Will You Owe US Taxes as an Expat in 2025?

October 20, 2023 | Paying Taxes | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 14, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 14, 2025

If you’re an American citizen who’s living outside of the US, you’ve probably asked yourself, “Do I owe US expat taxes?”. If you’re not sure whether or not you do, you’ve come to the right place! Taking care of your taxes can be one of the most dreaded parts of the year. Plus, taxes can be more complicated when you’re living abroad. We’ll help you figure out whether you owe US expat taxes and how to pay them if so.

Foreign Sourced Income

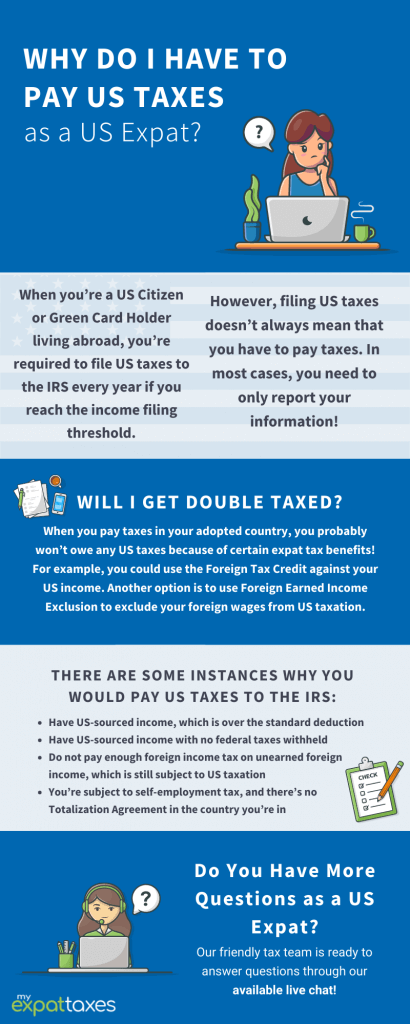

Being an American citizen means you probably have to report income and taxes to the US government. Even if you’re living in a whole different country (unfortunately), that responsibility doesn’t go away! Unlike nearly every other country, the United States places the onus of filing taxes on its citizens, even when they’re abroad.

In short, if you’re a US citizen abroad, you have an obligation to report your worldwide income to the IRS. Yes, even if you’ve earned money not earning your money in the US, you still have to report your worldwide earnings to the IRS once you reach the filing thresholds.

Prevent Double Taxation

US expats have to deal with the same tax laws as those living in the United States. Luckily, though, the IRS does provide a few avenues that can help you avoid pay taxes to both the US and in your home country. For instance, the Foreign Earned Income Exclusion (FEIE) tax benefit allows expats to exclude up to $126,500 from their US taxable income for 2025 (2024 tax year).

Expats might also use the Foreign Tax Credit (FTC) to account for income tax for earnings not excluded with the FEIE. Depending on which country you live in, you may also be able to take advantage of the specific Tax Treaty Benefit that the US has with that nation.

Difference Between Owing Taxes and Filing Taxes

Be clear about the considerable difference between owing taxes and filing them. Virtually every US citizen, even those living abroad, will have to file taxes.

To file a US tax return as an American living abroad you must determine your tax filing threshold through your status and worldwide gross income. Once you reach the following threshold for your tax status, then you’ll need to file a US tax return.

In 2025, the tax filing thresholds for 2024 tax returns are:

Single individuals, under 65 years old: $14,600

Married Filing Jointly, under 65 years old: $29,200

Married Filing Separately, under 65 years old: $5 (yes, you read that right)

Head of Household, under 65 years old: $21,900

Qualifying widower, under 65 years old: $29,200

Do I need to File Expat Taxes

As we’ve explained above, most likely US citizens abroad don’t owe US taxes due to the FEIE, FTC, Tax Treaties and other benefits. To file your US expat taxes, a lot of expats utilize our US expat tax software. Using online tax filing methods is typically easier and faster than submitting your tax return by mail.

Working for a US-based Company

If you work for a US-based company, your employer likely takes taxes out of your paychecks. When you file your taxes, the IRS will determine if you’ve already paid the amount that you owe through these employer deductions.

If you’ve paid enough through your employer, then great! You won’t owe anything extra and may even get a return if you’ve paid too much. However, if you haven’t paid enough (maybe you claimed allowances and got more in each paycheck), then you’ll owe the IRS some money and will have to pay taxes instead of getting a return.

If you owe taxes, you can pay the IRS through us, too and we can be there with you every step of the way.

2025 US Tax Payment Deadline

The majority of US citizens living abroad can avoid owing taxes thanks to benefits like the FTC and FEIE. If you do owe taxes though, they must be paid by April 15th to avoid penalties.

However, for filing your taxes, Americans abroad actually have until June 15th to do so. It’s best to act early and file as soon as possible to become tax compliant and receive Stimulus checks!

Penalties for Not Paying US Taxes

If you do owe US expat taxes and don’t pay the IRS, there are unfortunately some consequences.

In a nutshell, delaying your tax filings can lead to higher expenses down the road. Filing after the deadline (without an approved extension) or failing to make timely payments often triggers late payment penalties, which escalate the longer you wait. In the worst case, you might end up shelling out up to 25% of your owed taxes just in penalties!

Makeup Owed Taxes Through Streamlined Procedure

If you owe taxes as an American and are worried about getting in trouble. Worry no more, IRS has created a Streamlined Procedure for this case. You might qualify if you haven’t lived in the US for the last 3 years, haven’t filed a federal tax return in 3 years or more, and haven’t filed FBAR in 6 years or more. Those who do qualify can catch up on their taxes without the fear of penalties, which is a huge relief for many.

Here at MyExpatTaxes, we offer the most affordable Streamlined package for American expats, with top-reviews. With the Streamlined Procedure, we can assist you with up to 4 years’ worth of taxes in just a couple of hours. All for about 1/3 of the price of a traditional tax consultant.

Pay Your US Taxes With MyExpatTaxes

We make it easy to get your expat taxes taken care with the Base plan. Our human expert tax team can help you through the process and ensure you get all the deductions possible, keeping more money in your pocket! Start filing with us today to discover how we can help you file and pay US expat taxes for 2025!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 20, 2023 | Paying Taxes | 4 minute read