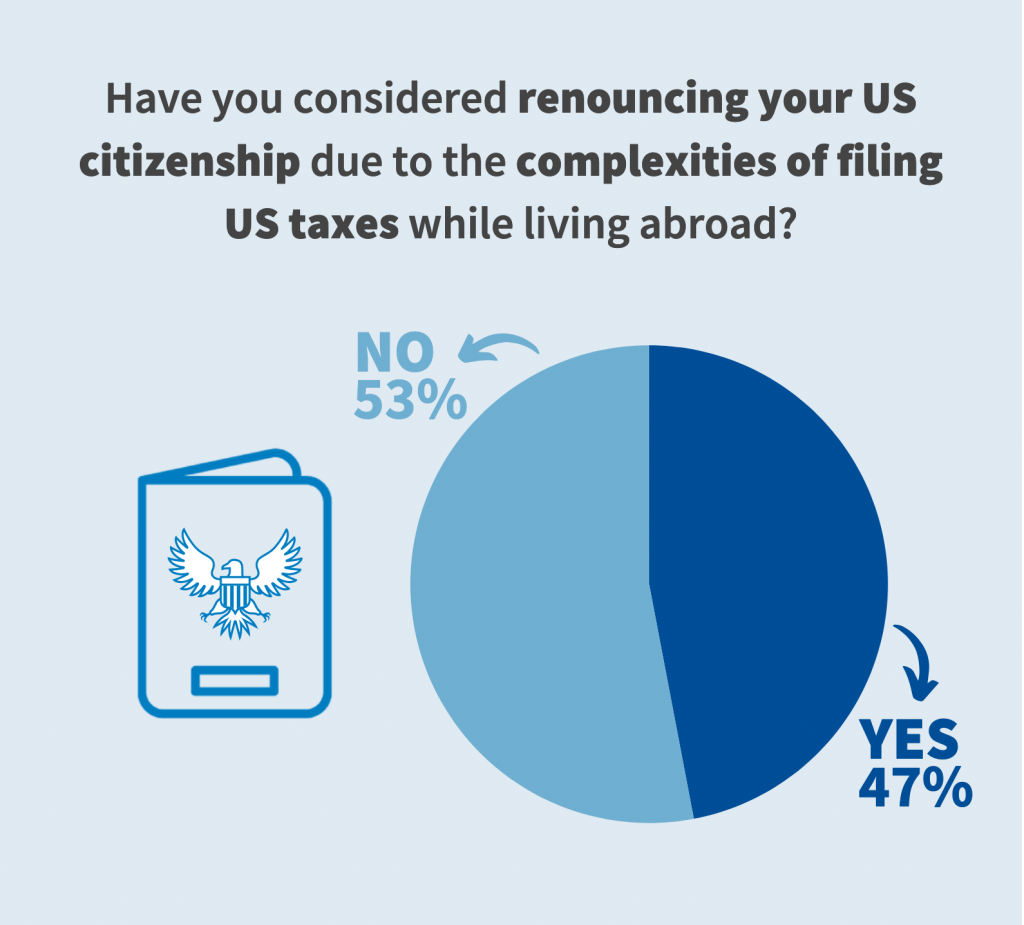

47% of respondents stated that they have contemplated the option to avoid the complexities of filing meaning nearly half of the American expat population has gravitated toward this potential solution. This highlights that US taxation has been a significant factor when considering renouncing their US citizenship meaning nearly half of the American expat population has gravitated toward this potential solution.

