Do I Need to File Form 8812: How to Claim the Child Tax Credit For US Expats

October 3, 2025 | Family Tax Support, Tax Forms | 7 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated October 10, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated October 10, 2025

Form 8812, officially called Schedule 8812 (Form 1040), plays a big role in helping US expats unlock valuable tax credits. It’s the key to claiming benefits like the Child Tax Credit and the refundable Additional Child Tax Credit, which can put thousands of dollars back in your pocket, even if you don’t owe US tax. For many expats, this form can mean the difference between owing tax and getting money back.

There have also been recent changes to the credit amounts and eligibility rules under the One Big Beautiful Bill, which directly affect expat families.

In this article, we’ll explain how Form 8812 works, what has changed, and what US expats need to know before filing.

Reusable Callout-Box

*For design changes please notify Dev Team.

*For bullet points please wrap text accordingly: (ul) *placeholderText* (ul)

One bulletpoint is defined by `(li)` > (ul) (li)bulletpoint1 (li)bulletpoint2 (ul)

Key Updates in 2025

(ul)

(li)Child Tax Credit (CTC): Raised from $2,000 to $2,200 starting in tax year 2025.

(li)Parent SSN Requirement: Starting with 2025 tax returns (filed in 2026), at least one spouse on a joint return must have a valid Social Security Number (SSN) to claim the refundable Child Tax Credit.

(li)Credit for Other Dependents: The $500 credit is now permanent; it was previously set to expire.

(li)Annual Inflation Adjustments: Beginning in 2026, the CTC and ACTC amounts will be indexed for inflation

(ul)

What Is Form 8812?

Form 8812 (Schedule 8812) is filed with your regular US tax return to claim the Child Tax Credit (CTC), the refundable Additional Child Tax Credit (ACTC), or the Credit for Other Dependents. For US expats, this form is especially important because it can mean the difference between owing nothing and actually getting money back.

What is the Child Tax Credit?

The Child Tax Credit is designed to give families with children financial relief. It’s a nonrefundable credit, which means it can reduce your US tax bill but cannot create a refund on its own. If you owe tax, the CTC directly lowers what you owe, up to the credit limit.

- For the 2024 tax year (filed in 2025), the CTC is worth up to $2,000 per qualifying child.

- For the 2025 tax year (filed in 2026), the maximum credit increases to $2,200 per child.

- Credit for Other Dependents: Provides up to $500 for each qualifying dependent who doesn’t meet the requirements for the Child Tax Credit. The amount remains unchanged.

What is the Additional Child Tax Credit (ACTC)?

The Additional Child Tax Credit extends the Child Tax Credit for families who don’t fully benefit from the regular, nonrefundable CTC because their tax bill is too low. If your CTC is larger than the tax you owe, the ACTC allows the IRS to refund the difference, up to a set maximum. For both 2024 and 2025 returns, the maximum is $1,700 per child, with annual inflation adjustments starting in 2026. To qualify, you’ll need at least $2,500 of earned income.

Does My Child Qualify for the Child Tax Credit?

To claim the Child Tax Credit, your child must meet all of these tests:

- Relationship: Must be your child, stepchild, foster child, adopted child, sibling, or a descendant of one of these.

- Age: Must be under 17 at the end of the tax year.

- Residency: Must have lived with you for more than half the year. On Schedule 8812, this is called having a principal abode, meaning your child’s main home was with you (no matter where that home is). Exceptions apply for temporary absences (like school, medical care, or military service).

- Support: The child cannot have provided more than half of their own support.

- Citizenship: Must be a US citizen, national, or resident alien with a valid SSN issued before the tax filing deadline.

Choosing the Right Strategy: FEIE vs. FTC

Many expats are able to reduce or even eliminate their US tax bill by using special expat tax benefits. The Foreign Earned Income Exclusion (FEIE), claimed on Form 2555, allows you to exclude foreign earned income, up to $130,000 for the 2025 tax year. The Foreign Tax Credit (FTC), claimed on Form 1116, gives you a dollar-for-dollar credit for income taxes you’ve already paid abroad.

Both strategies can reduce your US tax bill to zero, but they have very different effects on the Child Tax Credit:

FEIE

If you still have taxes owed after excluding income with the Foreign Earned Income Exclusion, you can use the Child Tax Credit to reduce them. However, using the FEIE comes with a trade-off: you lose access to the refundable Additional Child Tax Credit, which is the part that can put money back in your pocket.

