If you’re a US expat investing while living abroad, there’s a good chance you’ve encountered a passive foreign investment company (PFIC), often without even realizing it.

PFICs can be a major headache for US expats. These types of foreign investments can seem ordinary but often trigger complex reporting on IRS Form 8621. PFICs aren’t just a reporting hassle; They can result in aggressive tax treatment. Because foreign mutual funds don’t follow US reporting rules, the IRS considers them high-risk and imposes a punitive tax regime to discourage their use.

If you own a PFIC, the IRS expects you to report it each year using Form 8621, even if you didn’t receive any income from it. Here’s what you need to know.

What is a PFIC?

A PFIC is typically a pooled investment fund based outside the US that earns mostly passive income. Many US expats invest in foreign mutual funds without realizing they are PFICs. These funds are common in international investment portfolios and may seem like ordinary investment choices. Even ones recommended by local banks or advisors who are unaware of US tax laws.

A Passive Foreign Investment Company (PFIC) is a foreign corporation that meets one of the following conditions:

- At least 75% of its gross income is passive (e.g., interest, dividends, rents, or royalties)

- At least 50% of its assets produce or are held to produce passive income

Common examples of PFICs include:

- Foreign mutual funds

- Foreign ETFs

- Offshore investment trusts or funds

- Certain foreign pension plans, as they normally invest in mutual funds

- Foreign REITs (if they meet PFIC income or asset thresholds)

What is Form 8621?

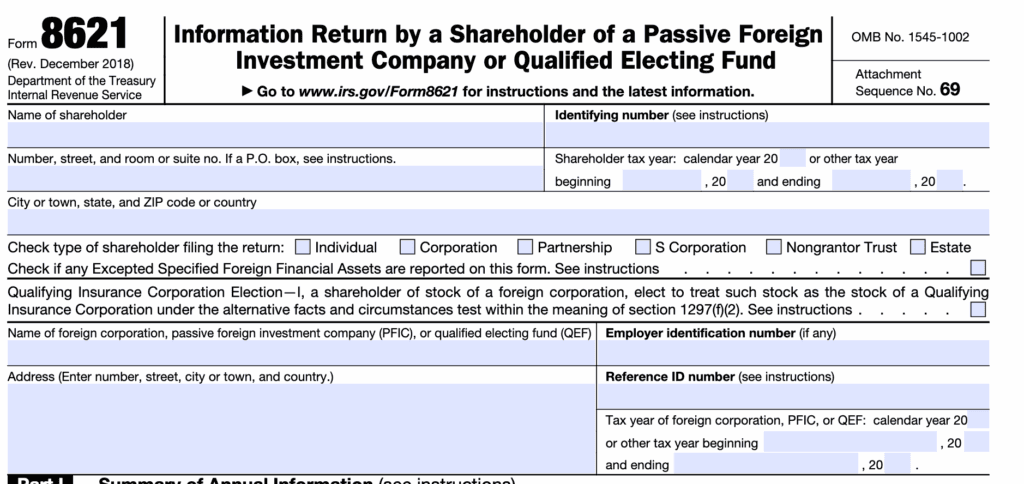

Form 8621, officially titled Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund, is the IRS form required to report investments in PFICs. If you’re a US taxpayer and you own shares, directly or indirectly, in a PFIC, you may need to file this form.

Do I Need to File Form 8621?

As a US taxpayer with investments in PFICs, you must generally file Form 8621 each year if any of the following apply to you:

- Receive distributions from a PFIC, even if reinvested

- Dispose of any PFIC shares

- Make an election with respect to the PFIC (e.g., QEF or mark-to-market election)

- Your holdings exceed the de minimis exception

Even if you don’t earn any income from a PFIC, you may still need to file Form 8621 if your holdings exceed certain thresholds:

- Over $25,000 (if single or married filing separately)

- Over $50,000 (if married filing jointly)

You may not need to file if you’re below these thresholds and didn’t receive any distributions or sell any shares. However, filing early still allows you to make an election before a distribution or sale, helping you avoid the default PFIC tax regime.

What Are My PFIC Reporting Options?

The IRS provides three tax regimes for PFIC shareholders. US taxpayers who don’t make an election are subject to the default and most punitive Excess Distribution regime. To reduce your PFIC tax exposure, you can instead choose the Qualified Electing Fund (QEF) election or the Mark-to-Market (MTM) election, if eligible.

