Form 8832 for US Expats: How to Choose the Right Tax Classification For Your Business

June 10, 2025 | Tax Forms | 7 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated

When you’re living abroad and running or investing in a business, you’re probably already juggling different tax systems, regulations, and deadlines. One of the smartest ways to take control of your US tax situation is to understand Form 8832—the IRS’s tool for helping you classify your business for tax purposes.

Filing Form 8832, also known as the Entity Classification Election, allows you to tell the IRS how your business should be taxed. Sounds boring? Maybe. But it could save you a ton of time, paperwork, and tax dollars. In short, if you’re a US expat with an eligible business entity, Form 8832 is your opportunity to make IRS rules work in your favor.

What Is Form 8832?

Form 8832 is used by eligible foreign and domestic business entities to elect how they’re treated for federal tax purposes. Eligible entities include US-based Limited Liability Companies (LLCs), US-based partnerships, and certain foreign entities. Without this election, the IRS applies default rules based on where the entity was formed and how many owners it has.

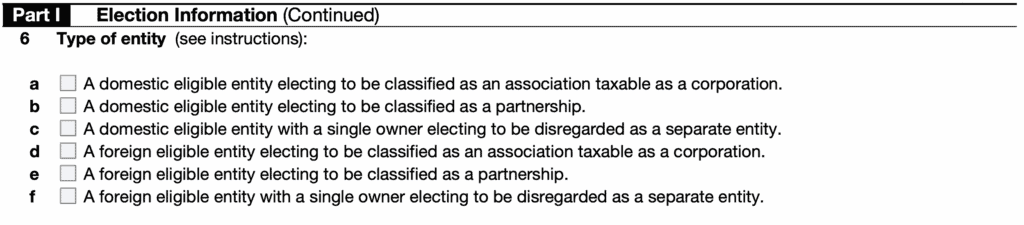

Here’s where it gets interesting: if you’re a US expat and own or operate a business, the default tax treatment might not be in your favor. Filing Form 8832 gives you a say. Depending on your eligibility, you can choose between:

- A disregarded entity: Available to single owner LLCs

- A partnership: For multiple owner LLCs

- A corporation: Separates the entity from its shareholders

For each option, there is a domestic and foreign classification. Domestic entities are formed in the US under state law, and foreign entities are formed under foreign (non-US) law. For both domestic and foreign entities, the owner is typically a US person.

Read More: Small Business Guide for Americans Living Abroad

Disregarded Entity

A disregarded entity is a business entity with a single owner that the IRS will ignore–or disregard–for federal income tax purposes. Income and expenses flow directly to the owner’s tax return.

US Single Member LLCs are by default seen as disregarded entities, and foreign corporations with one shareholder can also make this election.

As the owner of a Domestic Disregarded Entity (DDE), you’ll pay personal income tax on the corporation’s profits through your personal federal tax return (Form 1040).

If you have a Foreign Disregarded Entity (FDE), you’ll also need to file Schedule C and Form 8858.

Partnership

Entities with two or more owners can elect to file as a partnership. The LLC files Form 1065 detailing its financial activities. LLC members file a Schedule K-1 to report their share of the company’s profit or loss and include that income on their personal tax returns.

For foreign partnerships, members may also need to file Form 8865, which informs the IRS which specific foreign partnerships they are involved in. For foreign partnerships, members may also file Form 8865 to inform the IRS about the specific foreign partnerships they participate in.

Corporation

Filing Form 8832 lets your LLC opt to be taxed as a C-corporation. A C-corporation is an independent legal entity, owned by its shareholders, that has unlimited growth potential. With this structure, your business income is taxed at the corporate level and again at the shareholder level if profits are distributed, referred to as “double taxation”.

Advantages of C-corp treatment include:

- Flat 21% (2024) federal corporate tax rate for corporations.

- Unlimited shareholders, multiple classes of stock.

- Can deduct salaries, bonuses, and other business expenses.

A Corporation comes with greater regulatory and tax obligations but can lower your tax bill and other costs. This setup may suit growing businesses or those seeking outside investors, despite the greater regulations and reporting responsibilities.

If you own more than 10% of a foreign corporation, you may need to file Form 5471.

