Do US Expats Need to File Arizona State Taxes?

May 22, 2019 | State Taxes | 2 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 26, 2024

Do US expats need to file Arizona state taxes? Possibly. However, one thing for sure is that all US Citizens and Green Card Holders are required to report their worldwide income to the IRS regardless of where they live and work (just see this post to learn more about that).

If you are no longer domiciled (meaning, you don’t consider yourself to have a permanent home in the states that you will return to if your job contract expires) read on. If you still are domiciled in Arizona, you will most likely need to file a state return every year!

Arizona US Tax Guide

Here’s a simple guide to determine whether you need to file Arizona state taxes:

Did you live in Arizona for any part of the year?

- Yes: You will need to file as Part-Year Resident, skip down below

- No: Continue on

Did you earn any Arizona sourced income during the year?

- Yes: File as Non-Resident, skip down below

- No: You don’t need to file

An Arizona resident is subject to tax on all income, including earnings from another state. Part-year residents are also subject to Arizona tax on any income earned while an Arizona resident, and any income earned from an Arizona source before moving to (or after leaving) the state.

What is Arizona Sourced Income?

Before we answer more if US expats need to file Arizona state taxes, we’ll share more on Arizona Sourced Income. Most typically, this form of income is earned while working physically in Arizona State (i.e. any income including normal salary from your non-US employer) while on a business trip. Or income earned from physical property located in Arizona (i.e. rental income from your old Arizona home).

Arizona Specific Filing Details

Filing Thresholds:

- As a Part-Year Resident: You are taxed on all income received while a resident and only on income from Arizona sources while a nonresident.

- As a Non-Resident: You are taxed only on income from Arizona sources.

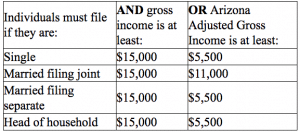

You will need to file an Arizona State Tax Return if you have Arizona sourced income and your total gross worldwide income is more than the relevant threshold shown below:

Filing requirements

Expat Tax Benefits

Which expat tax benefits does Arizona State allow?

- Moving Expenses: No

- Foreign Earned Income Exclusion: Yes

- Foreign Tax Credit: Yes

Additional US Tax Support

The information we shared on whether US expats need to file Arizona state taxes is a lot. So don’t panic if you can’t understand it all! We at MyExpatTaxes can also help out with your state tax filings in an affordable way. Click here to sign up for our app, and get ready for a fun ride!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

May 22, 2019 | State Taxes | 2 minute read