Form 4562: How to Deduct Business Property

November 5, 2025 | Tax Forms | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 5, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 5, 2025

If you’ve purchased equipment or property for your business, you may be able to write off part of those costs through depreciation or amortization. Form 4562 is used to claim these deductions and is filed with your individual or business tax return. Here’s what the form covers and how it can help lower your US tax liability.

Fast Facts: IRS Form 4562

- Purpose: Used to claim deductions for the depreciation or amortization of business property.

- Why it matters: Allows you to recover the cost of business assets over time as they wear out, lose value, or become obsolete.

- Who files: Business owners, self-employed individuals, or rental property owners claiming depreciation or Section 179 deductions.

- What it applies to: Tangible assets like buildings, vehicles, and equipment, as well as intangible assets such as patents or copyrights.

- What it excludes: Land and property held for resale, since they do not lose value through use or time.

What Is Form 4562?

Form 4562: Depreciation and Amortization reports deductions for the gradual write-off of business property over time. It applies to both tangible assets, such as equipment, buildings, or vehicles, and intangible assets, including patents or copyrights.

The IRS assigns an estimated useful life to each type of property, which determines how long you can deduct its cost. Because of this, you can’t always claim the full expense in the first year; most assets must be written off gradually through depreciation.

Beyond depreciation and amortization, the form also covers Section 179 expensing for eligible property and requires reporting on the business or investment use of assets like vehicles and listed property.

What Is Amortization?

For tax purposes, amortization refers to the gradual deduction of the cost of an intangible business asset, such as a patent, trademark, franchise right, or goodwill, over its useful life.

It’s similar to depreciation, but while depreciation applies to physical property (like equipment), amortization applies to non-physical assets that help your business earn income over time.

Who Files Form 4562

You must file Form 4562 if you claim deductions for business assets placed in service during the tax year.

This includes:

- Business owners or self-employed individuals claim depreciation on business assets, whether newly purchased or already in use, such as equipment, vehicles, or office furniture.

- Taxpayers electing Section 179 to immediately deduct the full cost of qualifying business property rather than depreciating it over several years.

- Anyone starting to amortize intangible assets such as patents, trademarks, or goodwill during the tax year.

- Rental property owners reporting deductions on income-producing real estate.

Property You Can Depreciate

Depreciation lets you recover the cost of business property over time as it wears out or becomes obsolete. The IRS assigns each asset to a property class with a specific recovery period based on its expected useful life. For example, the IRS classifies a business vehicle as a 5-year asset, so you deduct its cost gradually over five years.

Businesses must file Form 4562 each year they depreciate or amortize assets and deduct those expenses on their tax return. Use this form to track how much of each asset’s cost you’ve recovered so far and to ensure your reporting stays accurate.

Common types of depreciable property include:

- Buildings and improvements

- Office furniture and fixtures

- Machinery, tools, and equipment

- Computers and office electronics

- Vehicles used for business

Depreciation also applies to intangible assets such as patents, copyrights, trademarks, or goodwill. In these cases, the process is called amortization, which allows you to recover the cost of nonphysical property over its useful life for tax purposes.

Note: Land and property held for resale, since they do not wear out through use or time.

Section 179: Accelerating Your Deductions

In an effort to encourage capital investments, Section 179 allows businesses to deduct the full cost of qualifying property in the year it’s placed in service rather than depreciating it over time. The IRS places an annual limit on the amount of purchases eligible for this accelerated deduction. The One Big Beautiful Bill Act (OBBA) made Section 179 permanent and increased the 2025 deduction limit to $2.5 million. If your spending exceeds the limit, the extra amount must be deducted gradually through normal depreciation. These amounts will be adjusted annually for inflation. The election can be made directly on Form 4562.

How to File Form 4562

You must file a separate Form 4562 for each business or activity claiming depreciation or amortization. Attach the form to your corresponding individual or business tax return, such as Form 1120-S (S Corporation), Form 1065 (Partnership), Schedule C (Sole Proprietorship), or Schedule E (Rental Income or Royalties). This also applies to foreign businesses or rental activities reported to the IRS. You don’t need to include detailed depreciation records, but it’s advisable to keep them to support your deductions.

