Form 8865: When to Report Foreign Partnerships

August 27, 2025 | Tax Forms | 5 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated September 29, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated September 29, 2025

Holding an interest in a foreign partnership can add another layer to your US expat tax obligations. If you’re a US citizen with a stake in a partnership abroad, the IRS may require you to file Form 8865 to report your share of income, losses, and key transactions. Staying compliant is critical, and overlooking this form can result in costly penalties.

The upside? Once you know who must file, what information is required, and how to meet the rules, the process becomes much more manageable. Here’s a breakdown to guide you through it.

What Is Form 8865?

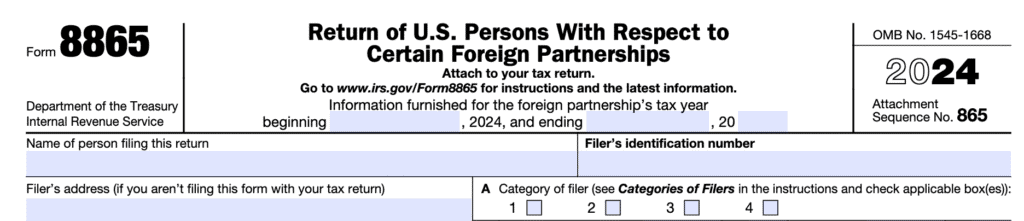

For Americans with an interest in a foreign partnership, Form 8865 is the IRS’s way of keeping track. The official name is Return of US Persons With Respect to Certain Foreign Partnerships. Its purpose is to report your share of income, distributions, and certain transactions tied to foreign partnerships.

You can think of it as the overseas counterpart to Form 1065, which domestic partnerships use. Form 8865 isn’t filed on its own; it’s attached to your annual US tax return on Form 1040.

So what qualifies as a foreign partnership? Essentially, any partnership that isn’t formed under US or District of Columbia law, or one that’s treated as foreign under IRS classification rules. If you hold an ownership stake, contribute property, or receive payouts from a partnership, Form 8865 may be required to keep you compliant.

Who Has to File Form 8865?

IRS Form 8865 applies to US persons with significant ownership in a foreign partnership. The filing requirement is triggered if you hold at least a 10% interest, or if the partnership is classified as a controlled foreign partnership. A partnership is considered controlled when more than 50% of its ownership is held collectively by US persons.

The rules also extend beyond traditional partnerships. Foreign entities that elect to be treated as partnerships for tax purposes, such as multi-member LLCs established abroad, can also create a Form 8865 filing obligation.

By filing, US taxpayers disclose ownership, income, and certain transactions to the IRS, ensuring compliance and avoiding steep penalties.

Reusable Callout-Box

*For design changes please notify Dev Team.

*For bullet points please wrap text accordingly: (ul) *placeholderText* (ul)

One bulletpoint is defined by `(li)` > (ul) (li)bulletpoint1 (li)bulletpoint2 (ul)

Constructive Ownership Rule

Even if you personally own less than 10%, the IRS may “attribute” ownership to you through family members or entities you control. In that case, you could still fall into a Form 8865 filing category. This is disclosed on Schedule A.Form 8865 Filing Requirements

The IRS requires Form 8865 for US taxpayers who meet certain ownership or transaction thresholds with foreign partnerships. Whether you’re an owner, contributor, or involved in significant transactions, your filing obligation depends on how the IRS classifies your role.

Form 8865 highlights four filer categories. Your reporting obligations depend on which category you fall into.

Categories of Filers

The IRS defines four categories of individuals or entities who may need to file Form 8865:

- Category 1 – A US person who owns more than 50% of a foreign partnership. This level of ownership means the partnership is considered a controlled foreign partnership.

- Category 2 – A US person who owns at least 10% in a foreign partnership and the partnership is controlled by US persons, making it a controlled foreign partnership.

- Category 3 – A US person who contributes property to a foreign partnership when the contribution either (a) represents at least a 10% interest in the partnership or (b) has a value of $100,000 or more during a 12-month period.

- Category 4 – A US person who engages in reportable events with a foreign partnership, such as acquiring or disposing of a 10% interest, or making other significant ownership changes.

Key Schedules on Form 8865

Form 8865 comes with several schedules, each covering a different aspect of a foreign partnership. Here’s a quick breakdown:

| Schedule | Purpose |

|---|---|

| A – Ownership | Lists US partners, ownership % (direct or indirect). |

| B – Income & Deductions | Reports partnership income, expenses, and net profit/loss. |

| K – Partners’ Shares | Shows each partner’s share of income, deductions, and credits. |

| L – Balance Sheet | Details assets, liabilities, and equity at year-end. |

| M & M-2 – Adjustments & Capital | Reconcile book vs. tax income and track partner capital accounts. |

| N – Related-Party Transactions | Discloses loans, sales, or transfers with related entities. |

Not every filer needs to complete every schedule. Your filing category and partnership activity determine which ones apply. For the complete filing rules, see the official IRS Form 8865 Instructions.

