A Complete Guide to IRS Form 4868 for US Expats

October 1, 2024 | Tax Forms | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 5, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 5, 2024

With the October 15th deadline right around the corner, you may find yourself needing a bit more time to collect or organize all your foreign financial records to complete your tax return. This is when it’s a good idea to be aware of Form 4868, the “Application for Automatic Extension of Time to File US Individual Income Tax Returns.” In this article, you will learn about the finer details of Form 4868, when it’s applicable, and how to file it.

What Is Form 4868?

Depending on your residency, US tax deadlines can change. To help better understand the differences, here is a table detailing tax extensions for filing and paying taxes.

| Category | Living Outside the US | Living in the US |

|---|---|---|

| Form Used for Extension | Form 4868 | Form 4868 |

| Automatic Extension | 2 months (automatically to June 15th) | 6 months (file before April 15th) |

| Filing Deadline | June 15th (if additional time is needed) | April 15th (before extension) |

| Payment Deadline | Must pay taxes owed by April 15th | Must pay taxes owed by April 15th |

| Extension Applies To | Filing only | Filing only |

Who Must File Form 4868?

For people who have complex tax cases, filing an extension for the October 15th deadline can be quite beneficial. Form 4868 is frequently used by self-employed individuals, investors, business owners, and taxpayers undergoing significant life changes, such as US expats.

Even if you think you may not need an extension for the October 15th deadline, filing form 4868 ensures you have additional time free of certain penalties. Whether you require an extension or not, filing can ensure you have flexibility and peace of mind.

Form 4868 vs. Filing an Amended Return

Filing an extension and amending a return are very different processes. Form 4868 provides you with additional time to file your tax return, but if you have already submitted it with incorrect information, you cannot use Form 4868 to correct it. To fix a mistake, you need to file Form 1040-X to amend your return. Form 4868 cannot fix previously submitted returns; only Form 1040-X can amend your past return.

Puerto Rican & Overseas Filers

US citizens or Green Card Holders living outside of the US receive an automatic two-month extension until June 15th with the possibility of filing for an October extension. This possibility also extends to Puerto Rico residents. Otherwise, if you are not outside of the US or in Puerto Rico, please file your extension before April 15th.

How to Request a Form 4868 Extension

There are three ways you can file an extension:

- Electronically: Submitting Form 4868 using tax preparer software like what MyExpatTaxes offers or via the IRS website.

- By Mail: Paper mailing is still an option for those of you who prefer to file Form 4868 this way. Make sure it is postmarked by the filing deadline though.

- With a Tax Professional: You can get a Tax Professional to file Form 4868 on your behalf.

You can file Form 4868, as you choose as long as your file before the deadline, which is April 15th for residents of the US, and June 15th for expats outside of the US.