FTC

By contrast, the Foreign Tax Credit (FTC) not only lets you use the Child Tax Credit to reduce any US tax you owe. It also allows you to claim the refundable Additional Child Tax Credit if your bill is reduced to zero, which it often is. For many expat families, this means a potential refund even when no US tax is due.

Real World Example:

David’s Situation: American expat in Germany with three qualifying children

- Earned income: $100,000 annually

- German taxes paid: $22,000

With FEIE Strategy:

- US taxable income: $0 (income excluded under FEIE)

- Child Tax Credit benefit: $0 (no US tax liability to reduce, and ACTC blocked by FEIE)

- Total outcome: Still no refund, despite having three kids.

With Foreign Tax Credit Strategy:

- US taxable income: $100,000

- US taxes before credits: $18,000

- Foreign Tax Credit: $18,000 (eliminates US taxes)

- Additional Child Tax Credit: $5,100 (refundable, $1,700 × 3 children)

- Total outcome: $5,100 refund

In short, choosing between the FEIE vs. FTC irsn’t just about lowering your tax bill, it can directly affects whether you qualify for thousands of dollars in refundable credits.

Does the Child Tax Credit Have Income Limits?

Yes, the Child Tax Credit begins to phase out once your modified adjusted gross income (MAGI) exceeds certain thresholds:

- $400,000 for married couples filing jointly

- $200,000 for all other filing statuses

Once above these levels, your credit is reduced by $50 for every $1,000 of income over the limit. These thresholds apply for both the 2024 and 2025 tax years and will remain unchanged in 2026.

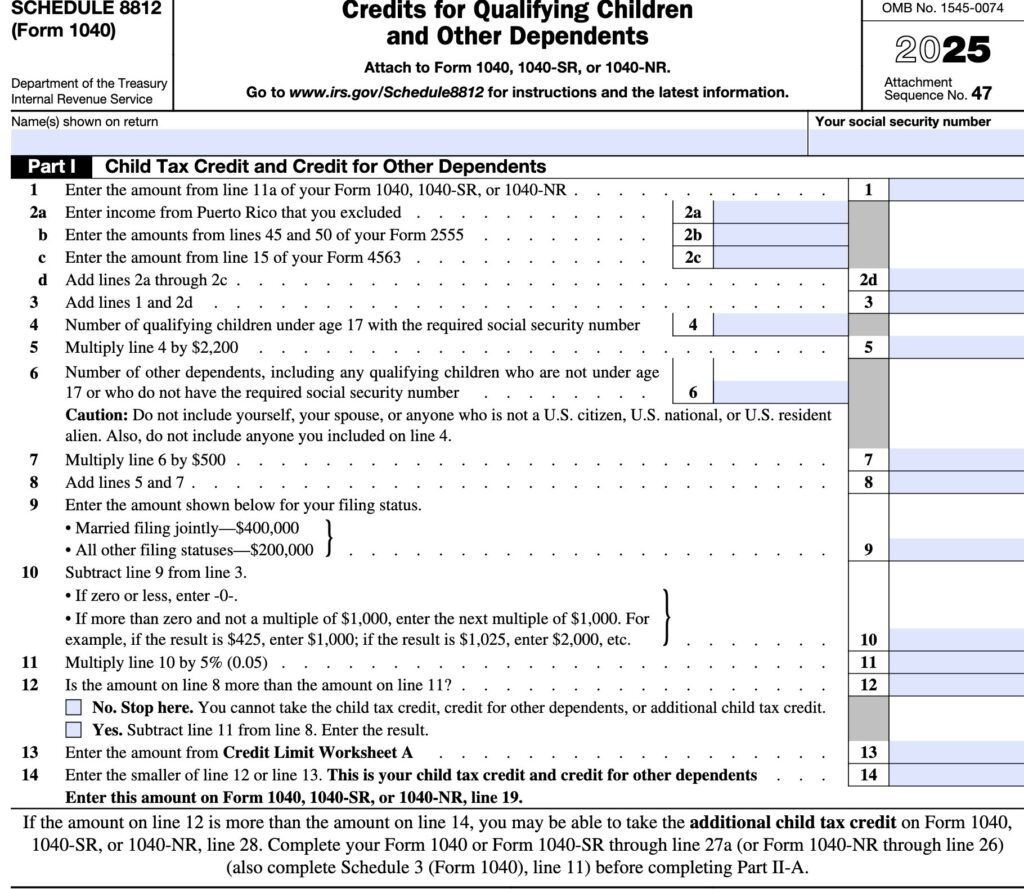

Form 8812 Instructions

Here’s a step-by-step look at how to complete Schedule 8812.

