US Stimulus Checks for Americans Abroad: All the Details

March 19, 2020 | Stimulus Checks | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated November 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated November 26, 2024

The first US stimulus payments for US expats have been sent out in March 2020 coming from a $2 trillion stimulus bill from the Trump administration. Now, the pandemic continues on and a dire need to restore the American economy and families pockets take precedence. to halt economic damage from the coronavirus (COVID-19) and inject cash into the economy, thus saving businesses from collapsing.

Who is Eligible for Stimulus Checks

The checks only benefit people within a certain threshold.

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have an eligible Social Security number with adjusted gross income up to:

$75,000 for individuals, $112,500 for head of household filers and $150,000 for married couples filing joint returns.

Taxpayers will receive a reduced payment if their AGI is over $75,000.

IRS.gov

The amount of the reduced payment will be based upon the taxpayers specific adjusted gross income.

Additional information to be eligible:

- You need a 2018/2019 tax return on file for the IRS to know your eligibility and where to deliver the funds (US bank or mailing address for paper checks).

- If your worldwide income was under the filing threshold and you didn’t file, you will still need to file a tax return. This is so the IRS has your information for the payments.

- Eligibility to receive the $1,200+ payments depend on your income and if you had a valid US social security number in time.

Social Security recipients who are not typically required to file a tax return do not need to take any action. They will receive their 1200 dollar checks directly to their bank account by paper check, just as they would normally receive their benefits.

It is unclear at this point if the IRS will do a direct deposit into a foreign bank account, however we assume not.

Checking Your Payment Status

As of April 15, 2020, the IRS launched the first of two web portals to allow all US citizens (at home and abroad) to get their payment information to the IRS. Make sure you use the right one.

Non-Filer Portal

These American expats can use this IRS Non-Filer portal to sign up for the Stimulus Payments if they:

- normally would NOT file a 2018/2019 tax return because they have less worldwide income (before expenses, tax treaties and deductions) than these filing status threshold amounts: Single: $12,200, Married Filing Separately: $5 (Most expats who have a Non US Citizen Spouse fall under this category), Head of Household: $18,350, Married Filing Jointly: $24,400.

If you need to file a tax return because your income was over the filing threshold above, DO NOT use the Non-Filer portal. By using the Non-Filer portal, you are declaring that you are under the income filing requirements to the IRS and if you are you require to file a proper tax return later, you will NOT be allowed to electronically file.

This has already happened to some of our customers, who now have to paper mail their 2019 tax returns rather than conveniently eFile through MyExpatTaxes.

For Expat Tax Filers

Expats, who do need to file a 2019 tax return, should do so ASAP and make sure to use a tax software that allows expats to eFile (most do not, so check before you pay).

The IRS has just opened up “Get Your Payment” here. In this portal, expats can confirm their mailing address and bank details (if they have a US bank account).

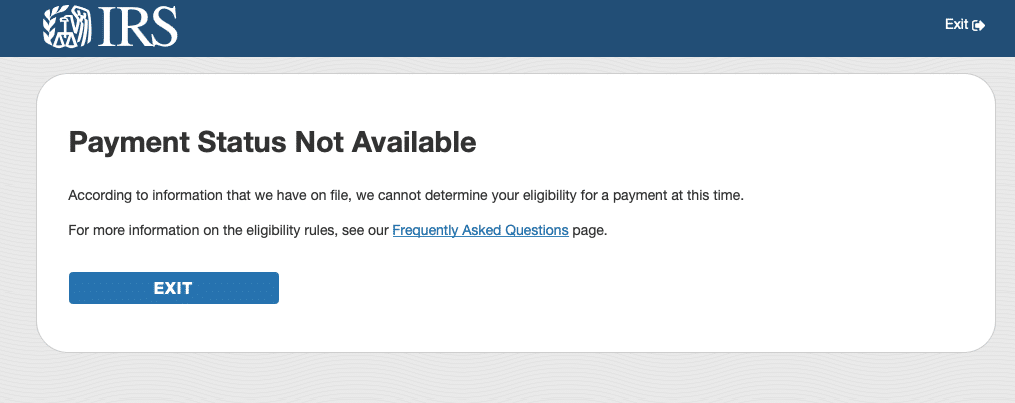

THIS TOOL MAY BE LIVE, BUT MANY USERS WHO HAVE FILED 2018/2019 TAXES ARE STILL SEEING “NOT AVAILABLE” STATUSES:

If this is happening to you, please just check again at a later time. The IRS may still be syncing up the tool with their databases.

Will Foreign Income Be Counted As Qualifying Income?

