IRS Form 3520: Reporting Foreign Trusts, Gifts, and Inheritances

June 16, 2025 | Gift & Inheritance | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated October 22, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated October 22, 2025

As a US expat it will come as no surprise that the IRS wants to know about assets you control. This applies even when those assets originate outside the US. That’s exactly why IRS Form 3520 is in place.

This Form is essential for reporting foreign trusts, large gifts, and inheritances. Although Form 3520 can seem complicated at first, this guide breaks it down clearly with helpful examples so you can stay compliant and avoid costly penalties.

What is IRS Form 3520?

If you meet certain criteria related to foreign trusts, or receive gifts or inheritances from foreign individuals or entities, you must file Form 3520. Understanding the Form 3520 filing requirements helps ensure you stay compliant and avoid penalties.

US citizens living abroad must report these transactions in the following situations:

Who Needs to File Form 3520?

Form 3520 is an annual informational form that US taxpayers must file if they have interests in foreign trusts or have received large gifts or inheritances from overseas. Only certain transactions trigger filing requirements, depending on the size, type, and source. Filing Form 3520 is about transparency, not necessarily about paying additional tax. Put simply, it keeps you in good standing with the IRS and helps you avoid penalties down the line.

If you meet certain criteria related to foreign trusts, or receive gifts or inheritances from foreign individuals or entities, you must file Form 3520. Understanding the Form 3520 filing requirements helps ensure you stay compliant and avoid penalties.

US citizens living abroad must report these transactions in the following situations:

Foreign Trusts

You must report if you create, transfer property to, or are considered the owner of a foreign trust. Trusts are complex entities though and their treatment depends on the type of trust:

- Grantor Trust: The grantor controls the trust. If you are the grantor, you are responsible for reporting income, distributions, and your ownership in the trust.

- Non-Grantor Trusts: These trusts operate independently of the grantor. The trust itself may have separate reporting obligations, and you generally do not report trust income unless you receive distributions or have an ownership interest.

You must file Form 3520 if you are involved in any trust-related transactions, such as creating or funding a foreign trust, making distributions, taking loans, or using trust property.

Example: Emma, a US citizen living in Spain, sets up a foreign trust to manage her family’s vacation property in Portugal. Since she is the grantor and owner, she must file Form 3520 and complete Part I to report the trust’s creation, and Part II to disclose her ownership interest.

Foreign Gifts and Inheritances

US taxpayers must file IRS Form 3520 if they receive substantial foreign gifts or inheritances. The filing thresholds are:

- More than $100,000 from a nonresident alien individual or foreign estate

- More than $15,102 (2024 threshold, subject to change) from a foreign corporation or foreign partnership

Example: John receives a $125,000 cash gift from his aunt in Germany. Since the amount exceeds the $100,000 threshold from a foreign individual, he must file Form 3520 and complete Part IV to report it.

Received an Inheritance From the US While Living Abroad?

If you’ve inherited from a US estate while living abroad, read our guide – US Inheritances While Living Abroad: Taxes, Transfers & What to Expect.

Do I Need to File Form 3520-A?

If a foreign trust has a US owner, the trust must file Form 3520-A to report its income and activities to the IRS. If the trust fails to file, the US owner or beneficiary must submit a Substitute Form 3520-A with their tax return. This ensures the IRS receives the required information and helps avoid significant penalties.

Understanding the Sections of Form 3520

Form 3520 is designed to collect detailed information about foreign trusts, large foreign gifts and inheritances. Understanding each part will help you complete the form accurately and avoid mistakes.

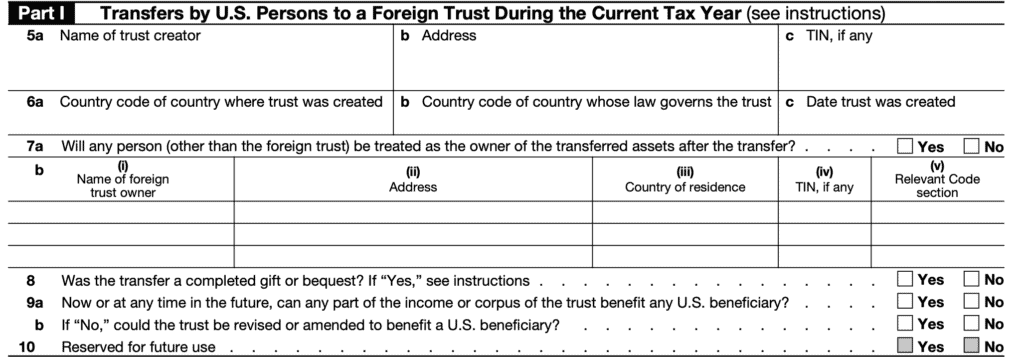

Part I – Transfers to Foreign Trusts

In this section, report any transfers of money or property you made to a foreign trust during the tax year. Include details such as:

- The type of property or funds transferred

- The date and amount of each transfer

- The nature and purpose of the trust

- Information about the trustee and beneficiaries. Providing a complete picture here ensures the IRS understands the transaction and your involvement.

