The Foreign Earned Income Exclusion

December 13, 2024 | Foreign Earned Income | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 15, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 15, 2025

In 2025, the Foreign Earned Income Exclusion is one of the best tax benefits for US expats. This tax benefit prevents double taxation by allowing expats to deduct $126,500 of foreign-earned income from their US tax liability. Often, the Foreign Earned Income Exclusion is enough to eliminate your US tax liability. So, here’s what you should know about IRS Form 2555, the Foreign Earned Income Exclusion.

What is the Foreign Earned Income Exclusion?

The Foreign Earned Income Exclusion is a tax deduction that allows expats to exclude up to $126,500 of foreign earned income from their US tax liability. Although the Foreign Earned Income Exclusion reduces your tax bill, it has some limitations, including that it can only be applied to earned income, such as wages and salaries.

The Foreign Earned Income Exclusion does not include investment accounts, capital gains, pension funds, or other non-foreign earned income.

Who Qualifies for the Foreign Earned Income Exclusion?

The Foreign Earned Income Exclusion is a smart option for those with a standard salary. Here’s how to qualify:

Your Tax Home Must Be in a Foreign Country: Your tax home is considered the place of your primary location of employment. In this case, your tax home will be regarded as the foreign country you’ve relocated to.

You Must Be a US Citizen or Green Card holder: Yes, even Green Card holders can claim the Foreign Earned Income Exclusion. With a Green Card, you are continuously tied to the US and have the same tax obligations as a US citizen.

Meeting the Bona Fide Residence Test or Physical Presence Test: There are two tests to determine whether you are considered a resident of a foreign country:

- Bona Fide Residence Test: You must have been a registered resident subject to local income taxes in your foreign host country for at least a full calendar year.

- Physical Presence Test: You must be outside of the US (i.e., physically present living abroad) for 330 full days in a consecutive 12-month period that begins or ends in the tax year.

Unsure which tax benefit is best for you? Use MyExpatTaxes “FEIE vs FTC calculator” to decide which tax benefit would be best for you.

Are You Married?

Even if you’re married to a foreign partner, you can still claim the Foreign Earned Income Exclusion when filing as ‘Married Filing Separately’.

When Should the Foreign Earned Income Exclusion be Filed?

The Foreign Earned Income Exclusion, or IRS Form 2555, must be filed simultaneously as your standard tax return. For US expats, this deadline is June 15th, as people living outside of the US get an automatic two-month extension.

If you cannot file before June 15th, you must file Form 4868 to receive an extension until October 15th. Learn more about what deadlines are best to know as a US expat!

Get your email reminders about upcoming deadlines!

"*" indicates required fields

How to File IRS Form 2555

IRS Form 2555 is straightforward when filing with MyExpatTaxes. All you need is:

- Name and (foreign) address

- Employer’s name and address

- Type of employment (traditional or self-employed)

- Reason for living abroad

- If you’ve claimed (and revoked) the Foreign Earned Income Exclusion previously

Calculating Your Foreign Earned Income

If you need help calculating your foreign earned income with this exclusion, here is an example to help you.

Monica works for a foreign company in Switzerland. In 2024, she earned $127,800 as foreign income. She can subtract the exclusion rate of $126,500 from her yearly salary. Leaving Monica with $1,300, which is taxable by the IRS.

Monica will only pay taxes on $1,300, but she could also use other benefits like the Foreign Tax Credit to eliminate the rest!

The taxable portion of your income is subject to the stacking rule, which means your tax rate is determined before applying the Foreign Earned Income Exclusion.

Filing with MyExpatTaxes

Most tax forms ask for the same basic information repeatedly. When you file with MyExpatTaxes, our user-friendly software automatically inputs your financial details to all the required forms, saving you time and effort.

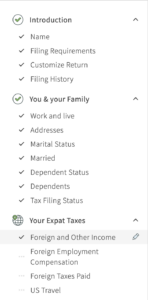

For filing IRS Form 2555, here is how it would look:

1. You can start by signing up and making a MyExpatTaxes account for free!

2. You’re going to fill out the information below. It will take a few minutes, but you will only need to fill it out once, and then it can be used for multiple forms!

