Foreign Housing Exclusion: Tax Savings for US Expats

August 6, 2025 | Foreign Earned Income | 8 minutes

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated October 16, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated October 16, 2025

If you’re a US expat living abroad, you know it isn’t cheap, but you may not know that the IRS offers a tax break that can help. The Foreign Housing Exclusion lets eligible US taxpayers abroad exclude certain housing expenses from their taxable income.

Whether you’re renting a city apartment or covering high housing costs in an expensive market, the Foreign Housing Exclusion can make a big difference.

In this guide, we’ll explain how it works, what counts as a qualified expense, and how it can save US expats money.

- Higher FEIE limit— For 2025, you can now exclude up to $130,000 in foreign earned income per taxpayer.

- Base housing amount— Still set at 16% of the FEIE ($20,800 in 2025), this threshold must be exceeded before housing costs qualify for exclusion.

- Standard housing cap— The default maximum for eligible housing expenses is $39,000 per year (around $106.85/day), unless you live in a designated high‑cost location.

- High‑cost locations— Certain cities have higher caps, allowing for a larger exclusion if you live there.

- No extra form’s to file— Use the same form you use for the FEIE Form 2555 and complete Part VI to claim the Foreign Housing Exclusion.

What is the Foreign Housing Exclusion

The Foreign Housing Exclusion (FHE) is an IRS provision designed to help offset the extra costs of living abroad. It lets qualifying US expats reduce their taxable income by excluding certain foreign housing expenses, like rent, utilities, and property insurance, on top of the Foreign Earned Income Exclusion (FEIE).

By subtracting a base housing amount set by the IRS from your actual qualified expenses, you can exclude the remainder, up to a location-based maximum. This means expats in high-cost cities like London or Singapore can often exclude more than those in lower-cost regions.

The exclusion only applies to amounts you pay out of pocket while your tax home is in a foreign country, and the expenses must be considered reasonable. Costs like cable, phone service, and domestic staff generally don’t qualify.

You claim the FHE on Form 2555, the same form used for the FEIE, making it a simple way to further reduce your US tax bill if you already qualify for the foreign earned income exclusion.

Who Qualifies for Foreign Housing Exclusion

The Foreign Housing Exclusion works alongside the Foreign Earned Income Exclusion (FEIE), so you must meet FEIE eligibility first. This requires passing one of two residency tests:

- Bona Fide Residence Test: You maintain residency in a foreign country for an entire calendar year.

- Physical Presence Test: You spend at least 330 full days in one or more foreign countries during any 12‑month period.

In addition, you must meet these other criteria:

- Your tax home is located in a foreign country (your primary place of business, not just where you stay).

- You earn income from working abroad and personally pay for qualified housing expenses.

- You are a US citizen or a resident alien who meets the requirements.

- Your housing costs are above 16% of the FEIE limit for that tax year ($130,000 in 2025)

Suppose your housing expenses are higher than the base amount. In that case, you may be able to reduce part of your foreign income from US taxation, particularly if you qualify for the full Foreign Earned Income Exclusion.

How Much Can I Deduct with the Foreign Housing Exclusion?

The Foreign Housing Exclusion is calculated using your actual qualified housing expenses abroad. Still, it’s limited to 30% of the Foreign Earned Income Exclusion (FEIE) minus a base housing amount equal to 16% of the FEIE.

For 2025, the FEIE exclusion is set at $130,000. The base housing amount is 16% of that figure, which equals $20,800. The maximum foreign housing exclusion is 30% of the FEIE, which equals $39,000. This maximum is the upper limit on the amount you can exclude or deduct for qualified foreign housing expenses.

In some high-cost locations, the IRS allows a higher cap, so your allowable housing exclusion may be greater depending on where you live. You can view the 2024 IRS annual notice on high‑cost locations and their maximum housing exclusion amounts in IRS Notice 2024‑31. For 2025, see IRS Notice 2025‑16.

Which Housing Expenses Qualify Abroad?