Excerpt from Part I of Form 3520 – Reporting Transfers to Foreign Trusts

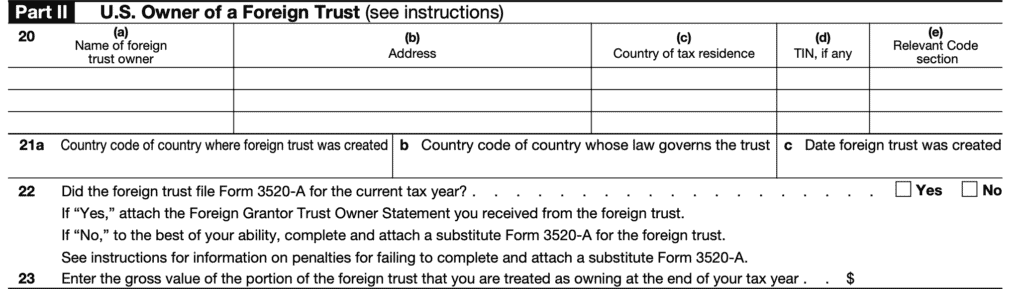

Part II – US Ownership of Foreign Trusts

Here, disclose your ownership interest in any foreign trusts. This includes:

- The type of trust and when it was established

- Your role or relationship to the trust (e.g., grantor, beneficiary)

- Any financial benefits or distributions you are entitled to. Detailing ownership helps the IRS track control and benefits received from foreign trusts.

Excerpt from Part II of Form 3520 – Declaring US Ownership of a Foreign Trust

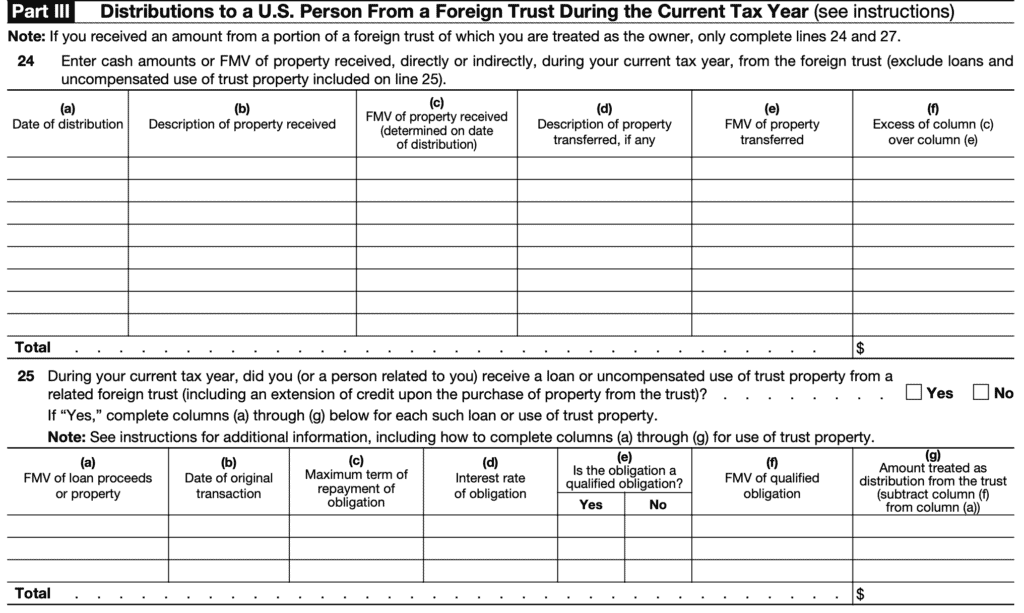

Part III – Foreign Trust Distributions

Use this section to report distributions you received from foreign trusts. Be specific about:

- The type of distribution (income, principal, etc.)

- The value of each distribution

- The source of the distribution within the trust Also disclose any indirect benefits, like rent-free use of trust property or interest-free loans, which count as distributions for tax purposes.