S-Corporation

For some, an S-corporation offers the best tax structure as it allows income to “pass-through” to shareholders. You’ll only pay personal income tax on profits—there’s no corporate tax. If you want S-Corporation treatment, file Form 2553 instead of Form 8832.

Foreign Entities

If you’re a US expat who owns a business registered abroad, the default IRS classification will depend on the number of owners and whether they have limited liability under local law.

Unless you file Form 8832 to elect a different classification, the IRS applies these foreign default rules:

- If your foreign entity has a single owner who does not have limited liability, it’s treated as a Disregarded Entity.

- If it has two or more owners, and at least one does not have limited liability, it defaults to a partnership.

- If all owners have limited liability, the IRS classifies it as a foreign corporation.

If your foreign entity is treated as a corporation:

- You must file Form 5471 if you own 10% or more, an extremely complex form with high failure to file penalties.

- Foreign Earned Income Exclusion (FEIE) and Foreign Tax Credit (FTC) don’t apply to profits, unless you pay yourself a salary.

- May be subject to GILTI tax if the entity is a Controlled Foreign Corporation (CFC).

Because of these risks and complexities, many expats with a business registered abroad elect a Foreign Disregarded Entity:

- You may qualify for the FEIE or FTC on net profit.

- This often results in lower overall tax if you pay less than 19% in foreign corporate tax.

- You might owe self-employment tax (15.3%) unless covered by a totalization agreement.

If the business has two or more owners, the default is usually a foreign partnership:

- Similar to the Foreign Disregarded Entity, you can use FEIE and FTC on net income, and partners may owe self-employment tax, unless exempt under a totalization agreement.

- You must file Form 8865 to report the partnership’s activity. Reporting is complex and heavily penalized if missed.

Form 8832 Options Summary

The chart below compares the key differences between disregarded entity, partnership, or corporation classifications for both domestic and foreign entities.

| Feature | Disregarded Entity | Partnership | Corporation |

|---|---|---|---|

| # of Owners | One | Two or more | One or more |

| Default (Domestic) | For single-member LLCs | For multi-member LLC | No (must elect or file as corporation) |

| Default (Foreign) | For single owner that does not have limited liability. | For 2+ owners and at least one member does not have limited liability. | If 1 or more owners,all of whom have limited liability. |

| Tax Filing (Domestic) | Form 1040 + Schedule C | Form 1065 + K-1s | Form 1120 (or 2553 for S corp) |

| Tax Filing (Foreign) | Form 1040 + 8858 | Form 1040 + 8865 + K-1s | Form 5471 (if ≥10% owner) |

| FEIE/FTC on Profit? | Yes | Yes | No – only on wages and FTC on dividends |

| Subject to Self-Employment Tax? | Yes (unless exempt) | Yes (unless exempt) | No |

| Risk of GILTI (foreign only) | No | No | Yes (if a Controlled Foreign Corp) |

How & When to File Form 8832

Form 8832 is relatively simple to complete. You’ll need basic information such as the business name, address, and Employer Identification Number (EIN). For sole owner entities, you’ll need the owner name and social security number.

You can file Form 8832 when you start your business or at any point in a business’s lifetime. However, you need to file within 75 days prior to the desired effective date or within the following 12 months.

Mail Form 8832 to the appropriate IRS office, and the IRS will send you a response within 60 days.

It’s important to note that you can normally only change classification once every five years, so make your election carefully.

MyExpatTaxes

Form 8832 is just one of the many international tax forms our award-winning expat tax software supports. Whether you’re filing your federal return for the first time from abroad, or restructuring your LLC for tax efficiency, MyExpatTaxes simplifies the filing process—no jargon, no stress.

Our US expat tax software is the only platform designed specifically for Americans abroad that includes full checks for Form 5471 filing requirements. And if you do need to file, our rates are the most affordable on the market.

Our standard plan includes FBAR and FATCA reporting, and we’ve helped thousands of expats file smoothly from abroad. If you need Form 8832, we support that in our Premium or Planning Services to help you ensure your foreign business structure is as tax efficient as possible. Let us help to maximize your US tax benefits and ensure your return is filed correctly!

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

June 10, 2025 | Tax Forms | 7 minute read