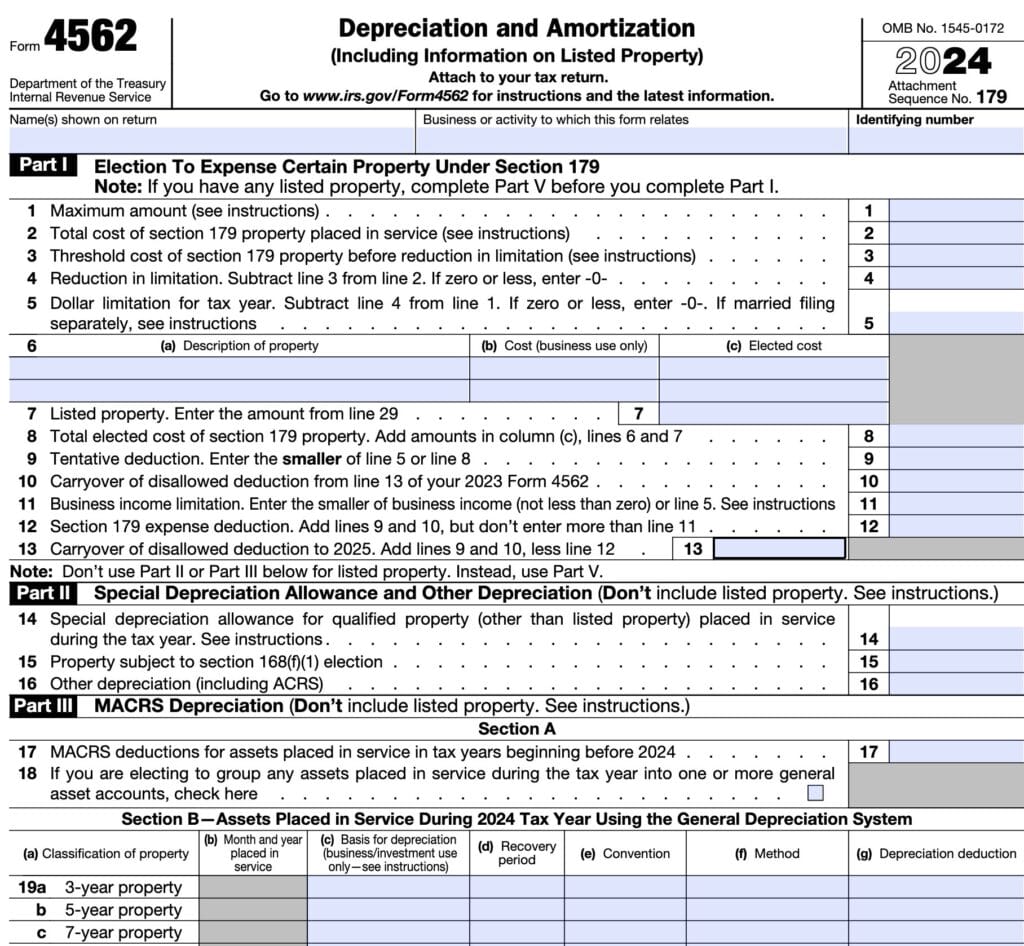

Part I: Electing Section 179

Part I of Form 4562 covers the Election to Expense Certain Property Under Section 179. This provision lets businesses deduct the full cost of tangible personal property, such as machinery, equipment, and certain qualified real property, in the year they place it in service, instead of depreciating it over time.

Part II: Bonus Depreciation

Part II outlines the special depreciation allowance and other depreciation that applies to qualified property, excluding listed property.

To write off the full cost of an eligible asset in its first year and claim the special (bonus) depreciation allowance, complete Part II. Bonus depreciation is similar to Section 179 in that it provides an immediate expense deduction; however, it differs because it allows you to fully deduct qualified property without dollar limits. You may also be able to combine bonus depreciation and Section 179 deductions in the same tax year.

Bonus depreciation had been scheduled to decrease annually. However, under the One Big Beautiful Bill, Congress permanently restored 100% bonus depreciation for qualified assets acquired and placed in service after January 19, 2025.

Part III: Reporting MACRS Depreciation

Part III reports MACRS (Modified Accelerated Cost Recovery System) depreciation for most business, rental, and investment property placed in service after 1986. Under MACRS, assign each asset to a specific class and recovery period to determine its depreciation timeline.

Instead of using Section 179 or bonus depreciation, you may choose MACRS to spread the cost of an asset over its useful life. This method allows for larger deductions in the early years and smaller ones in later years. If you use MACRS, this section must be completed.

File Form 4562 each year you claim depreciation or amortization and deduct those expenses on your tax return.

For more details, see IRS Form 4682 Instructions

Let MyExpatTaxes Help

For US expats, Form 4562 can play an important role in lowering taxable income from foreign business or rental activities. Depreciation and amortization deductions apply even to property located abroad, as long as it’s used for a business that reports income to the IRS.

At MyExpatTaxes, we support Form 4562 and all related filings, making it simple for expats to correctly report depreciation, amortization, and Section 179 deductions. Our platform ensures your return is accurate, keeping you compliant while maximizing your deductions.

Frequently Asked Questions

Content of the Accordion Panel

You must file Form 4562 if you’re claiming depreciation or amortization on property used in your business or rental activities. This includes equipment, vehicles, buildings, or intangible assets such as patents or goodwill.

Content of the Accordion Panel

Yes. US expats who own foreign businesses or rental properties that generate income reported to the IRS must include Form 4562 to claim depreciation or amortization deductions, just as they would for US-based property.

Content of the Accordion Panel

Both allow you to deduct the cost of qualifying property more quickly. Section 179 lets you choose which assets to expense immediately, but it has annual dollar limits. Bonus depreciation, on the other hand, has no dollar limits and allows you to deduct 100% of the cost for eligible assets placed in service after January 19, 2025.

Content of the Accordion Panel

Depreciation applies to tangible business assets such as machinery, furniture, vehicles, and buildings, as well as intangible assets like copyrights, patents, and trademarks (through amortization). Land and property held for resale cannot be depreciated.

Content of the Accordion Panel

MACRS, or the Modified Accelerated Cost Recovery System, is the standard IRS method for depreciating most business and rental property. It assigns assets to specific classes and recovery periods, allowing larger deductions in the first few years of ownership.

Content of the Accordion Panel

Yes. You can claim both in the same year—first apply the Section 179 deduction, and then use bonus depreciation for any remaining cost of the qualifying property.

Content of the Accordion Panel

Keep detailed records showing the cost of each asset, the date placed in service, and how it’s used in your business. You don’t need to submit these records with your tax return, but you must keep them to support your deductions in case of an IRS review.

Content of the Accordion Panel

By claiming depreciation or amortization, you spread the cost of your business assets over their useful lives, lowering your taxable income each year. These deductions can significantly reduce your overall US tax liability.

Content of the Accordion Panel

Form 4562 is required for any tax year in which you claim depreciation, amortization, or a Section 179 deduction. If you’re continuing to depreciate assets from prior years without adding new ones or making new elections, you generally don’t need to file Form 4562 again unless your deductions change.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

November 5, 2025 | Tax Forms | 4 minute read