Example: A foreign trust owns a vacation home in Bali. Sarah, a US beneficiary, stays there rent-free for two weeks. Even though no money changed hands, this counts as a distribution and must be reported on Form 3520.

Excerpt from Part III of Form 3520 – Reporting Distributions or Use of Trust Assets

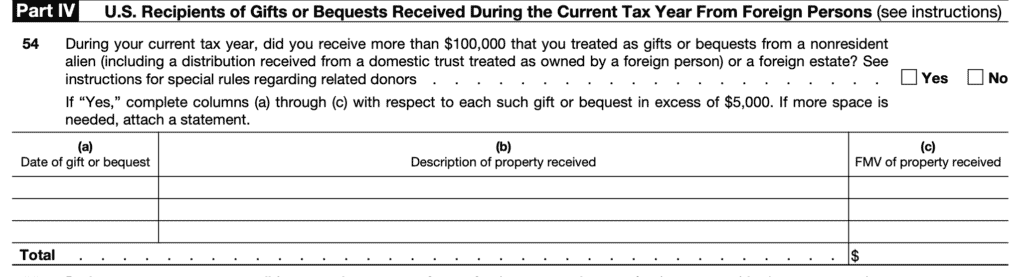

Part IV – Large Foreign Gifts Received

Report any substantial gifts or inheritances from foreign sources here. You should include:

- The relationship between you and the gift giver

- The source and nature of the gift or inheritance

- The value of the gift, especially if it exceeds IRS thresholds This section covers gifts from foreign individuals, estates, corporations, and partnerships, ensuring proper disclosure to the IRS.

Excerpt from Part IV of Form 3520 – Reporting Foreign Gifts and Inheritances

Information You Need to Include on Form 3520

Filing Form 3520 accurately requires gathering detailed information about your foreign transactions. Here’s what you should have ready:

- Personal Information: Your full name, taxpayer identification number (SSN or ITIN), and contact details.

- Foreign Trust Details: Name, address, and identifying information of the foreign trust; trustee’s name and contact info; dates and descriptions of transactions involving the trust.

- Transfer Information: Dates, values, and types of property or funds transferred to or received from foreign trusts.

- Ownership Information: Details about your ownership interest in any foreign trusts, including trust type and your role (grantor, beneficiary, etc.).

- Distribution Records: Amounts and types of distributions received from foreign trusts, including indirect benefits such as loans or use of property.

- Gift and Inheritance Details: Information about foreign gifts or inheritances received, including the donor’s identity, relationship, and the value of the gift.

- Supporting Documentation: Copies of trust agreements, gift letters, appraisals, or any documents that support the reported amounts and transactions.

Collecting this information ahead of time will help you complete Form 3520 thoroughly and reduce the risk of errors or delays.

How to File IRS Form 3520

Many people wonder, can Form 3520 be filed electronically? Currently, the IRS does not allow electronic filing for Form 3520 or Form 3520-A. You must complete a paper copy, sign it, and mail it to the IRS by the deadline. Form 3520 is due April 15, with an automatic two-month extension for expats until June 15 (June 16 in 2025). Form 3520-A is due March 15, however if a substitute Form 3520-A, it can take the deadline of Form 3520 If needed, you can file Form 4868 to extend your tax deadline for both 3520 and substitute Form 3520-A and avoid penalties.

Where to Mail Form 3520

Send your completed Form 3520 to the IRS at the address listed in the official Form 3520 instructions. The mailing address may vary depending on your location, so it’s important to check the most current IRS guidance before sending.

Consequences of Non-Compliance

The IRS enforces harsh penalties for failing to file or providing inaccurate information on Form 3520. If you don’t report a foreign gift, you could face a monthly penalty of 5% of the unreported gift amount, with total penalties reaching up to 25%.

Failing to disclose transfers to foreign trusts can result in penalties exceeding $10,000 dollars or 35% of the distribution value. Non-compliance carries serious financial risks and can trigger increased IRS scrutiny.

Form 3520 Filing Made Easier with Experienced Professionals

US expat taxes can feel overwhelming, but they don’t have to be. Partner with MyExpatTaxes experienced professionals who can help you navigate the process smoothly and protect your financial interests. Remember, Form 3520 is an informational return, and typically, no taxes are due when filing it. Ready to get started? Contact us today to learn how we can help you stay compliant and avoid penalties.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

June 16, 2025 | Gift & Inheritance | 6 minute read