Paying US Expat Taxes as an American Abroad

November 1, 2022 | Paying Taxes, Short-Term Expat | 5 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 15, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 15, 2025

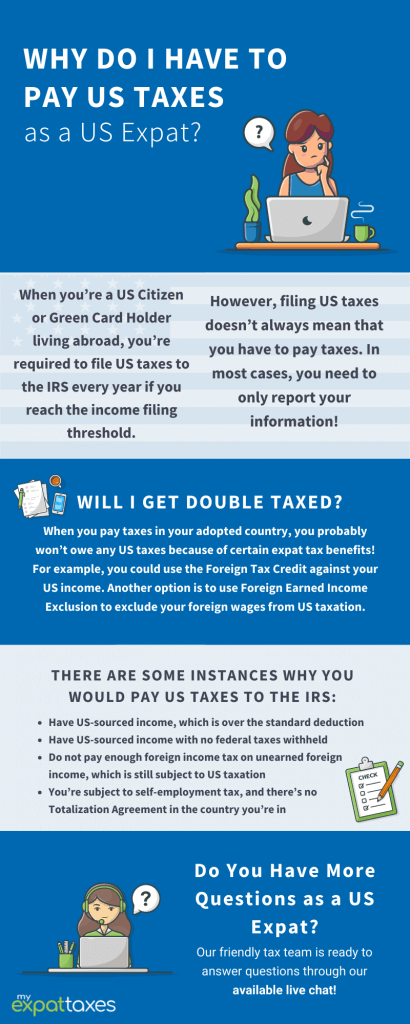

Most expats will not pay US taxes thanks to the benefits of Foreign Earned Income Exclusion and Foreign Tax Credit. However, expats must file taxes annually if their gross worldwide income exceeds the annual filing threshold. So, even if you do not owe any taxes to the IRS, you still may need to file.

US Expats are Taxed on their Worldwide Income

Per the IRS, American citizens living abroad are still subject to US taxation on their worldwide income, no matter where they live or work. Therefore, expats must combine their US and foreign income to determine if they need to file.

US income for expats normally includes investment or rental income. If you receive Form 1099 abroad, the IRS records your income earned. Foreign income for expats normally includes their salary earned abroad, ie income earned as an employee outside the United States of America.

The income filing threshold is usually based on the standard deduction of each tax filing status. However, those with non-US Citizen spouses are normally assumed to file separately and have an extremely low filing threshold of only $5 per year. Yes – just FIVE dollars!

US Expat Taxation of Foreign Income

The United States may be one of two countries to enforce citizen-based taxation. However, most countries already tax foreign income.

The US tax laws for citizens living abroad are essentially the same for those living in America. Expats file the same Form 1040 and are subject to the same US federal income tax rates. While expats can use form 1040, it’s always a good idea to read up on the other important tax forms for expats.

In addition, the IRS provides a couple of options to prevent the double taxation of expats. Expats can either:

- Exclude their foreign-earned income from US taxation

- Use foreign income tax paid as a tax credit against US taxes owed

- Exclude other income types from US taxation using a valid tax treaty

One catch in foreign investment income; is that it can be classified as PFIC investments. These will not be eligible for the favorable 20% US capital gains taxation.

When to File Form 2555 – The FEIE

First off, what is the Foreign Earned Income Exclusion (FEIE)? FEIE is an expat tax benefit, allowing qualifying expats to exclude up to $126,500 in 2025 from their 2024 US taxable income.

MyExpatTaxes advises expats to use the Foreign Earned Income Exclusion if:

| MyExpatTaxes advises expats to use the Foreign Earned Income Exclusion if: |

|---|

| They pay low to no income tax in their host countries. |

| They have |

| They do not have or plan on having children, who will register for US Social Security Numbers. |

FEIE, although the most common expat tax benefit, can be limiting if you wish to:

- contribute to your US retirement accounts (i.e. your IRA)

- claim your refundable tax credits (For example, the Additional Child Tax Credit)

Another downside to using Form 2555 right, when you move abroad, is that once you start, you cannot stop excluding your foreign earned income with FEIE without incurring some consequences. The IRS will generally not allow you to use Form 2555 again for five years once you stop using FEIE in exchange for another expat tax benefit.

If you live in a country with a high-income tax rate, such as within the European Union, there is no real reason to use Form 2555 since you can just use the Foreign Tax Credit approach.