Default Excess Distribution Regime

This is the default if you don’t make a PFIC election. If you sell your PFIC or recognize a gain, the IRS taxes your entire gain retroactively. Spreading it across the years you held the investment, even if you didn’t receive any distributions. It also adds interest, as if you underpaid tax in each of those years.

Excess distributions are payouts that exceed 125% of your average annual distributions over the past three years and are also taxed this way.

Example:

You buy a foreign mutual fund for $10,000 and sell it five years later for $15,000. The IRS treats the $5,000 gain as excess and as if you earned $1,000 per year, taxes each portion at that year’s rate, and tacks on interest for each year you owned the PFIC. Your final tax bill could exceed the actual gain.

Mark-to-Market (MTM) Election

This is often the most practical election for PFICs that are publicly traded. Each year, you treat unrealized gains as ordinary income, even if you haven’t sold the shares. You avoid deferred tax and interest charges, but you may end up paying tax sooner before any distributions are made.

This method applies only to marketable securities, such as foreign mutual funds or ETFs traded on recognized exchanges.

The MTM election must be made in the first year you file Form 8621 for the PFIC; otherwise, you may be locked into the more punitive default regime going forward.

Qualified Electing Fund (QEF) Election

This election lets you report your share of the PFIC’s annual income and capital gains, avoiding deferred tax and interest charges. It is treated similarly to a US mutual fund for tax purposes. However, very few PFICs provide the detailed annual statements required to make this election, so it’s rarely a practical option.

Form 8621 Instructions: What to Include

When completing Form 8621, you’ll need to follow the IRS Form 8621 Instructions, which outline how to:

- Identify the PFIC and describe the investment, including share class, acquisition date, and cost basis. Reported in Part I: Summary of Annual Information, includes general information about the PFIC and the shareholder

- Indicate whether you’re making any elections (QEF, mark-to-market). Reported in Part II: Elections

- Calculate and report income and gains under the applicable regime. Varies by method. Part III, IV, or V.

- Report any excess distributions (those exceeding 125% of your average distributions over the last three years). These are reported only under the default PFIC method and entered in Part V of Form 8621.

Important: You must file a separate Form 8621 for each PFIC you own, even if you didn’t receive any income.

Part I: Summary of Annual Information

Form 8621 can be submitted with your regular tax return, either electronically or by mail. However, it’s also one of the most complex IRS forms; even small mistakes can mean significant penalties. MyExpatTaxes specializes in helping expats handle complex tax situations, including Form 8621 and PFIC compliance. We’ll help you determine whether your investments qualify as PFICs, file any necessary forms, and explore election strategies to minimize tax.

What Are the Penalties for Not Filing?

Failing to file Form 8621 when required can lead to severe consequences:

- Form 8621 failure: There are no late filing fees for this form; however, as tax is normally calculated, you can face financial penalties on underpayment of tax

- Unlimited audit window: If you fail to file your tax return, it may be considered incomplete. This pauses the statute of limitations, allowing the IRS to audit your return indefinitely.

- Interest and penalties: You may face interest charges and accuracy-related penalties

- Loss of beneficial tax elections: You may lose access to more favorable PFIC treatment (QEF or MTM), locking you into the default excess distribution regime

In short, skipping Form 8621 can expose you to long-term IRS scrutiny and a bigger tax bill.

Special Considerations for US Expats

PFIC rules apply regardless of where you live. The IRS still requires you to report PFICs, even if you’re fully taxed in your country of residence. This can lead to double taxation.

To reduce your risk, consider investing in US-domiciled funds or directly in individual foreign stocks and bonds. Just be sure they’re not held inside a pooled foreign fund.

You can also work with expat-friendly brokerages, like MyExpatInvest, specializing in investment and financial strategy for Americans abroad. Let us guide you to investment strategies that won’t trigger PFIC treatment.

If you’ve just discovered you own PFICs, don’t panic, but don’t ignore them either. Talk to a trusted Tax Professional like MyExpatTaxes right away. You may still be able to make a late election, reduce penalties, and limit your IRS exposure. The sooner you act, the more options you’ll have.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.