Filing Form 4868 with the IRS

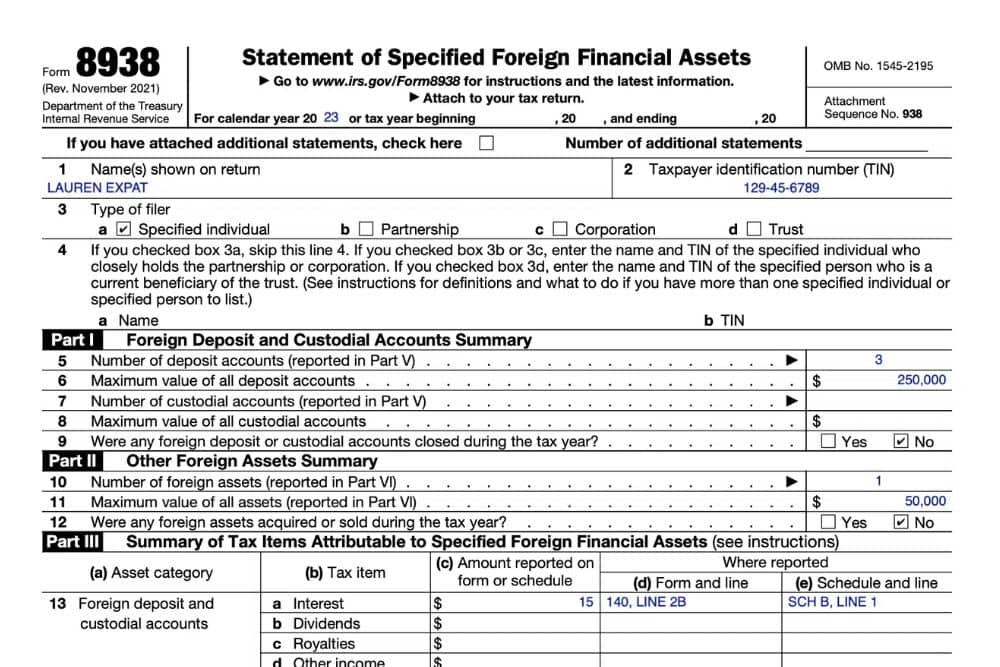

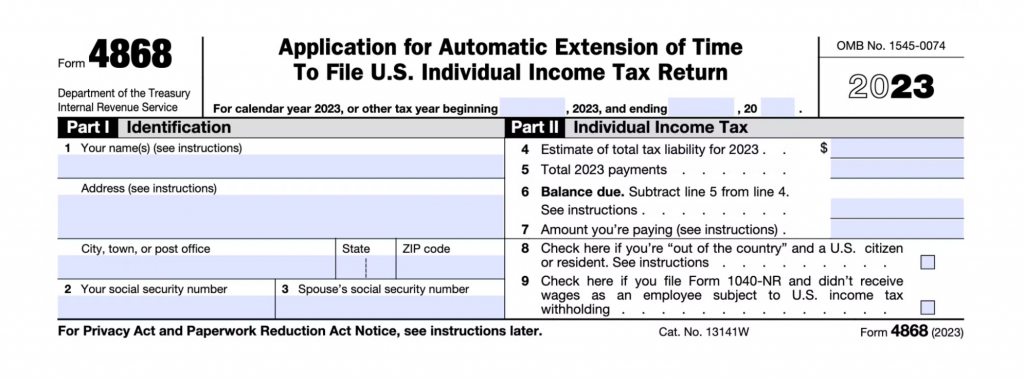

Preparing Form 4868

Personal Information (Lines 1-3): Provide your name, address and Social Security number. If you are married filing jointly, include your spouse’s information as well.

Estimated Tax Liability (Line 4): You must estimate the taxes you are expected to owe for the year. If you expect to get a refund, enter 0.

IRS Payments (Line 5): Include any payments you’ve already made to the IRS this year.

Balance Due (Line 6): Subtract the amount on Line 5 from your estimated tax liability on Line 4 to calculate the remaining balance due. If you get a refund, you’ll need to enter that amount in Line 7 instead.

Amount Paid with Extension (Line 7): Enter the amount you are paying with your extension request. If you owe nothing, enter 0.

Out of the Country (Line 8): Check this box if you are a US citizen or resident living abroad to indicate that you’re eligible for the automatic two-month extension.

Submitting Form 4868 to the IRS

Once you have filled out your form, you can head to the IRS website and submit it using one of their trust partners. Now, you should receive an automatic extension. You can choose to continue downloading your IRS forms, fill them out individually, and file them, or you can sign up and file using US tax software.

Filing With MyExpatTaxes

Filing your tax extension through MyExpatTaxes is a straightforward process that allows you to easily complete and submit the required information online. Follow the steps below to sign up, fill in your details, and submit your extension for the October 15th deadline.

