Navigating US Expat Taxes for Americans in Mexico

September 11, 2024 | Country Guides | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 20, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 20, 2025

Welcome to the vibrant tapestry of Mexico, where the aroma of Enchiladas fills the air, and the birthplace of the colored TV adds innovation to the landscape. Nestled in warmth, Mexico is a haven for American expats, offering dual citizenship, seamless relocation, an unrestrained property market, and enticing tax benefits through the Mexico-US tax treaty. Ideal for retirees, Mexico provides a retiree-friendly atmosphere with a lower cost of living, a favorable climate, and rich cultural experiences, creating the perfect destination to savor the golden years. Whether it’s tranquil beaches, historic cities, or welcoming communities, retiring in Mexico promises an extraordinary tapestry of experiences.

Choosing to live in Mexico, making it your permanent residence, is a testament to embracing the rich culture and the laid-back lifestyle it offers. Yet, even in this sun-kissed paradise, US citizens and Green Card holders are tethered to the responsibility of reporting their worldwide income. Yes, taxes may not be the most thrilling topic, especially when you’re living outside the US, but fear not! We have crafted an exceptional guide to navigate the intricacies of the US tax season, ensuring that your financial affairs remain as sunny as your Mexican abode.

Should I be Filing Taxes in US Expat Taxes in Mexico?

Even for US citizens and Green Card holders living in Mexico, your tax obligations will follow you in almost every country. However, there are still a few potential factors that could make it so you, as a US citizen or Green Card holder, do not need to file your US taxes. One major one is the minimum income threshold.

You will not have to file if:

- You are making under as an average employee $14,600,

- You make less than $400 as a self-employed person or

- You’re married and planning on filing separately, then your any worldwide income under $5

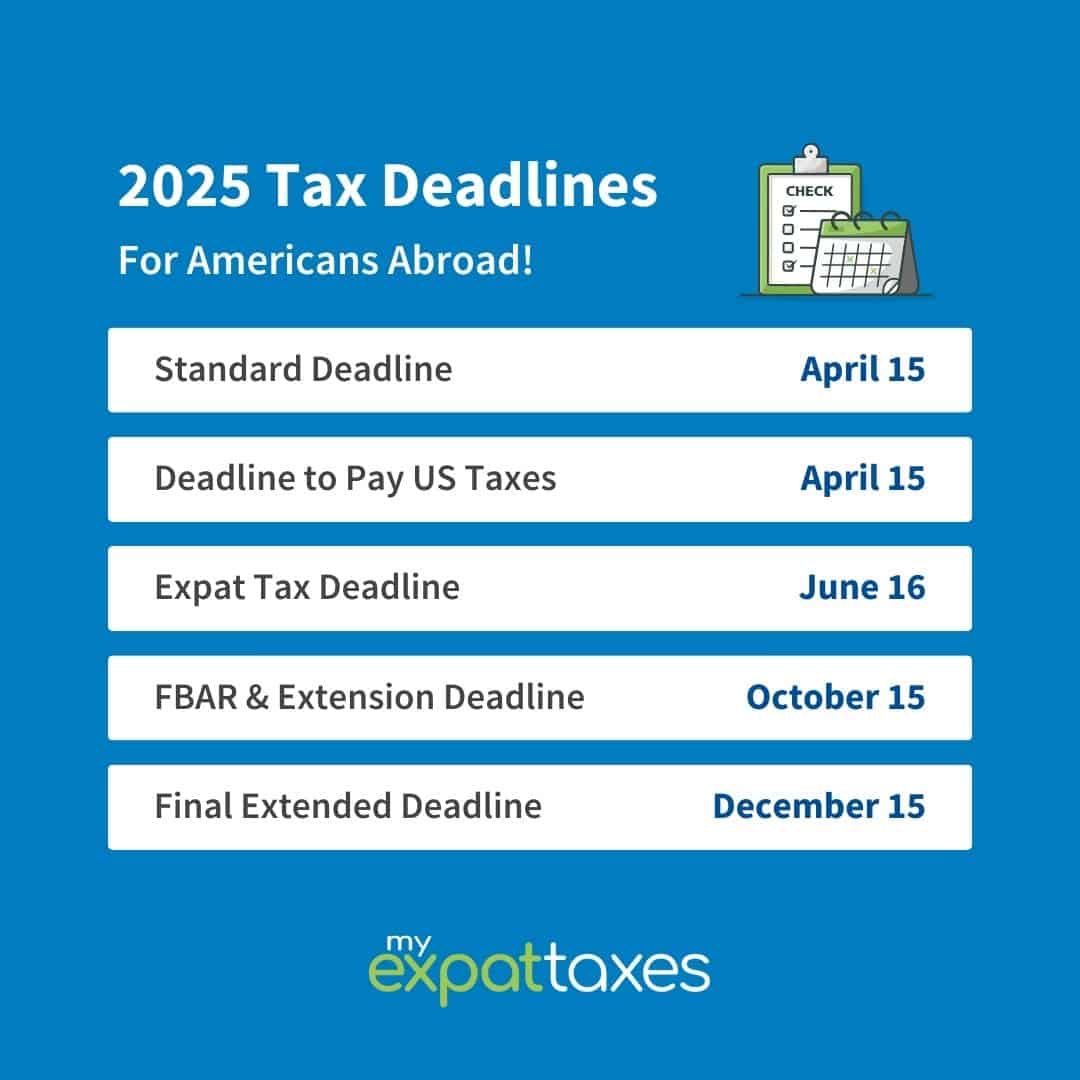

Expat Tax Deadlines

Below is an infographic outlining the general tax deadlines that US citizens abroad must watch for. However, these dates are subject to change if one of them falls on a weekend or holiday. For instance, in 2025, the June deadline falls on the 16th due to the 15th landing on a long weekend.

