How US Expats Can Use the Foreign Tax Credit Carryover

June 30, 2025 | Foreign Tax Credit | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 10, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 10, 2025

As a US expat, you likely pay taxes to your host country on local income. Because the US taxes are based on citizenship rather than residency, you must still file a US tax return each year, even while living abroad.

The IRS helps eliminate double taxation through the Foreign Tax Credit (FTC), which you claim by filing Form 1116. This provision allows you to offset foreign taxes paid with a dollar-for-dollar credit against your US tax bill on the same income.

Often, though, the taxes you paid will exceed what you owe to the IRS. So what happens to the unused credits? That’s where the carryover and carrybacks come into play.

In this article, we show you how to optimize your long-term tax strategy with the Foreign Tax Credit Carryover so you don’t lose out on credits you’ve earned.

What is the Foreign Tax Credit Carryover?

The FTC Carryover allows you to utilize unused tax credits from a given tax year and either carry them forward up to 10 years or back to the previous year. This flexibility allows you to maximize the Foreign Tax Credit over time, even when your income or US tax liability varies year to year.

Carrybacks can help you recover taxes paid in the prior year, while Carryovers preserve unused credits for future years when your US tax bill may be high enough to use them.

Carryforward Example

In 2023, you paid $12,000 in foreign taxes to Germany, but your US tax liability on the same income was only $8,000. You can carry the remaining $4,000 in unused credits forward and use it to reduce your US tax on foreign income in the same category for up to 10 years, if your tax bill increases.

Carryback Example

In 2024, you paid $9,000 in foreign taxes to Japan, but could only use $6,000 in credits that year due to a lower US tax liability. You may carry the unused $3,000 back to 2023 if you had US tax owed on foreign income that the FTC didn’t entirely eliminate. This could reduce your 2023 tax bill and potentially result in a refund. This is especially useful for those who had a lower foreign tax liability in the year they initially moved abroad.

Note: Convert all foreign tax amounts to US dollars before reporting them. You can use the IRS’s yearly average exchange rates to do this.

How to Carry Over the Foreign Tax Credit

You can only carry over the Foreign Tax Credit if you paid foreign taxes and claimed the FTC using IRS Form 1116 in the original year.

If you’re carrying unused credits forward, you must apply them before claiming any new FTC credits in a future tax year. You also need to complete Form 1116 again for each income category, general (e.g., salary, pension) or passive (e.g, dividends, rental income), and attach it to Form 1040.

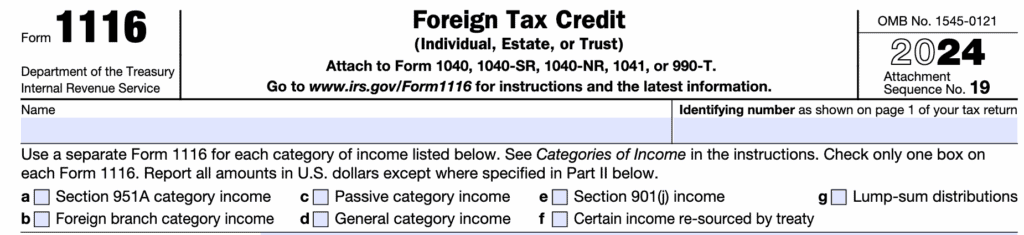

At the top of Form 1116, you’ll select the appropriate income category (or “bucket”).

Keep your own records of the year the credit was created, the income bucket it falls under, how much you’ve used each year, and what remains. For example, if you carry forward $3,000 and only use $1,200 in a future year, you’ll need to note the remaining $1,800 separately. Form 1116 only reports what you use in a given year, it doesn’t track your full credit history. That’s why the IRS requires you to properly maintain Schedule B of Form 1116, which will track all these credits for each income category.

To help you stay organized, the IRS includes a Foreign Tax Credit Carryover Worksheet Form 1116 instructions.