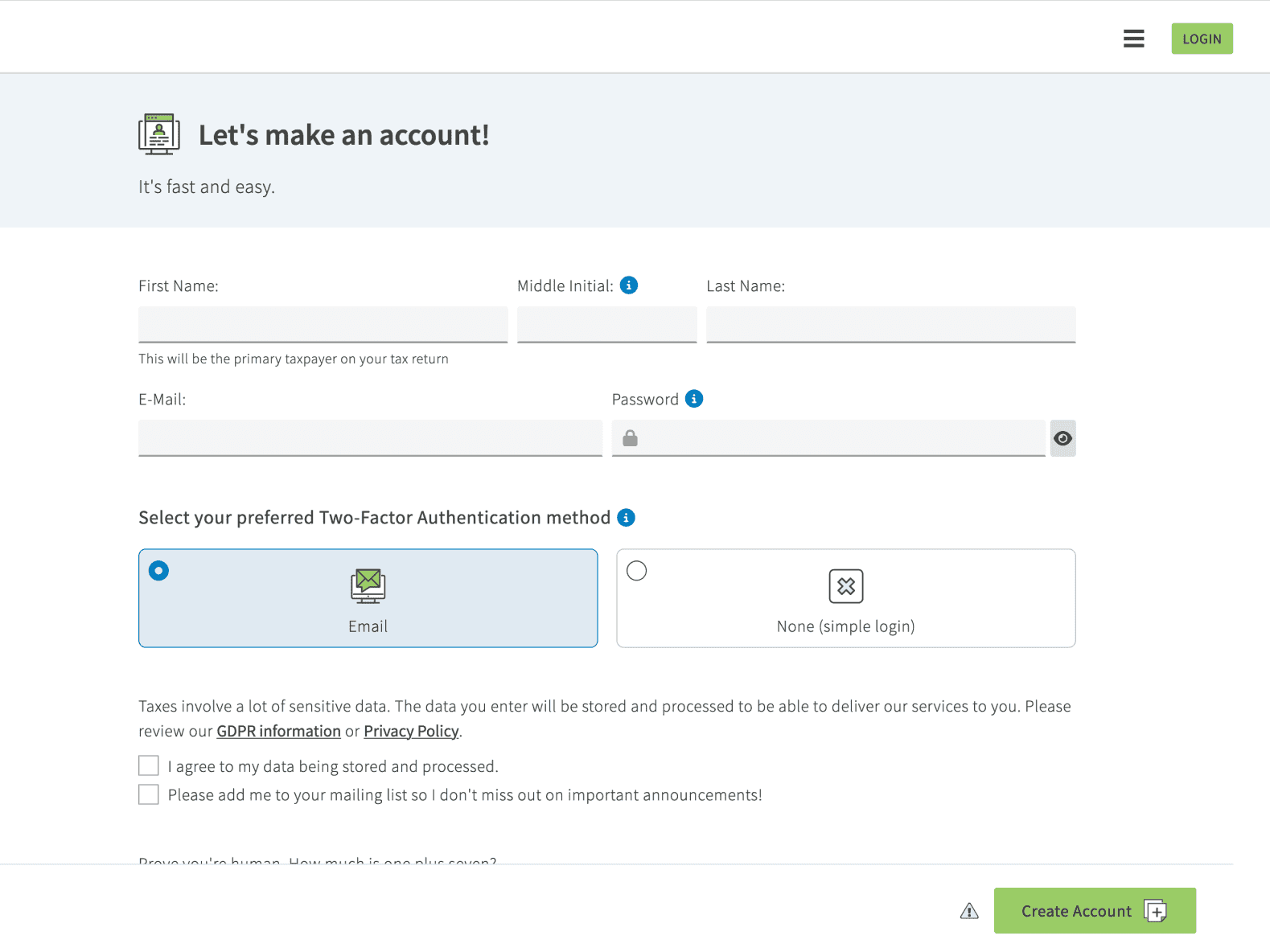

Step 1: Start by Signing Up

To get to this page you will need to go to the MyExpatTaxes sign up page.

