What US Expats Need to Know About the Foreign Tax Credit

October 14, 2023 | Foreign Tax Credit | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 14, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 14, 2025

The Foreign Tax Credit (or Form 1116) converts what has been paid in foreign taxes into a credit that can be used to lower your US tax liability. It does this by calculating the total amount of taxes paid, converting the total to USD, and applying the dollar amount to your US tax liability. By using the Foreign Tax Credit, expats can prevent double taxation.

Plus, this credit is flexible and can be carried back for one year and then carried forward for ten years.

How to Qualify for the Foreign Tax Credit

Qualifying for the Foreign Tax Credit is quite easy. US expats are only required to have foreign income that has been taxed by a foreign country that is not sanctioned by the US.

What Cannot be Claimed on the Foreign Tax Credit?

The Foreign Tax Credit does have a few limitations:

- You cannot claim more than your US tax liability, meaning this credit is nonrefundable

- You cannot claim the Foreign Tax Credit if you live in Syria, North Korea, Cuba, or Iran because the Secretary of State considers them state sponsors of terrorism

- Situations where the Foreign Tax Credit cannot be applied:

- If you paid withholding taxes on dividends from foreign corporations, income from short-term property ownership, or related property payments that you did not hold for the required period

- If you participated in an international boycott, related foreign taxes are excluded

- If you paid taxes on income from the purchase or sale of oil or gas

If your corporation plans to use the Foreign Tax Credit, they must file Form 1118, not Form 1116!

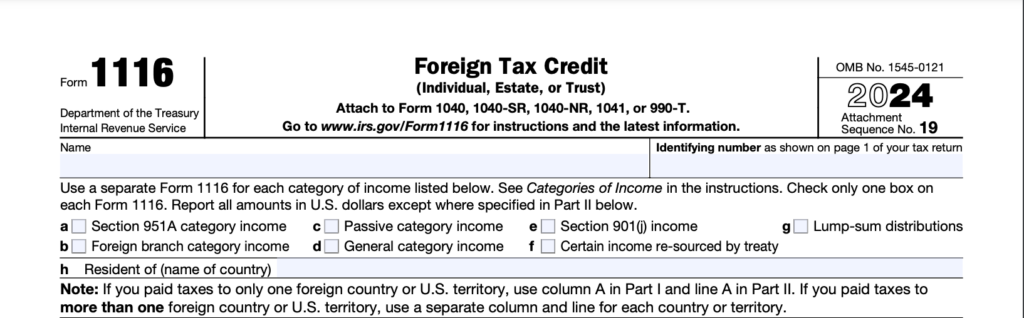

How to File Form 1116

Form 1116 is quite a hefty form to file, as it involves many calculations. For taxpayers eager to file their own taxes, here is an overview of how to file Form 1116.

Gather Your Documents

As per most forms, taxpayers must collect all of their documentation. This will include foreign income statements such as salary records, dividend receipts, or bank interest. Ensure to gather any documentation highlighting any foreign taxes paid to a foreign country.

Determine the Type of Foreign Income

Determining which type of income is one of the most important steps to filing Form 1116. Choosing the incorrect category is a common mistake, so double-check before calculating.

Here is a list of the top 3 most common income categories:

- Passive income such as interest, dividends, or royalties

- General category income, such as foreign-sourced wages

- Foreign branch category income, such as foreign-sourced self-employment income

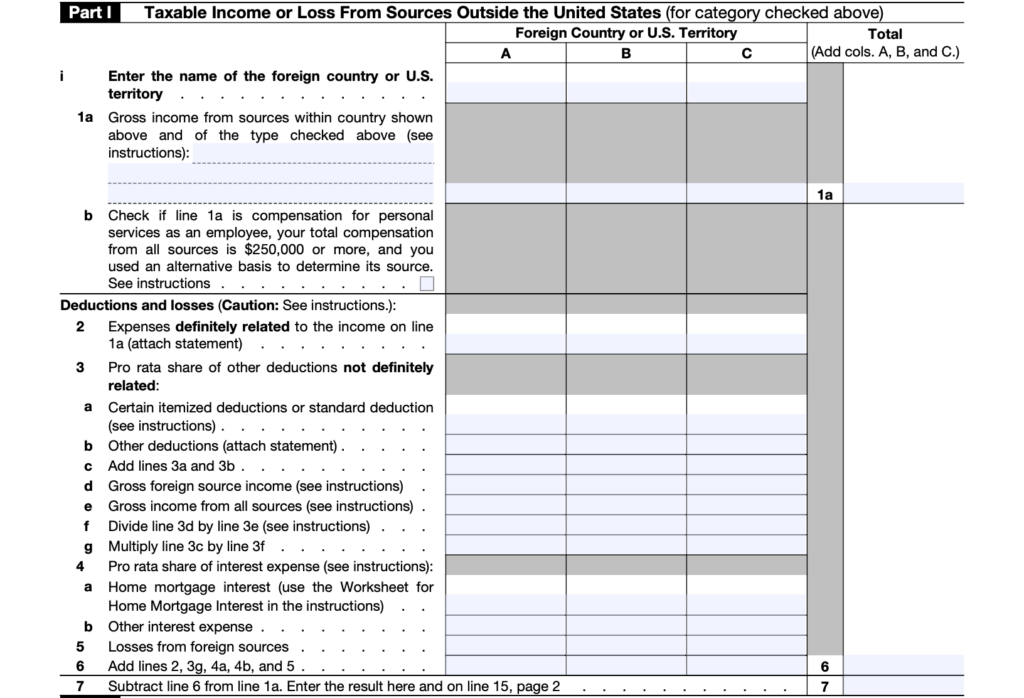

Part I: Taxable Income or Loss

For part I, taxpayers must report and calculate their foreign income or loss. The income category will determine how the Foreign Tax Credit is calculated. For more instructions, go to the IRS website.

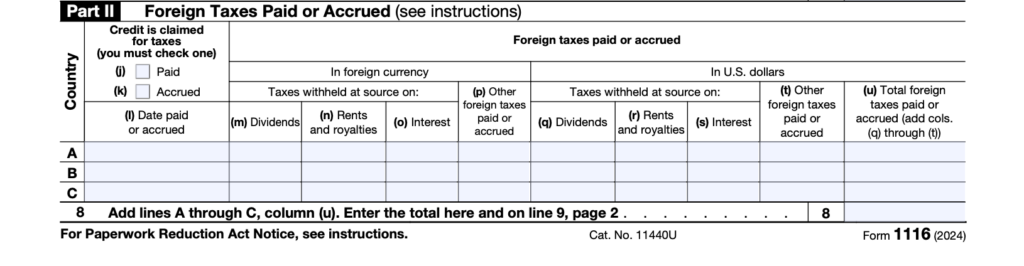

Part II: Foreign Taxes Paid or Accrued

In part II, foreign taxes paid or accrued must be converted into US dollars with the IRS exchange rates. The foreign and US currencies must be documented in this section.