The Voter Experience

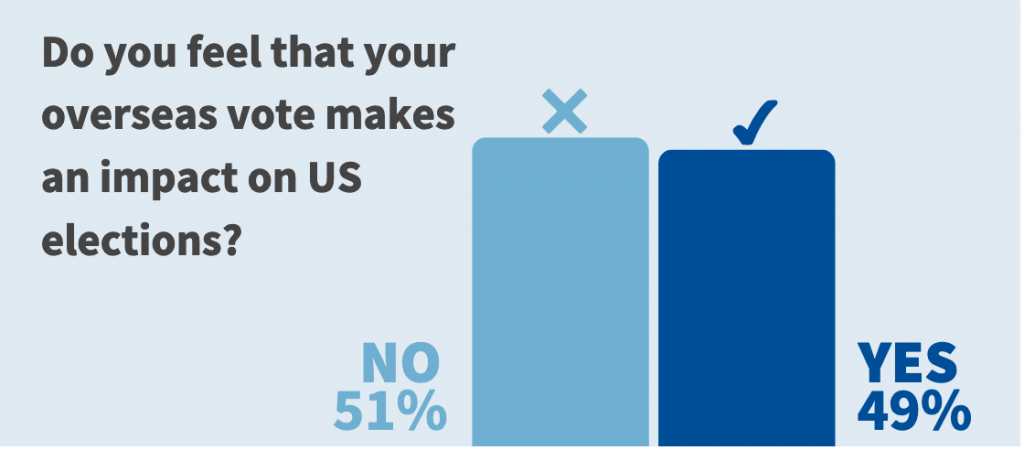

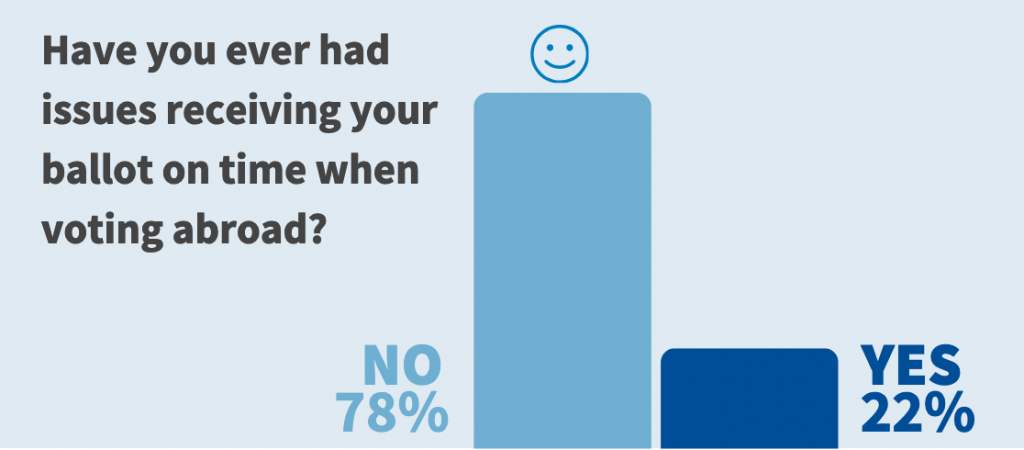

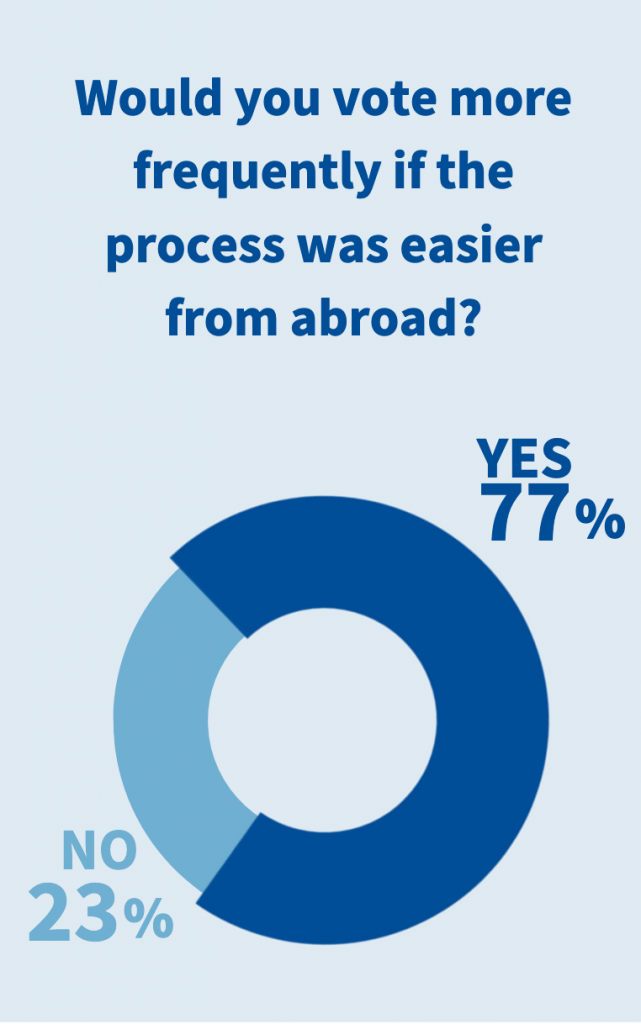

Voting is a right and a responsibility for all citizens of the US. Our 2024 election survey delved deep into the experience of overseas voters and their levels of satisfaction. While 73% of respondents have voted while living abroad, the findings are mixed in regard to the process:

- 51% of expats felt their vote from abroad did not have a meaningful impact on US elections.