Qualified housing expenses for the Foreign Housing Exclusion include:

- Rent

- Utilities (except for telephone, TV services, and internet)

- Personal property insurance (such as homeowner’s or renter’s insurance)

- Leasing fees

- Furniture rentals

- Parking rentals

- Repairs

The following do not qualify:

- Mortgage payments

- Domestic labor (maids, housekeepers, etc.)

- Purchased furniture

- Anything considered “lavish or extravagant”

These expenses are reported on Form 2555 along with the Foreign Earned Income Exclusion.

Foreign Housing Exclusion Example and Calculation

Let’s say you live and work in Madrid, Spain, and qualify for the Foreign Earned Income Exclusion. Your total qualified housing expenses for the year are $50,000. The base housing amount for 2025 is $20,800 (16% of the $130,000 FEIE).

You subtract the base amount from your total expenses:

$50,000 – $20,800 = $29,200.

Because Madrid is a high‑cost location with an annual housing cap of $53,300, your $29,200 is fully allowable under the Foreign Housing Exclusion.

However, If your expenses meet or exceed Madrid’s 2025 housing cap of $53,300, the exclusion would be limited to $32,500 ($53,300 cap − $20,800 base).

The Foreign Housing Exclusion only comes into play when your housing costs exceed what’s already covered by the Foreign Earned Income Exclusion, letting you increase the total income you can exclude.

Claiming the Foreign Housing Exclusion

1. Qualify for the FEIE First

Before you can use the Foreign Housing Exclusion, you must be eligible for the Foreign Earned Income Exclusion. This means meeting either the Physical Presence Test or the Bona Fide Residence Test.

2. Calculate Your Total Foreign Earned Income

Add up all income you earned while working abroad, including wages, self‑employment profits, and any other compensation. Be sure to keep thorough records, especially if your pay includes allowances, bonuses, or other employer‑provided benefits.

3. Calculate Your Allowable Housing Costs

Work out your total qualified housing expenses for the year, then apply the IRS rules and the limit for your location. High‑cost cities may have larger caps, so check the latest IRS list for your area.

4. Report on Form 2555

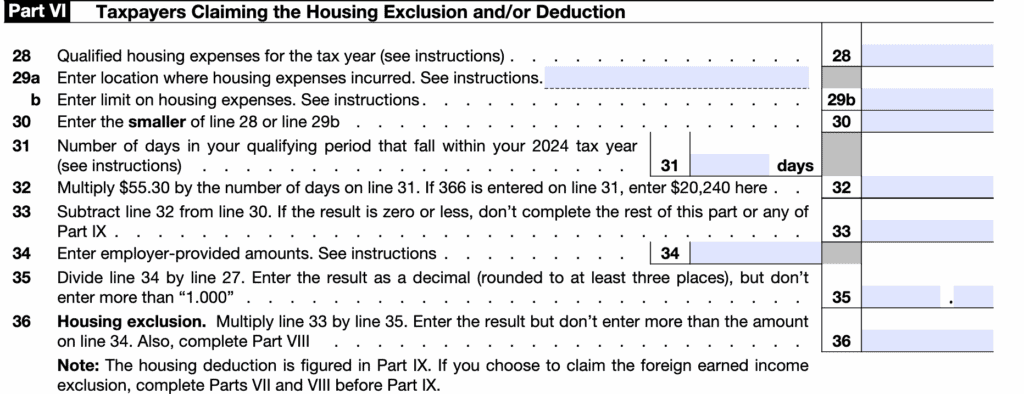

Complete Part VI of Form 2555, entering your actual foreign housing expenses along with the limit for your location. Indicate whether you are claiming the exclusion, the deduction, or both (if self‑employed).

Part VI of Form 2555 – Taxpayers Claiming the Housing Exclusion and/or Deduction

5. File with Your Tax Return

Submit the completed Form 2555 along with your Form 1040. Keep records like receipts, rental contracts, and utility bills in case the IRS requests verification.