For those who pay low or no foreign income tax, such as employees in an international organization, then the FEIE and Foreign Housing Exclusion is the only way to go! The Foreign Housing Exclusion allows expats to deduct some costs of living abroad.

FEIE can only be used by Americans living abroad, who can prove that:

- they have a residence for tax purposes in a foreign country

- are present in a foreign country or countries for at least 330 full tax days in a 12-month period starting or ending in the tax year

When to File Form 1116 -The Foreign Tax Credit

The other common tax credit for US expat taxes is the Foreign Tax Credit, claimed by completing Form 1116. This benefit is used to prevent US expat double taxation. For every euro, pound, dollar, you pay in income taxes to a different country, you can re-use as a credit against your US tax liability.

For example, US Citizens paying UK tax can claim their UK income taxes on Form 1116. The US tax rules for expats allow the portion of taxes allocated to foreign income to be offset by any foreign income tax paid.

| US Expats should use Form 1116 when: |

|---|

| If they pay more income tax in their host country, they would be based on the US Expat Tax Rate (same as the tax rates for Americans back home). |

| They have investment and other types of “unearned” income that cannot be excluded with Form 2555 anyways. |

| They earn more than the foreign maximum exclusion ($126,500 in 2025). |

Form 1116 can be used in addition to Form 2555 to account for income tax on amounts that are not excluded via the FEIE. However, Income Tax directly allocated to any excluded income must also be excluded.

Even though Form 1116 can be a rather difficult form to complete, we do suggest expats to use it if they have enough foreign income tax credits to reduce their US taxes to zero!

When to File Form 8833 – The Tax Treaty Benefit

Every American abroad should be familiar with the tax treaty between the US and the foreign country they call home. Otherwise, they can look to use a dedicated US expat tax software, like MyExpatTaxes, which accounts for tax treaty benefits!

Most tax treaties will outline which country has the tax rights on different types of income such as:

- Social Security Benefits

- Pension Income

- Royalties

The international tax treaties can even outline how the capital gains tax of US Citizens living abroad is treated.

On Form 8833, Treaty-Based Return Position Disclosure, expats (or our expat tax software) will inform the IRS of the following:

- which tax treaty is used

- the specific article of the tax treaty

- explain the treaty-based return position, such as income being exempt

Common US Expat Filing Mistakes

The most common US Expat filing mistakes are when taxpayers do NOT

- Include Form 2555 or Form 1116 in your expat tax filing

- Claim the Additional Child Tax Credit

- File an extension after June 15th

- File an FBAR with your tax return

Even some mistakes can happen when using professional US expat tax services. Most tax firms will use Form 2555 rather than Form 1116 due to the popularity and ease of using the form. Even if families abroad are eligible for the Additional Child Tax Credit refund of up to $1,700 per qualifying child.

Simply not filing US taxes is another mistake that Americans abroad and Accidental Americans can make. However, this mistake, like the others above, can be fixed. Those not filing their US taxes, they can use the US expat tax amnesty program called the Streamlined Filing Compliance Procedure.

Expats Paying US Taxes

A US expat abroad would only need to pay US taxes if they:

- have US-sourced income, which is over the standard deduction, thus subject to US income tax

- do not pay enough foreign income tax on unearned foreign income, which is still subject to US taxation (i.e., capital gains on foreign property sold)

How to File, Pay and Ask for Support from the IRS

Americans abroad are encouraged to electronically file either through our US expat taxes software or a US Expat tax firm that supports this service. Otherwise, the address to send US tax return from abroad (without a check) is:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

United States of America

Tax bills can be paid online directly on the IRS payment site.

The IRS will not necessarily inform you when they receive your US expat tax return. They only mail notices if they have questions. To check the status of your US expat tax return, you can use their “Where’s my refund” page. If you are not expecting a refund, the only way to confirm that they received your mailed US expat taxes is to call them directly.

The IRS expat tax support phone number is: +1 267-941-1000. This number is not

Taxes for Expats Support

MyExpatTaxes specializes in the US Expat Taxes of both Americans and Green Card holders living abroad – or not! If you are an expat repatriating to the US we can also support you. File your return with our easy expat tax online software, rated by over 3,000 happy expats on TrustPilot, Facebook, and Google.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

November 1, 2022 | Paying Taxes, Short-Term Expat | 5 minute read