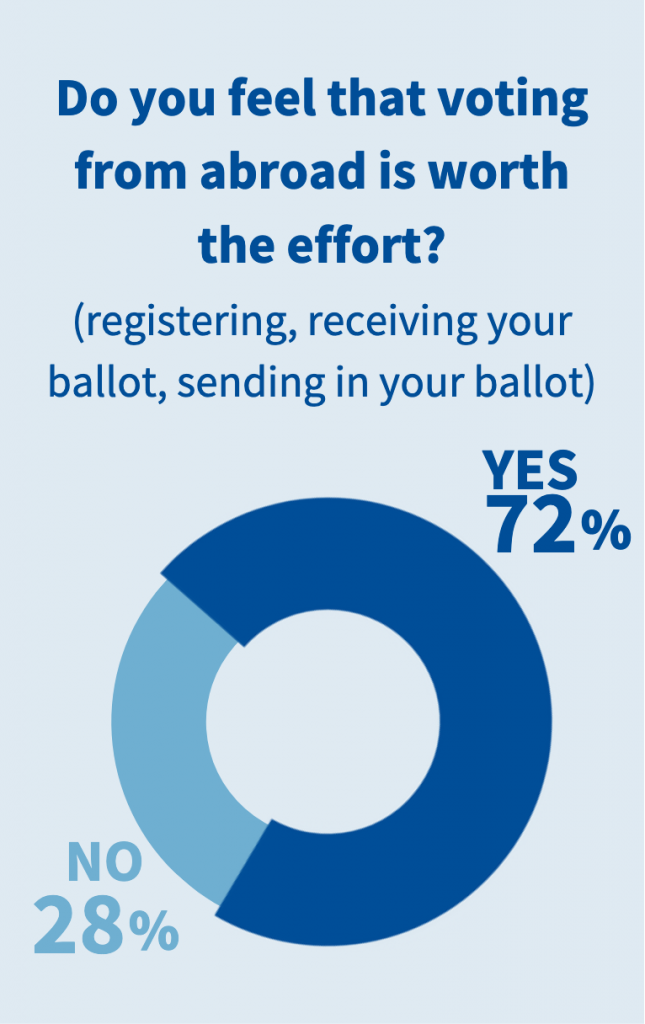

- 28% expressed that the effort required to vote while living abroad wasn’t worthwhile.

- 22% encountered challenges with receiving their ballots on time.

These statistics call attention to the ongoing concerns of the overseas voting experience.

Although there are challenges with the voting process, 72% of US expats still believe voting is worth the extra effort despite 77% expressing that they would be more likely to vote if the process was more simple abroad. This statistic showcases the need for improvement regarding the overseas voting process.