Common Expat Credits to Avoid Double Taxation

As a US expat living in Mexico, you need to be aware of how you can avoid double taxation. Listed below, there are a few options that can save expats thousands:

- Foreign Earned Income Exclusion (FEIE) – Allows US expats to exclude a certain amount of foreign earned income from their US tax liability.

- Foreign Tax Credit (FTC) – This credit is a dollar-by-dollar reduction based on your worldwide income.

Example

If you’re making 1,000,000 Mexican Pesos, you’d first have to convert it to USD and then see if it’s under the $126,500. In 2025, the conversion would be around $56,000, which means you are far lower.

What if you’re above $126,500?

Well, that’s when you have to do some simple math. After converting your pay from PESO-to-USD, you’ll take whatever amount and subtract it by $126,500. You’re making $130,500 after converting to USD.

$130,500 – $126,500 = $4,000

This $4,000 is the only part that can be taxed by the IRS. Therefore, odds are, you probably will not owe US taxes as an expat.

Tax Treaty

As you dive into the world of international finances, the US-Mexico tax treaty may be useful to you. However, beware as a US Citizen, you normally cannot use the majority of US tax treaties due to the Savings Clause. The Savings Clause in a tax treaty upholds each country’s right to tax its citizens and treaty residents as if no treaty existed, but this clause often excludes specific income types, potentially enabling US citizens or residents to claim certain treaty benefits.

If you are a non-US Citizen/Green Card holder and residing in Mexico with US-sourced income, this treaty will spare you. This treaty not only spares you the headache of double taxation but smooths out your financial journey. This is all by reducing withholding rates on various income sources like dividends and royalties. It acts as a protective shield, offering specific exemptions and tax credits that keep certain incomes off the tax hook. Think of the treaty’s residency rules as a roadmap, clearly outlining who owes what taxes in both countries.

If you are a US Citizen/Green Card holder, you cannot so heavily rely on the treaty. However, you can utilize it to make sure the US acknowledges any Mexican foreign tax credits, preventing double taxation.

Just a friendly tip: seeking professional advice is a smart move, and keeping an eye on updates ensures that your tax situation stays sunny, just like Mexico.

Dual Citizenship in Mexico

Embracing dual citizenship in Mexico as an American adds a unique layer to US tax considerations. Opting for dual citizenship allows you to enjoy the vibrant cultural tapestry while navigating cross-border taxes. Whether it’s “managing dual nationality,” “balancing dual allegiance,” “embracing dual rights,” or “navigating dual tax obligations in Mexico,” understanding US tax implications is crucial. Amidst the richness of a transnational lifestyle, fulfilling US tax obligations involves considering the “Closer Connections Exception” and addressing challenges faced by Accidental Americans – those unaware of their US citizenship due to birth circumstances.

Dual citizenship in Mexico isn’t just about culture; it’s also about the financial landscape. Strategic tax planning and professional guidance are essential to seamlessly navigate the US and Mexican tax systems. Staying informed about tax regulations ensures a harmonious balance between the benefits and complexities of dual citizenship in Mexico.

Property in Mexico

Buying property

Lucky for us US expats, Mexico is one of the countries which allows us to purchase property free of restrictions. However, that doesn’t mean there are not rules for purchasing property in Mexico. Here is an overview of what you should know before purchasing property in Mexico.

When purchasing property in many countries, a deposit is usually necessary. In Mexico, it is quite the same. Foreigners must pay 5-10% of the overall sales price as a deposit on any property.

Selling property

When selling foreign property in Mexico, there is a few things to note. One is to remember that it must be sold in the local currency – also known as the peso. After selling your foreign property, you can exclude up to $250,000 of profit ($500,000 if filing jointly) if is you meet the Section 121 exclusion requirements. Any taxable profit will be subject to capital gain tax rates and foreign tax credit can be applied.

Renting property

Renting property in Mexico is actually quite easy for a foreigner. It’s actually more advisable to rent a property in Mexico before purchasing. However, as a foreigner, you will most likely be asked for an additional step known as the Fiador, which is a co-signer on your lease. Everything else is fairly standard in America; you must show proof of identity and funds and provide a deposit 30 days before moving in. The even greater benefit is that in all of North America, Mexico offers the cheapest rent so you’ll be saving money.

Saving money is absolutely amazing when it comes to renting property abroad, but keep in mind that if you have a foreign financial account to pay rent, you will most likely need to report it. To report a foreign financial account is actually a little different than filing a tax return. With a foreign financial account, you must file an FBAR (Foreign Bank Account Report). There are two conditions before running to file an FBAR:

- The obvious, you have a bank account outside of the US

- Your combined maximum balance from all foreign financial accounts is over $10,000 in total

Retiring in Mexico

If you’re a retired US citizen living in Mexico, we get it! Mexico offers numerous benefits for the average American retiree. From the enticingly low cost of living and surprisingly good and affordable healthcare to a relatively straightforward visa process – retiring in Mexico is a choice that makes perfect sense. Whether you’re a retiree in Mexico seeking a serene beachside retreat, a retiree in Mexico embracing the rich cultural experiences, or a retiree in Mexico enjoying the vibrant local communities, the lifestyle here caters to a variety of preferences. Moreover, being retired in Mexico is made even more appealing if you find yourself comfortably under the minimum threshold. It’s clear why retirees in Mexico find it an attractive haven for their golden years.

Getting Tax Help

At MyExpatTaxes, we understand the challenges that come with filing taxes while living abroad. It can be a real hassle, and that’s why we’re here – to make the process a bit smoother for you. Our mission is to simplify tax filing for expatriates, including those in Mexico, through user-friendly resources and expert guidance.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 11, 2024 | Country Guides | 6 minute read