Reusable Callout-Box

*For design changes please notify Dev Team.

*For bullet points please wrap text accordingly: (ul) *placeholderText* (ul)

One bulletpoint is defined by `(li)` > (ul) (li)bulletpoint1 (li)bulletpoint2 (ul)

Stricter Reporting Rules

The IRS now requires expanded international tax reporting on Schedules K-2 and K-3. If your foreign partnership has cross-border income, deductions, or credits, you may need to complete these schedules in addition to the standard Form 8865 schedules.IRS Penalties for Failing to File Form 8865

The IRS divides Form 8865 obligations into several groups, and the penalties vary depending on your role in the partnership:

Ownership or Control (Category 1)

US persons who own more than 50% of a foreign partnership face a $10,000 penalty per year. If the form is still not filed within 90 days of receiving an IRS notice, additional fines of $10,000 apply for every 30 days of continued noncompliance, up to $50,000.

Minority Owners (Category 2)

US persons with at least 10% ownership in a partnership that is otherwise controlled by US persons are subject to the same penalties as Category 1 filers: $10,000 per year, with escalating fines after 90 days, capped at $50,000.

Property Contributions (Category 3)

US persons who contribute property to a foreign partnership can be penalized up to 10% of the value of each contribution. The total penalty is capped at $100,000 per year, unless the failure to file is intentional, in which case no limit applies.

Ownership Changes (Category 4)

US persons who acquire, dispose of, or change their interest in a foreign partnership are penalized under the same rules as Categories 1 and 2.

Reusable Callout-Box

*For design changes please notify Dev Team.

*For bullet points please wrap text accordingly: (ul) *placeholderText* (ul)

One bulletpoint is defined by `(li)` > (ul) (li)bulletpoint1 (li)bulletpoint2 (ul)

Other Consequences

Beyond monetary fines, the IRS may:

(ul)

(li)Reduce or deny foreign tax credits

(li)Extend the statute of limitations on your return

(li)Pursue criminal charges in cases of fraud

(ul)

Form 8865 or Form 5471: Which One Applies?

The IRS uses different forms depending on the type of foreign entity you own. Form 8865 applies to partnerships, while Form 5471 applies to corporations. Both involve detailed reporting, both attach to your US tax return, and both carry significant penalties if ignored. The form you file comes down to how your business is classified under US tax rules.

Reusable Callout-Box

*For design changes please notify Dev Team.

*For bullet points please wrap text accordingly: (ul) *placeholderText* (ul)

One bulletpoint is defined by `(li)` > (ul) (li)bulletpoint1 (li)bulletpoint2 (ul)

Entity Classification Rule

Foreign partnerships, by definition, do not provide limited liability to all members. If all members have limited liability, the IRS classifies the entity as a foreign corporation by default. In that case, you would stop filing Form 8865 and instead file Form 5471. However, you can override the default classification by filing Form 8832 (Entity Classification Election) with the IRS.When Is Form 8865 Due?

Form 8865 is filed with your US tax return, not separately. This means it follows the same deadlines as your Form 1040 (individual) or Form 1120 (corporate) return:

- April 15 – standard filing deadline.

- June 15 – automatic two-month extension for Americans living abroad (though estimated taxes are still due by April 15 to avoid interest and penalties).

- October 15 – extended deadline if you request an official extension.

To be accepted, all filers must also have a valid US taxpayer identification number (TIN).

Stay Compliant with Form 8865

Form 8865 is more than just reporting paperwork; it’s a critical IRS requirement for Americans with foreign partnership interests. Missing it can mean steep penalties and ongoing IRS scrutiny.

At MyExpatTaxes, our award-winning software and trusted Tax Professionals ensure you file Form 8865 accurately and on time. We can also help you determine whether you should be filing Form 8865 or Form 5471, and whether an Entity Classification Election makes sense for your situation. That way, you avoid costly mistakes and stay fully compliant so you can focus on your business with peace of mind.

Frequently Asked Questions

Content of the Accordion Panel

Form 8865 is used to report US persons’ ownership, contributions, and transactions with foreign partnerships. It ensures compliance with IRS international reporting rules.

Content of the Accordion Panel

Any US person who meets IRS ownership thresholds (10% or more), contributes property, or engages in significant transactions with a foreign partnership may be required to file.

Content of the Accordion Panel

Penalties for failing to file start at $10,000 per year and can increase based on the type of filer. Property contributions may trigger a penalty of up to 10% of the contribution’s value.

Content of the Accordion Panel

Form 8865 must be filed with your US tax return (Form 1040 or 1120). The deadline is April 15, with automatic extensions to June 15 for expats and October 15 if you file for an extension.

Content of the Accordion Panel

Form 8865 applies to foreign partnerships, while Form 5471 applies to foreign corporations. Both are complex IRS reporting forms and carry steep penalties if missed. By default, the IRS determines classification based on liability rules. However, you can file Form 8832 to elect a different classification.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

August 27, 2025 | Tax Forms | 5 minute read