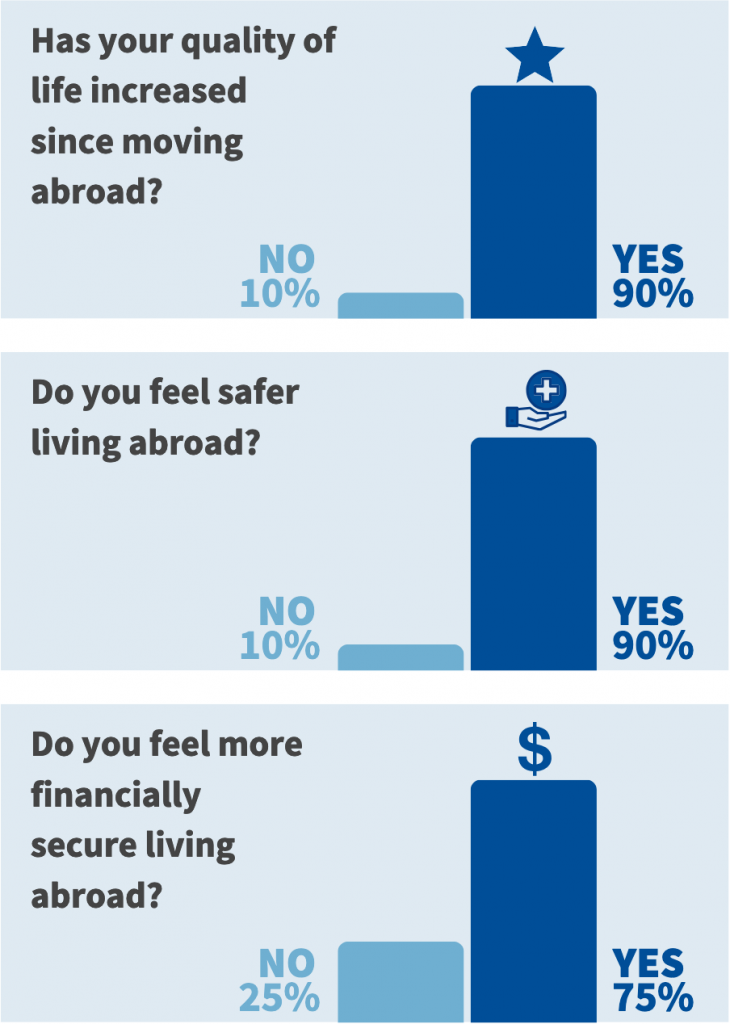

Quality of Life Abroad

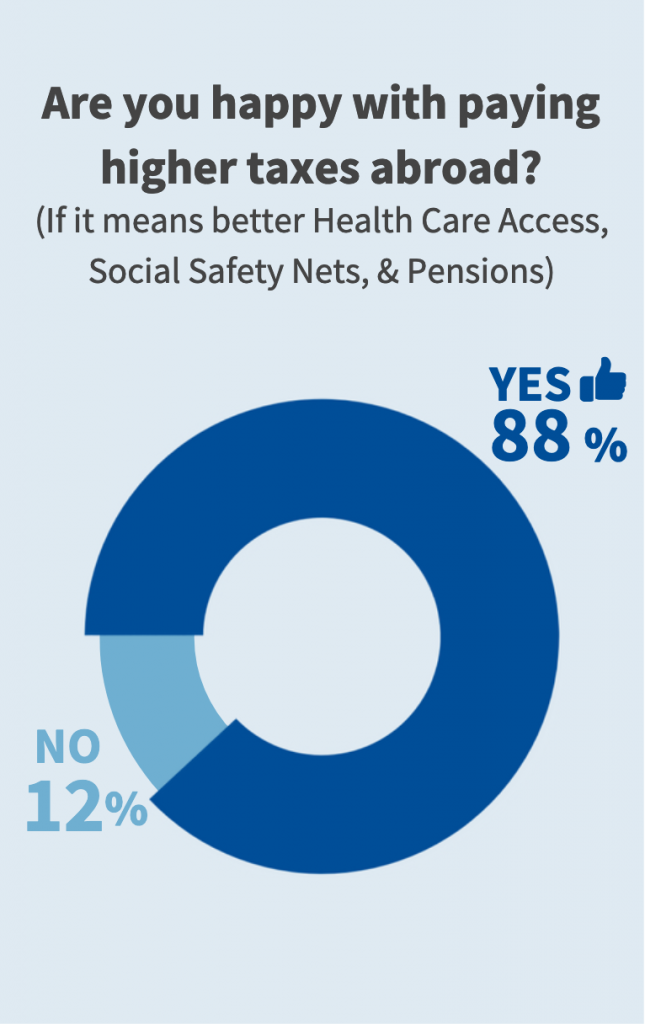

In addition to taxation and voting, this 2024 election survey wanted to understand the US expat life and potentially why people choose to live abroad while also finding a healthy balance between taxation and life abroad. US expats felt they had a better quality of life, they felt safer, and they felt more financially secure. These results ranged from 75% to 90% of the 1,500 participants who agreed they had an overall better life abroad. With an increase in the quality of life, 88% of individuals were happy to pay higher taxes if it meant better access to health care, social safety nets, and pensions.

Concluding Thoughts

The overall result of this survey indicates that American expats desire a simpler US taxation system. Expats are continuing to feel a high dissatisfaction to the point of wanting to willfully relinquish their fundamental right to vote or in extremes, to give up their US citizenship entirely.

As the 2024 US federal election approaches, voters will be left wondering if these concerns will be addressed. The lingering issue of taxation without representation raises questions about voter turnout and the continuation of citizenship for US expats.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 27, 2024 | Featured | 4 minute read