A Beginner’s Guide to Filing an FBAR as a US Expat

December 6, 2024 | Featured, Foreign Bank Account | 5 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated April 9, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated April 9, 2025

What’s a Foreign Bank Account Report?

The Foreign Bank Account Report (FBAR) or FinCEN Form 114 is a mandatory report you must file if you have foreign financial accounts collectively exceeding $10,000 at any point during the year. An FBAR must be filed even if the combined maximum balance of those financial accounts were $1 over the threshold at any given time in the year.

You can eliminate the confusion and excessive steps by filing your FBAR and US tax return with MyExpatTaxes. With MyExpatTaxes, FBARs are included in every package!

How to Determine if You Need to File

For US expats with foreign financial accounts, monitoring their accounts frequently is important to determine whether filing an FBAR is required. The FBAR is based on the maximum balance of all your foreign financial accounts, meaning if you have max balances of $3,000 in one account and $8,000 in another, filing an FBAR is mandatory.

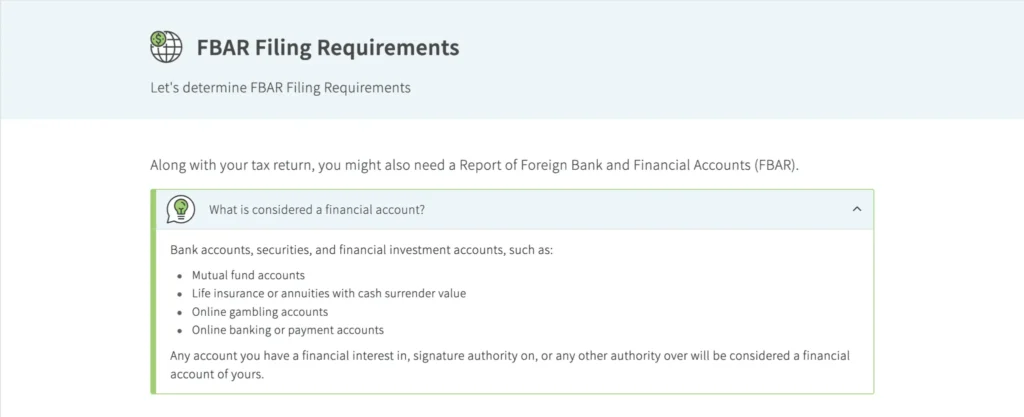

Additionally, FBAR filing requirements expand to all foreign financial accounts with your financial interest and signature authority.

Financial Interest: If you have direct or indirect ownership, you must file an FBAR. Direct ownership is when your name is on the account. Indirect ownership is when someone else’s name (like a business partner, friend, or attorney) is on the account, but they own their funds.

Signature Authority: You do not own the funds but have control over the transactions and other activities. This is common among elderly parents, having their funds managed by their adult child.

The FBAR Deadline

FBAR is due on April 15th every year to coincide with the tax date for Americans both inland and overseas. If you miss the filing deadline, US expats have an automatic extension until October 15th.

Keep in mind that the FBAR grants an automatic extension until October 15th. This automatic extension does not apply to the US tax return. No extension is needed to file an FBAR, but if you want to file your tax return by October 15th, you must submit extension Form 4868 before June 15th!

Get your email reminders about upcoming deadlines!

"*" indicates required fields

Foreign Financial Accounts

These are the most common foreign financial accounts that must be reported on an FBAR as a US expat:

- Bank accounts outside the US

- Foreign life insurance policies with cash value

- Foreign mutual funds

- Pension funds due to working abroad

Like many things in the US taxation world, there are always at least a few exemptions. These are three examples of financial accounts that are exempted from FBAR requirements:

- ‘Social Security’- type program benefits provided by a foreign government

- Foreign real estate

- Accounts maintained by a US military account

Do Wise Accounts Count as Foreign Financial Accounts?

Wise is not a US company; it originates from the UK, meaning the default financial regulations fall under the Foreign Conduct Authority (FCA). Alongside the FCA, Wise is also subject to international banking regulations because it is a globalized company.

Adding Your Spouse or Children

An FBAR is required if your children have foreign savings accounts, spending accounts, trusts, or other foreign financial assets over $10,000. For parents with signature authority over their children’s financial accounts, you must include the maximum balances of the accounts on your FBAR. In addition, your children will also need to file their own FBAR. We make it easy to file your and your children’s FBARs using your MyExpatTaxes account.

Similarly, if you have joint accounts with your spouse, identify each account with your signature authority and calculate the maximum balances.

Filing an FBAR with FinCEN

Your FBAR is completely separate from your standard US tax return, meaning it does not go to the IRS but to FinCEN, the Financial Crimes Enforcement Network. If you choose to file your FBAR using their platform, use the BSA e-filing site to submit your FBAR electronically.

If you have to file both your FBAR and US tax return, it is highly recommended that you use expat tax software, which can streamline both filing procedures.