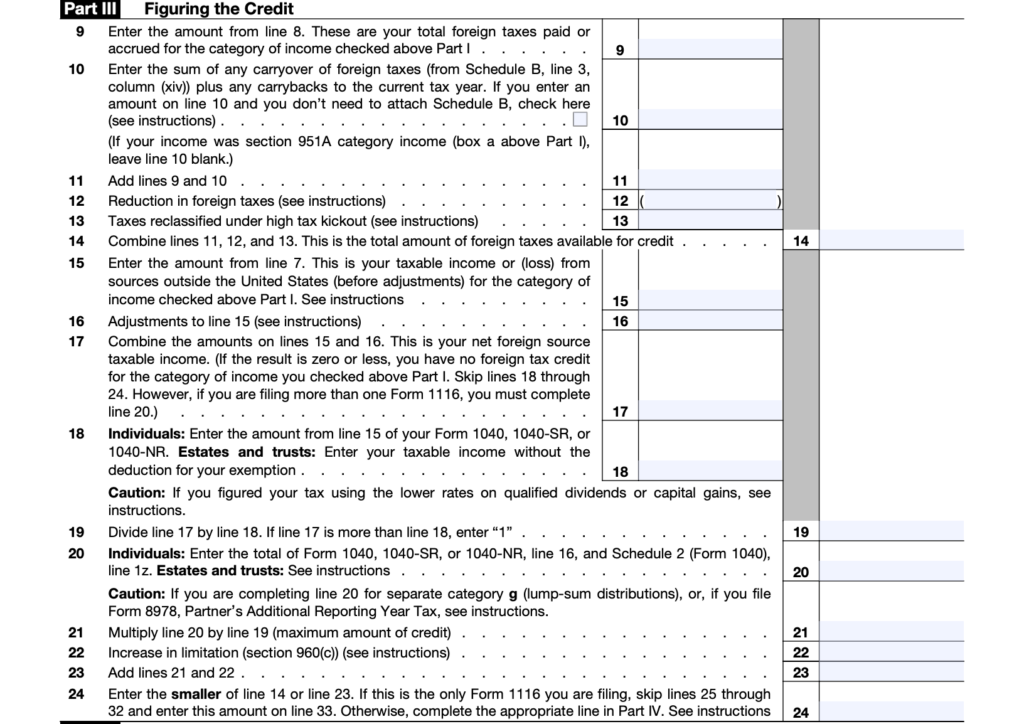

Part III: Computation of Foreign Tax Credit

Now that the first parts have been completed, taxpayers must calculate the Foreign Tax Credit for each income category. A few adjustments may need to be made to determine the Foreign Tax Credit limit. This section is essential for defining the foreign income from the US-sourced income.

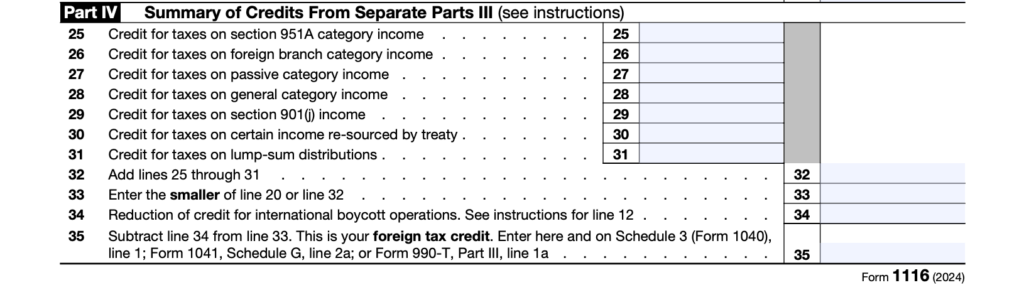

Part IV: Summary of Credits

Lastly, all calculations must be combined to determine the credit allowance that can be deducted from your US tax liability to prevent double taxation.

Attach Supporting Documents and Submit Form 1116

Keep all relevant documents, such as copies of your foreign tax returns, receipts, and any former tax returns detailing carryover amounts. In addition to filing Form 1116, you may need to file supplemental schedules, such as Form 1116 Schedule B, to document your carryovers. After all the sections have been filled out and schedules have been attached, you can submit Form 1116 with your income tax return.

Basic Calculation for the Foreign Tax Credit Limit

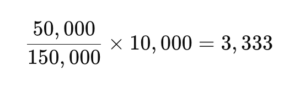

The IRS uses a specific formula to calculate the Foreign Tax Credit limit:

For example, if you earned $100,000 in the US and $50,000 in, let’s say, Italy (after using the IRS exchange rate), and your US tax liability is $10,000, then one-third of your income is foreign-sourced.

Your Foreign Tax Credit limit would be $3,333.

Foreign Tax Credit vs. Foreign Earned Income Exclusion

Whether you choose the Foreign Tax Credit, the Foreign Earned Income Exclusion (FEIE), or both will depend on your tax situation. If you’re in a high-tax country like Norway or Japan, the Foreign Tax Credit could be the better option. If your foreign earned income is under $126,500 and you live in a lower-income tax country, using the FEIE may be better.

Your tax approach is very important because switching from the FEIE to the Foreign Tax Credit can make you ineligible for five years for the FEIE. Mistakes can be quite costly, but with MyExpatTaxes, we can help you through the process and prevent you from filing errors.

Claiming the Foreign Tax Credit Without Filing Form 1116?

In some exceptional cases, you can claim the Foreign Tax Credit without filing Form 1116. As long as the following apply:

- In the tax year under consideration, all of your foreign income came from passive sources

- Your foreign taxes for the year did not exceed $300 when filing single

- Your foreign taxes for the year did not exceed $600 when filing jointly

- You receive a payee statement, including a dividend statement and a 1099 interest statement, that includes all your foreign income and foreign taxes

Unfortunately, these cases will only apply to a small number of US expats abroad, primarily those with a small income and already paying foreign taxes.

MyExpatTaxes is Here to Help!

Form 1116 is very time-consuming and confusing; there are a lot of aspects to consider. From calculating the exchange rates to choosing the correct income category to calculations, avoid potential penalties and missed tax credits by filing with MyExpatTaxes.

MyExpatTaxes simplifies the filing process by handling all the calculations for you, and if any credits can be carried forward to future years, we also keep track of that. Stay tax-complaint and avoid double taxation by getting assistance from our Tax Professionals!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 14, 2023 | Foreign Tax Credit | 6 minute read