When figuring your Foreign Housing Exclusion, remember to convert all expenses to US dollars using an IRS‑approved exchange rate, and be consistent with the method you use for the entire year.

Filing Jointly vs. Separately for the Foreign Housing Exclusion

If you and your spouse live in the same household, only one Foreign Housing Exclusion (FHE) can be claimed, either on a joint return or by one spouse on separate returns.

If you maintain separate households that are not within commuting distance, both spouses may be able to claim the FHE individually.

Whether joint or separate filing is better depends on your overall tax situation, so it’s worth running the numbers or getting professional advice before deciding.

Foreign Housing Deduction vs. FHE: Don’t Get Confused

Form 2555 covers both the Foreign Housing Exclusion (for employees) and the Foreign Housing Deduction (for self‑employed individuals). In Part VI, you calculate your allowable housing amount the same way, but its use depends on your work status:

- Employees – The result is applied as an exclusion to reduce taxable foreign earned income.

- Self‑employed taxpayers – The result is applied as a deduction and reported on Form 1040, line 36, under “Adjustments to Income,” instead of being combined with the FEIE.

Both benefits follow the IRS limits set, but they work differently: the deduction lowers adjusted gross income, while the exclusion directly removes eligible housing expenses from taxable foreign earned income.

State Tax Considerations for the Foreign Housing Exclusion

The Foreign Housing Exclusion only reduces your federal taxable income; it doesn’t automatically apply to state taxes. Some “sticky‑domicile” states, such as California, New York, and Virginia, may still consider you a resident even if you live overseas. If that’s the case, the state can tax your entire worldwide income, including amounts excluded on your federal return. Review your state’s residency rules to see if you need to take steps to break residency.

Maximize Your Housing Exclusion with Confidence

If you pay for housing expenses abroad, don’t miss out on the Foreign Housing Exclusion. It can be a game‑changer for lowering your US tax bill when paired with the Foreign Earned Income Exclusion.

With MyExpatTaxes, our easy-to-use software and experienced Tax Professionals guide you through every step. From tracking eligible expenses to applying the correct IRS limits for your location, so you can claim the maximum benefit while staying fully compliant.

Frequently Asked Questions

Content of the Accordion Panel

The Foreign Housing Exclusion (FHE) lets qualifying US taxpayers reduce their taxable foreign earned income by certain housing expenses paid while living abroad. It works alongside the Foreign Earned Income Exclusion but applies only to costs above a base amount set by the IRS each year.

Content of the Accordion Panel

Qualified expenses generally include rent, utilities (excluding phone and internet), property insurance, repairs, parking, and furniture rental. Non‑qualifying costs include luxury accommodations, cable TV, phone service, purchased furniture, and domestic help.

Content of the Accordion Panel

The base amount, 16% of the FEIE for that year, must be subtracted from your total housing expenses before calculating your exclusion. The IRS only allows you to exclude costs above this base, and ignoring it could mean overstating your exclusion.

Content of the Accordion Panel

Yes. Some cities have higher housing caps under the annual IRS notice (for 2025, see Notice 2025‑16). If you live in one of these cities, you may be able to exclude more than the standard maximum.

Content of the Accordion Panel

Yes. Employer‑provided housing is handled differently than self‑paid housing on Form 2555. The exclusion applies only to amounts you paid out‑of‑pocket for qualified expenses.

Content of the Accordion Panel

Complete Part VI of Form 2555, listing your housing expenses, the base amount, and the maximum limit for your location. Attach the form to your Form 1040 when you file.

Content of the Accordion Panel

Yes, but not on the same income. Choosing between them depends on your income mix, foreign tax rate, and location. Sometimes a combination of both (applied to different income types) results in the lowest tax bill.

Content of the Accordion Panel

Yes, but not on the same income. The Foreign Housing Exclusion applies to amounts earned as an employee, while the Foreign Housing Deduction is for self‑employment income. If you have both types of income in the same year, you may be able to claim each benefit on its respective income source, using the same calculation on Form 2555.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

August 6, 2025 | Foreign Earned Income | 8 minutes