How to File an FBAR with MyExpatTaxes

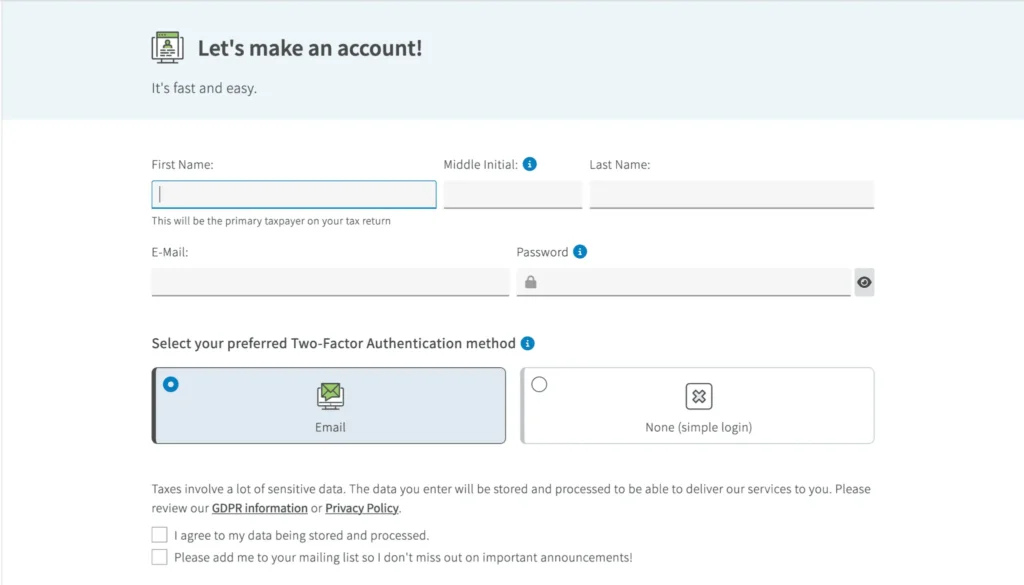

1. You can start by creating a free account with MyExpatTaxes.

2. After creating your account, you must provide accurate personal, family, and financial information.

3. After reaching this page, you will receive an overview of information regarding FBAR filing.

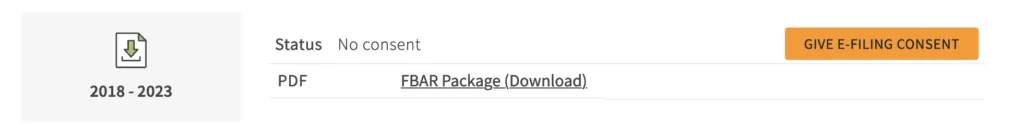

4. Additionally, the software will allow delinquent FBARs, meaning unfiled FBARs from prior years, to be filed as well.

5. Finally, it’s time to submit your FBAR!

FATCA vs. FBAR

How does the FBAR and FATCA differ?

The FBAR is reported to the FinCEN and is NOT part of your US tax return. Foreign Account Tax Compliance Act (FATCA), more commonly referred to as Form 8938, is a form that goes to the IRS, meaning it is a part of your annual tax return.

In addition, the account balance requirements for filing FATCA are much higher. Expat Americans only need to file using Form 8938 if they have over $200,000 in foreign financial assets if filing single or $400,000 when married filing jointly. If you lived in the US during the year, the threshold will be lower for Form 8938.

What do FBARs and FATCA have in common?

They both require Americans to report their foreign financial accounts if their total balances exceed the threshold amount.

Penalties of the FBAR for US Expats

The FBAR may seem insignificant, but it aims to limit global money laundering. Therefore, if you don’t comply with FinCEN, you could be subject to hefty fines.

There are two categories of fines: willful failure and non-willful failure.

Willful Failure: If you willfully failed to file an FBAR, meaning you knew you had to and chose not to file, it can result in up to $100,000 or 50% of the account’s maximum value.

Non-Willful Failure: There is a $10,000 per violation for non-willful failure to file.

The Streamlined Procedure

For US expats who did not know they needed to file an FBAR while living abroad, you can use the Streamlined Procedure. The Streamlined Filing Procedures helps US citizens abroad file six years of FBARs and three years of unfiled tax returns (if needed) without penalties.

Suppose you want to use the Streamlined Procedure. In that case, the IRS must not have contacted you regarding any unfiled FBARs or tax returns, as it will result in an automatic disqualification.

Will the IRS Find You?

With every US expat having to comply with FATCA law, the IRS can track your accounts rather efficiently. Although the US government cannot force any foreign country to comply with this law, there are numerous agreements between the US government and foreign financial institutions. Overall, with the data accessible to the IRS, they can cross-reference and figure out who hasn’t filed.

Need to Catch Up?

You can take advantage of the Streamlined Procedure filing process. This procedure can help you get back on track and become tax-compliant with the IRS. It helps Americans abroad make up for unfiled taxes and FBAR while preventing penalties from accumulating as they were innocently unaware of your filing requirements.

If you sign up through our app, we can get started immediately!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

December 6, 2024 | Featured, Foreign Bank Account | 5 minute read