Step 1. Gather your documents

- Your completed Form 1040 through line 15

- Social Security Numbers for all qualifying children

- Proof of your child’s US citizenship or residency

- Form 2555 (if claiming the FEIE) or Form 1116 (if claiming the FTC), since these directly affect how much of the Child Tax Credit you can claim

Step 2. Fill out Part I of Schedule 8812

This section calculates your Child Tax Credit and Credit for Other Dependents based on your modified adjusted gross income (MAGI) and number of qualifying children.

Step 3. Complete Credit Limit Worksheet A

Found in the Schedule 8812 instructions, this worksheet ensures you don’t claim more credit than your tax liability allows.

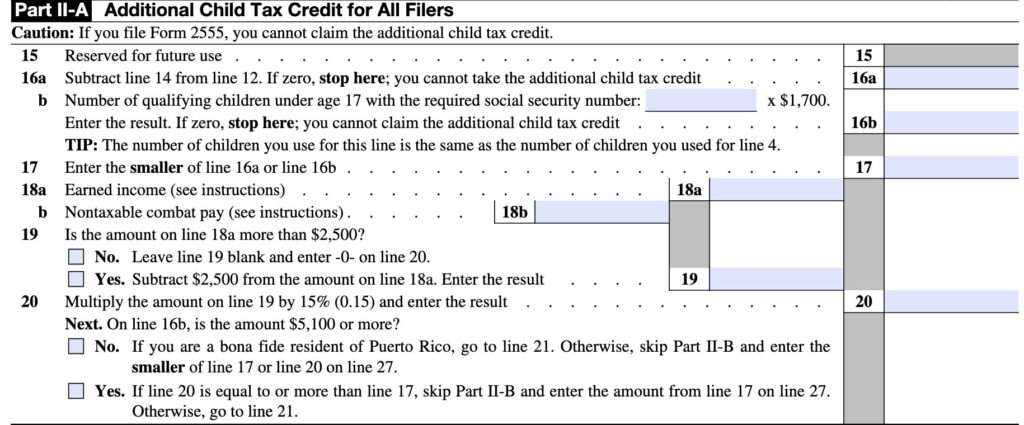

Step 4. See if you qualify for a refund (Part II-A)

If your credits are larger than your tax bill, Part II-A determines if you qualify for the refundable Additional Child Tax Credit. Remember, if you filed Form 2555, you are disqualified from the refundable ACTC. Remember, you need at least $2,500 in earned income.

In some cases, the IRS may also require you to complete Form 15110 (Additional Child Tax Credit Worksheet) to confirm whether you qualify for a refund.

Step 5. Attach Schedule 8812 to your Form 1040

Once complete, file it with your tax return.

Let MyExpatTaxes Help

Form 8812 is one of the most important tools US expats have for unlocking valuable family tax credits. From the Child Tax Credit to the refundable Additional Child Tax Credit, it can mean the difference between owing tax and getting thousands of dollars back. But the rules are complex, especially when you factor in expat benefits like the FEIE or FTC, and new changes under the One Big Beautiful Bill.

At MyExpatTaxes, we help expats choose the right strategy to maximize their Child Tax Credit while simplifying the entire filing process. Our software and tax professionals ensure you file correctly, claim every credit you qualify for, and never leave money on the table.

Frequently Asked Questions

Content of the Accordion Panel

Yes. Even if your tax bill is zero, you must still file a return to claim refundable credits like the ACTC. Skipping filing means missing out on money you may be entitled to.

Content of the Accordion Panel

Using the FEIE can reduce your US tax bill to zero, but it also blocks you from claiming the refundable Additional Child Tax Credit. Many expats benefit more from the Foreign Tax Credit instead.

Content of the Accordion Panel

No. To claim the refundable ACTC, you must meet the earned income requirement ($2,500 for 2024 and $3,000 for 2025). Passive income like dividends or rental income doesn’t count.

Content of the Accordion Panel

For joint returns filed in 2025 and later, only one parent needs a valid SSN to claim the refundable portion of the credit. This update provides relief for mixed-status households.

Content of the Accordion Panel

Yes. You can file amended returns (Form 1040-X) up to three years after the original due date to claim missed credits. Some expats recover thousands by switching from FEIE to FTC in prior years.

Content of the Accordion Panel

The IRS cannot issue refunds for returns claiming the ACTC before mid-February. After that, most refunds are issued within 21 days if you file electronically, choose direct deposit, and avoid errors.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 3, 2025 | Family Tax Support, Tax Forms | 7 minute read