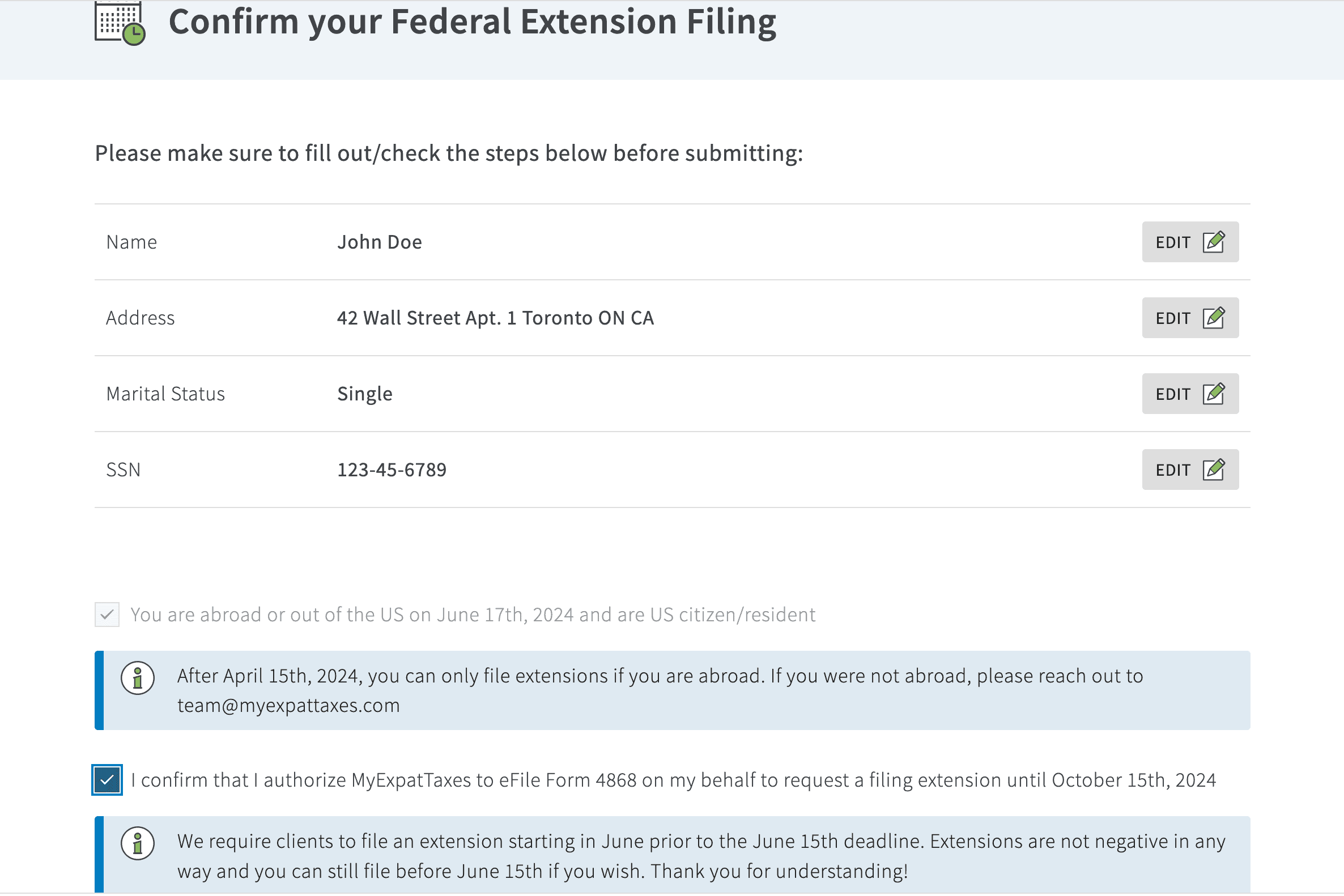

Step 2: Fill in Your Information

If you’re filing as a single person, your data should look similar to this photo. If you would like to include your spouse, make sure to change your martial status to married.