In the amended version passed on March 25, 2020, there is NO income threshold required to receive the full check.

Therefore, American expat taxpayers who filed a 2018/2019 tax return (even if no income was reported) and are on record with the IRS SHOULD receive the full refund, unless their Adjusted Gross Income is over the phase-out limits.

Most Expats Don’t Have US Tax Liability, Does This Make Us Ineligible?

In the original bill, there was a requirement to have a net income tax liability. Net income tax liability will be your leftover tax due AFTER foreign tax credits are applied. However, even if you have $0 net income tax liability, you can still be eligible if you have $2,500 of qualifying income.

Now, there seems to be no income or US tax liability requirement anymore. So all Americans overseas who file their taxes SHOULD be eligible for the stimulus checks, assuming you are not over the AGI thresholds mentioned above.

When Will the $1,200+ Checks Come Out?

According to the IRS, the checks would be paid out starting April. The exact dates are still unknown. Before any payment comes out, the Treasury still needs to publish develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

Once this app is available, we will send out an update to all registered MyExpatTaxes users so make sure you create an account here to get the latest updates.

How Do You Know You Received the Stimulus Payment?

IRS news from April 1, 2020 states that when you file a tax return, you should include your US bank details. The stimulus check can be deposited in your US bank account (direct deposit) or mailed to the last known address on your tax return (US or Foreign).

If you don’t have a US bank account, Transferwise is a great option.

MyExpatTaxes allows you to include your US bank details on your 2019 tax return EVEN if you are not due a refund. Other tax software companies do not allow this.

Also, make sure if you are using one of the popular US-based tax software that they allow you to eFile. MyExpatTaxes allows almost all expats to eFile, even if they have non-US citizen spouses, tax treaty disclosures, etc.

If you have already filed a tax return for 2019 without bank details, watch out for the IRS website that should come “within weeks” to submit your information for previously filed returns.

Taxpayers should receive a notice up to 15 days after payment was made to their last known address stating:

- a method by which such payment was made

- amount of the payment

- a phone number for the appropriate point of contact at the IRS to report any failure to receive the payment

Extended Tax Payment Deadline

There is now automatic payment relief for Americans abroad who owe taxes. Usually, you need to pay taxes by the April 15th deadline to avoid interest. Yet in these times, the IRS extended the filing and tax payment deadline to July 15, 2020.

This particular payment relief includes all individual tax returns, plus self-employed individuals and all other entities (except trusts, estates or C-Corporations).

This is important to know because for any US citizen abroad, it means penalties and interest will begin to accrue on any remaining unpaid balances as of July 16, 2020. Before, these fees would start to accrue from April 15th.

This new payment relief though does not include state tax payments, payments or deposits of any other type of federal tax. Additionally, you do not need to call or contact the IRS for any additions or to ask if you qualify for this relief. All US citizens are included in this new law.

File to Receive the $1200 Check

Due to the stimulus checks, it may be wise to file US taxes earlier if possible. Please note that you can still take advantage of our expat tax software service. Electronically pay your taxes smoothly and within 30 minutes, even before the new deadline comes in.

Additionally, if you need to file for an extension, you can do so for free via our expat tax software. Just sign in, give us consent to file on your behalf, and then fill in the appropriate information. It’s that easy!

According to the IRS, these economic impact payments will be available throughout the year, if you need more time to file a return.

We at MyExpatTaxes will make this easy for you by helping you update the IRS with your current mailing address and income eligibility details. You can also file both 2019 and back taxes through our app at the same €149 ($175) fixed price per year of filing. Plus, you’ll receive helpful customer service from our team and can file in less than 30 minutes!

This post gets updated and enhanced frequently.

To get notified about updates please enter your e-mail:

"*" indicates required fields

This article has been updated:

- 04/15/2020: The IRS recently launched the first of two web portals to allow all US citizens to get their payment information in to the IRS.

- 04/08/2020: Most Americans to receive the EIP starting in April.

- 04/03/2020: The US Department of the Treasury and the Internal Revenue Service announced that Social Security beneficiaries who are not typically required to file tax returns will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts.

- 04/01/2020: First guidelines from IRS and announced a way to file a simple tax return to get the most important information on file.

- 03/28/2020: The bill is now enacted into law. Make sure your address and US bank account details are updated.

- 03/27/2020: The bill has now been passed by the Senate. It seems there are no more minimum income or tax requirements. All expats should be eligible if filing taxes.

- 03/25/2020: The original proposed senate bill here, with the amendments reflected here (official text has not yet been released).

- 03/23/2020: The latest IRS announcements here.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

March 19, 2020 | Stimulus Checks | 6 minute read