15 Things Expats Should Know About US Child Tax Credits

September 17, 2024 | Family Tax Support | 7 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 22, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 22, 2025

Many parents have benefited from US family tax credits; this year is no different. If you’re a parent living abroad, you’ll want to know which family benefits you are eligible for in 2025. The Additional Child Tax Credit and the Child and Dependent Care Credit are two of the most common family credits, and they will be the topic of this article!

15 Things to Know When Filing Your 2024 Tax Return

It is broken into two main categories:

- 7 Fact Expats Should Know About the Additional Child Tax Credit

- 8 Must-Knows Expats Should Know About the Child and Dependent Care Credit

7 Facts Expats Should Know About the Additional Child Tax Credit

1. What is the Child Tax Credit?

The Child Tax Credit is a non-refundable credit that allows US expats to deduct $2,000 per qualifying child from their US tax liability. While the Additional Child Tax Credit is still part of the Child Tax Credit, it allows US expats to claim up to $1,700 as a refundable credit.

2. Do Your Children Meet the Qualification?

The Child Tax Credit is applied to US expats with children, foster children, stepchildren, grandchildren, nieces, nephews, or other dependents. Any dependent must meet the following qualifications:

- Have a valid Social Security Number by the filing deadline of your tax return, including extensions

- Live with you for at least 50% of the year

- The child cannot provide more than half of their own financial support during the year

- Are under the age of 17 before December 31st, 2024

3. Getting Your Child a Social Security Number

Are you worried your child may not have their Social Security Number in time for the April 15th deadline? We recommend you apply for the Social Security Number as soon as possible.

Once it’s in the process, there’s no need to stress because as long as you don’t have any outstanding taxes to pay to the IRS, you already have a few benefits as an expat.

One benefit is that US expats get an automatic two-month extension to June 15th. If that’s still not enough time, you can file an extension with MyExpatTaxes for October 15th!

4. Limitations for Higher Income Earners

The refundable portion for the Child Tax Credit has increased to $1,700 for most families in 2025. However, there are limits for US expats with a higher adjusted gross income.

The total amount of the Child Tax Credit will not phase out below $2,000 UNLESS their income reaches:

- For taxpayers filing as ‘single’ or ‘married filing separately,’ the amount is $200,000

- For taxpayers who are ‘married filing jointly’ with their spouse, the amount is $400,000

If your adjusted gross income is above the highest thresholds, the Child Tax Credit will continue to gradually decrease by $50 for every additional $1,000 (or partial $1,000) until it eventually reaches zero.

5. Claimed with the Foreign Earned Income Exclusion

If you use the Foreign Earned Income Exclusion, you won’t be eligible to receive the Additional Child Tax Credit. The Additional Child Tax Credit is calculated based on your earned income and requires a minimum income of $2,500. Therefore, if your entire income is excluded (often the case), you will be ineligible for the refund. Many expats claim the Additional Child Tax Credit by using the Foreign Tax Credit to counter this.

Unsure if you should use the FEIE or FTC? Choosing the right tax write-offs and exclusions is incredibly important as a US expat. At MyExpatTaxes, we specialize in Americans abroad, meaning we designed our tax software to help you maximize all possible deductions and refunds!

6. Denied or Received a Reduced Amount in Previous Years?

If you want to qualify for future years, you must file Form 8862, an additional form stating that whatever issue caused a reduction or denial in prior years has been resolved. With MyExpatTaxes, you regain your footing and take advantage of that much-needed credit again.

You should ONLY be filed for any reason beyond calculation errors.

7. No Differences Between Expat Families and US Families

The Additional Child Tax Credit does not depend on whether or not you live in the US. Expat families and US families can benefit from this credit!

Calculate Your Child Tax Credit

Want to know how much you can claim in 2025? Use the MyExpatTaxes Child Tax Credit Calculator to get an estimate on how much you can claim on your 2024 tax return!

8 Must-Knows About the Child and Dependent Care Credit

1. Child and Dependent Care Credit

The Child and Dependent Care Credit allows taxpayers to offset their US tax liability with child or dependent care costs. This credit helps parents and guardians receive additional support for child care or care for other dependents while they are working or looking for work.

2. Covers Expenses for Caregiving

Only some expenses are considered for the Child and Dependent Care Credit. To receive this credit, your care expenses must be one or more of these qualifying expenses.

Types of qualifying care expenses:

- Daycare/preschool

- Before and after-school care programs

- In-home care providers

- Day camp

3. How Much Can You Claim?

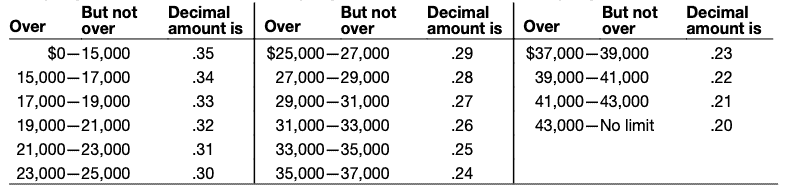

The Child and Dependent Care Credit does not consider the full cost of expenses when determining your credit limit. The maximum that can be claimed is 35% of the total expenses. Additionally, if your income exceeds $43,000, the credit will phase out to 20% of all care costs.

There are also limits to this credit. If you have one qualifying dependent, you can claim a maximum of $3,000 in expenses; for more than one, you can claim a maximum of $6,000.

Determine which percentage you can claim by using the table below.

4. You Cannot be Filing as ‘Married Filing Separately’

Taxpayers filing as married filing separately are not eligible for the Child and Dependent Care Credit. US expats who are married to non-US Citizens and pay more than 50% of their combined home expenses can file as head of household rather than married filing separately, enabling them to claim this credit if otherwise eligible.

You can also claim the credit if you are legally separated; otherwise, you must file as single or married filing jointly to be eligible.

5. Parents Must be Working or Full-Time Students

This credit is designed to help families recuperate expenses while working outside the home. If the couple is married filing jointly, both parents must be employed, looking for work, or full-time students.

There is no minimum definition of employment. Working parents can only claim expenses up to their earned income. Students are treated as if they make $250 per month with one child or $500 per month with two or more children.

6. Know Whose Expenses You Can Claim

Parents and guardians can receive credit for expenses related to caring for children under 13. Additionally, if a spouse or other adult in the home cannot care for themselves, the credit can be used to reduce the guardian’s US tax liability.

7. This Credit is Non-Refundable

Unlike the Additional Child Tax Credit, the Child and Dependent Care Credit is non-refundable and can only be used to reduce your US tax liability. If expats have an excess of credits, it will not be given to them as a refundable credit, meaning the credit will be used.

8. Employer-Paid Expenses

Does your employer offer childcare reimbursement? If that is the case, you won’t be able to claim that portion of your care costs with the Child and Dependent Care Credit. If you could, you’d be receiving twice the benefits.

Get the Credit(s) You Deserve!

Pun intended, but all jokes aside, having a family can become quite costly, so ensure you are claiming every family credit you can in 2025. The earlier you file, the better your chances are of receiving your benefits in a timely manner. Don’t wait for the credits; start filing with MyExpatTaxes today!

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 17, 2024 | Family Tax Support | 7 minute read