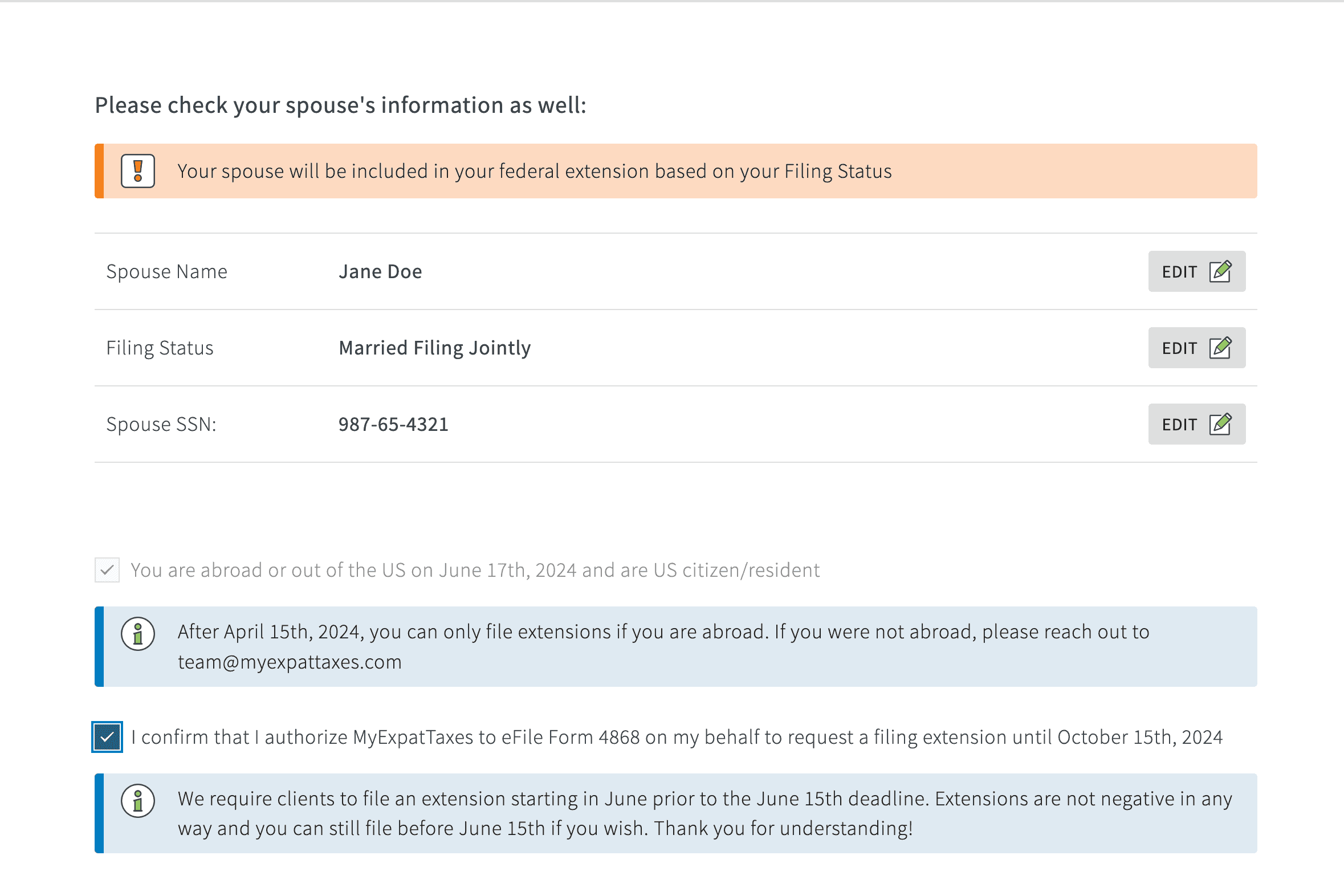

Step 3: Fill in Your Spouse’s Information

If you have a spouse and you’re filing jointly, you will have a section that will look similar to this with your spouse’s information.

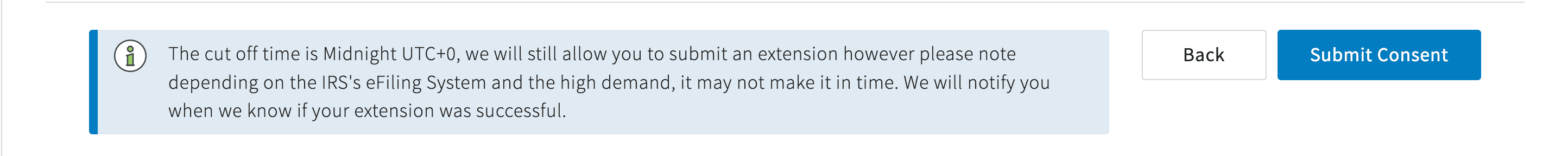

Step 4: Submit Your Consent

After you submit your consent, your extension will be filed automatically for the October 15th extension deadline. Your account securely stores your data, allowing you to continue filing later with MyExpatTaxes.

Form 4868 for Joint Filers

In order to file an extension jointly with your spouse, you will need to include both Social Security Numbers and personal details on Form 4868. You do not need two forms as there is a section where you can put ‘Your Social Security Number‘ and your ‘Spouse’s Social Security Number.’

Filling out the form will address your income and tax liability, and payment estimates should include your and your spouse’s combined income.

If you decide to file ‘married filing separately‘ later on, you will both need to attach a copy of your extension to your tax return before submission.

Form 4868 and State Tax Returns

Form 4868 is specifically for extending your federal tax return deadline, but it can also automatically extend your state return deadline, depending on your state. Some states, such as California and Illinois, offer an automatic extension if you file Form 4868.

If you would like to learn more about filing an extension for your state return, check out this article: State Taxes and Extensions. It can provide you with information about whether your state grants automatic extensions based on federal extension Form 4868.

What Happens If You Miss the Form 4868 Deadline?

The golden question is, what happens if I miss the deadline to file Form 4868? Well, your return will be considered late; therefore, subject to penalties. You could be looking at the following:

The Failure to File penalty is 5% of the unpaid taxes for each month or part of a month that a tax return is late. The penalty won’t exceed 25% of your unpaid taxes.

Source: IRS Failure to File

The Failure to Pay penalty is 0.5% of the unpaid taxes for each month or part of a month the tax remains unpaid. The penalty won’t exceed 25% of your unpaid taxes.

Source: IRS Failure to Pay

Practice filing Form 4868 even if you don’t think you’ll need it because it could save you from potential penalties.

Need Help Filing Form 4868 for Your Taxes?

Do you need some help filing Form 4868 or estimating your tax liability? MyExpatTaxes recommends utilizing the help of a US expat Tax Professional to streamline the process, or you can file an extension using MyExpatTaxes software. In order to file, simply provide the necessary information about yourself and your spouse, and then you can complete your extension.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 1, 2024 | Tax Forms | 6 minute read