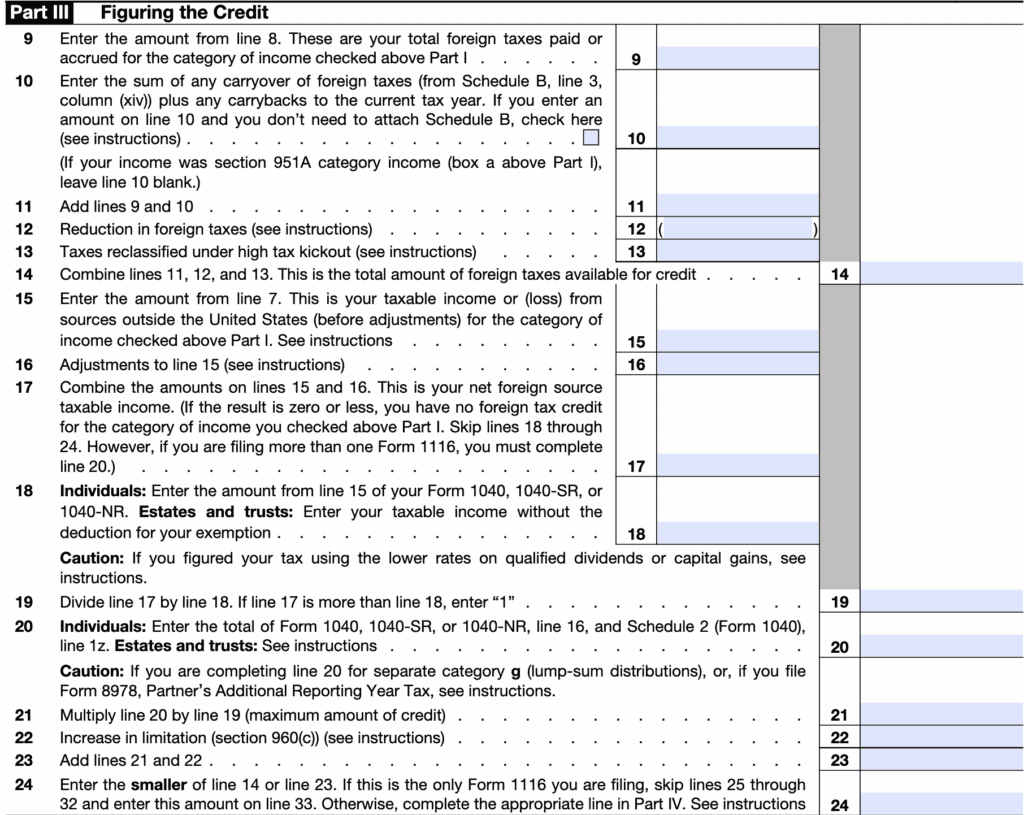

Part III of Form 1116 is where you report any carryover from prior years and calculate your total Foreign Tax Credit limit for the current year.

Line 10 is where you enter unused credits from a prior year, and Line 24 shows the final amount of credit allowed after applying IRS limits.

How to Carryback the Foreign Tax Credit

If your US tax liability was higher in the prior year than in the current year, a carryback may offer immediate savings, especially if it results in a refund!

For example, If you moved to the UK in 2024, you may have paid little or no UK tax that year due to the mismatch between UK and US tax years. But by 2025, your UK tax liability could increase significantly. If that results in excess foreign tax credits, you may be able to carry them back to reduce your 2024 US tax liability on foreign income.

To do this, you’ll need to:

- File Form 1040-X to amend the previous year’s return

- Show the foreign income, taxes paid, and the credit you’re applying by completing Form 1116 for that amended year.

- Clearly indicate that you’re applying a carryback of unused credit from the following year

Carrybacks follow the same process as carryforwards, using Form 1116 and applying by income category. You can only apply them to the previous tax year, while carryforwards let you use the credit for up to 10 future years.

Need help filing an amended return or applying a carryback? MyExpatTaxes can handle the paperwork for you, accurately and efficiently. So you don’t leave valuable credits on the table.

How to Calculate the Foreign Tax Credit Carryover

You calculate the Foreign Tax Credit based on the portion of your US tax liability that applies to your foreign income, using the Foreign Tax Credit Limitation Formula.

Foreign Income ÷ Worldwide Income × US Tax Liability = FTC Limit

You can calculate your carryover by using the Foreign Tax Credit Limitation Worksheet in the Form 1116 instructions to determine how much of your foreign taxes you can claim as a credit for that year. If you paid more in foreign tax than the limit allows, the unused portion becomes your carryover.

Check out our full guide, Form 1116: How to Maximize the Foreign Tax Credit, for a step-by-step breakdown of how to calculate the Foreign Tax Credit.

Don’t Let Your Credits Go to Waste

The Foreign Tax Credit carryover and carryback rules can be a powerful way to reduce your tax bill as a US expat, but only if you track and apply them correctly. With thoughtful tax planning, you can make the most of every dollar you’ve already paid in foreign taxes.

Need help maximizing your FTC? Let the experts at MyExpatTaxes guide you through it. We make Form 1116 simple, so your credits don’t go to waste.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

June 30, 2025 | Foreign Tax Credit | 4 minute read