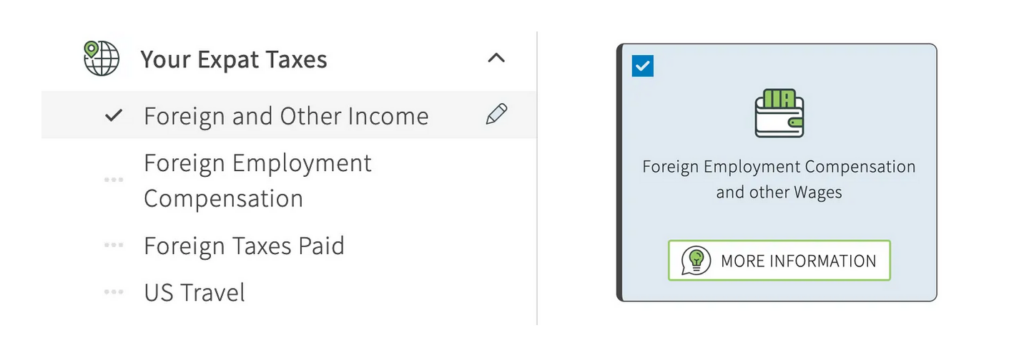

3. For foreign income, you must select this box unless you’re self-employed. Other options are also available. Select them as needed.

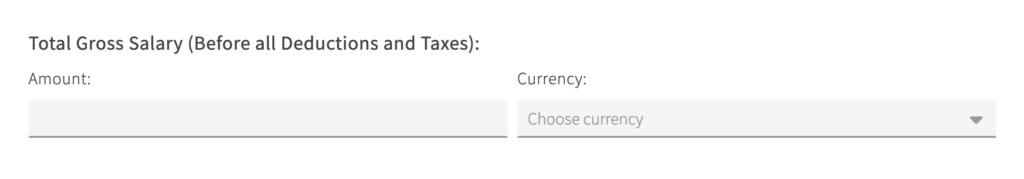

4. Now, you can add financial information, such as your employer’s name, address, gross salary (before taxes), and other relevant information.

5. You can include the Foreign Housing Exclusion, which allows you to deduct some housing expenses.

6. After that, finish filing normally, and MyExpatTaxes will do the rest! No calculations are necessary!

The Foreign Housing Exclusion

A section on IRS Form 2555 allows you to exclude qualifying foreign housing expenses such as rent, utilities, household repairs, and more. This amount varies yearly based on location and your cost of living. For your 2024 tax return, you could exclude up to $37,950 in addition to your $126,500 for foreign housing expenses.

Limitations with IRS Form 2555

Key Considerations for Self-Employed Expats

Self-employed US expats living abroad are subject to an additional US self-employment tax in addition to their regular US taxes. The Foreign Earned Income Exclusion can only be used to reduce individual taxes; it cannot help to reduce self-employment taxes.

For your self-employment taxes, there are Totalization Treaties that can help to eliminate double taxation. However, not all countries have a tax treaty with the US, meaning you could still be subject to double taxation as a self-employed US expat.

The Additional Child Tax Credit Cannot Be Claimed

If you claim the Foreign Earned Income Exclusion, any excluded income no longer counts toward the Additional Child Tax Credit. This can be problematic because the Additional Child Tax Credit requires a minimum earned income of $2,500 to qualify.

If the Foreign Earned Income Exclusions exclude all of your foreign earned income, you will not qualify. If you would still like to claim the Additional Child Tax Credit and prevent double taxation, you can use the Foreign Tax Credit instead!

Revoking the Foreign Earned Income Exclusion

You cannot claim the Foreign Earned Income Exclusion for five years if you have previously revoked it in favor of the Foreign Tax Credit. Therefore, it’s best to talk with a Tax Professional to determine the best course of action!

MyExpatTaxes is Here to Help

Whether you need tax support for the Foreign Earned Income Exclusion or other expat tax benefits as an American living abroad, our expert support team can help you every step. The best way to check eligibility and tax benefits is to make an account for free with MyExpatTaxes.

Do you need to file expat taxes and make up for previous years? Check out our affordable Streamlined program. You’ll be able to make up years of back taxes in hours.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

December 13, 2024 | Foreign Earned Income | 6 minute read