US Expat Taxes for Americans in the Czech Republic

September 6, 2024 | Country Guides | 7 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 26, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 26, 2024

Historically referred to as Bohemia, the Czech Republic is a landlocked country in Europe, neighboring Austria, Germany, Poland, and Slovakia. A country rich in history and is rated the eighth safest and most peaceful country by the World Bank Human Capital Index. With a sprawling landscape, delicious Pivo, and intriguing language, it’s no wonder thousands of US expats are enjoying their lives in the Czech Republic! You’re no longer a US citizen just visiting Prague as a tourist; you live in the Czech Republic! The only thing left to do is to offer a bit of guidance when it comes to filing US taxes as a US citizen living and working in the Czech Republic.

Even though your days may be filled with goulash, Czech lessons, and the occasional trip to Cesky Krumlov to visit Kaufland, a beloved grocery store for American expats to stock up on goods, there is one thing to remember – your US tax responsibilities. Yes, despite being over five thousand miles away, the IRS still expects to hear from you, but that doesn’t mean April needs to be a stressful experience each year.

We created this guide for expats like you to help you navigate your US expat taxes!

Who should file US Expat Taxes in the Czech Republic?

You, probably! If you are reading this, chances are you are one of the following:

- US citizen

- Green Card holder, or

- Simply curious about US taxes with no US connections (which, in that case, you do not need to file)

Each US citizen and Green Card holder who meets or surpasses the minimum income threshold must file a US tax return annually.

In 2025, when filing your 2024 tax return, you’ll need to file if you:

- Are Single and making $14,600 or more

- Are Married Filing Jointly, and make at least $29,200 combined

- Are Married Filing Separately and making at least $5– yup, just $5

- Are Self-employed and make at least $400

Deadlines for US Expat Taxes in the Czech Republic

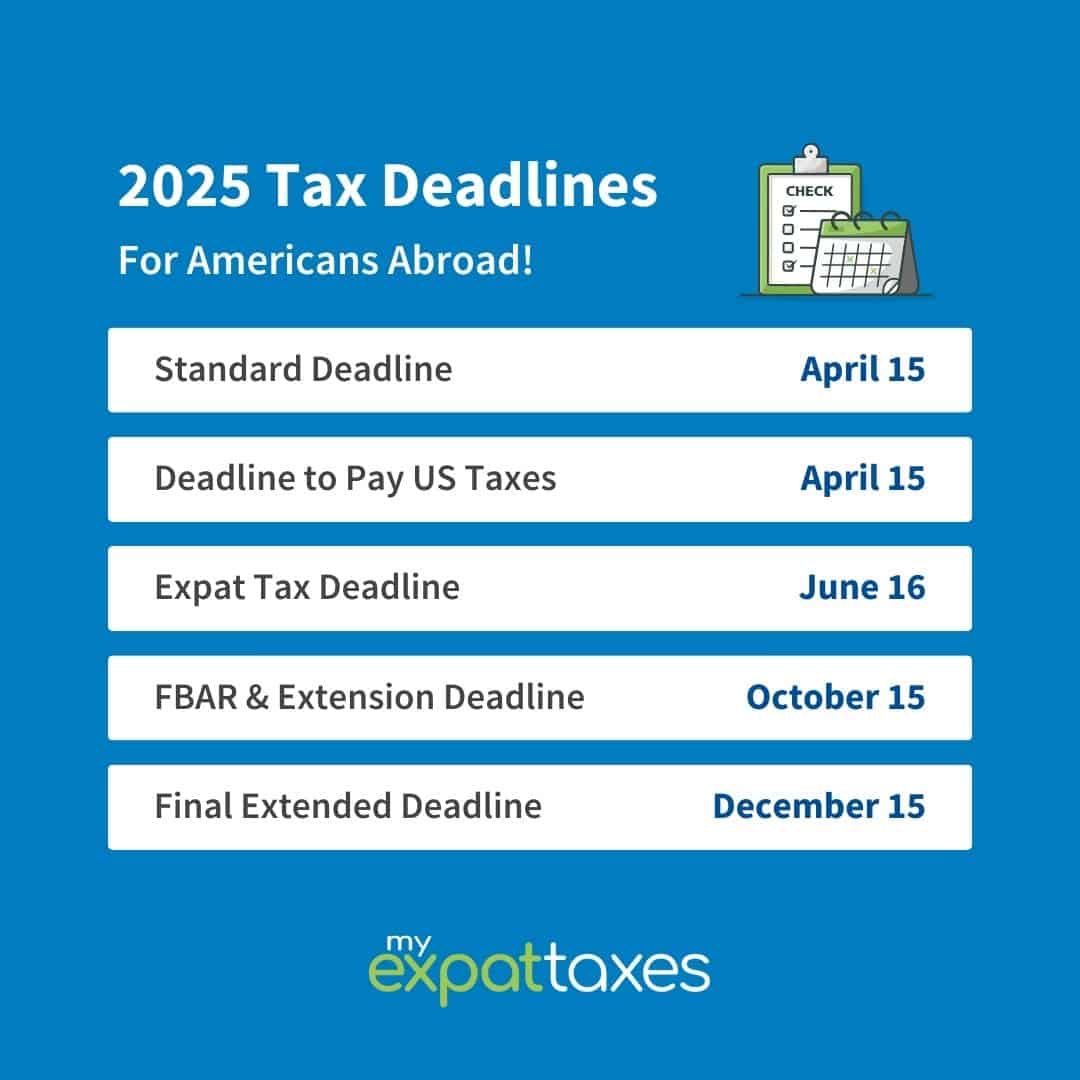

You’re a US citizen living and working in the Czech Republic, so now is a great time to become familiar with the different filing dates for Americans abroad. While you were required to file in the US by April 15th of the tax year, there are other dates expats should take caution of.

April 15th: Traditional Tax Filing Deadline. This date is for anyone who owes US taxes and needs to pay them. Yup, even Americans abroad need to pay by April 15th.

June 15th: Automatically extended deadline to file US expat taxes in the Czech Republic. There is no need to file for an extension for this date; it is automatic for expats.

October 15th: Additional Extension Deadline. If you need extra time to gather documents, you can file for an extension. Just be sure to do so by June 15th!

December 15th: The Last Extension Deadline. Are you having trouble filing on time for a specific reason? You may write to the IRS (by October 15th!) to request this last deadline; there are no more after this one! Remember, when requesting this final date, you must state your case to the IRS.

Expat Tax Tip: Any deadline on a public holiday or weekend will be pushed forward to the nearest business day. Are you feeling motivated? Check your calendar for next year and see if this will apply!

Getting Caught Up via The Streamlined Procedure

If you have never filed US taxes, it is time to get caught up! For many US expats, the realization of having to continue to file may come as a surprise. Even more so for Accidental Americans!

To give a helping hand to Accidental Americans and American Expats, the IRS created The Streamlined Procedure. This amnesty program gives a grace period for US citizens or Green Card holders the chance to catch up on their taxes. Through streamlining, you can file a limited number of past returns and FBARs without penalty.

However, if the IRS does catch up to you, you may have some problems with facing fines or penalties while also not qualifying for the use of this program. In that case, you should use the streamlining procedure before the IRS sends a letter asking about whereabouts.

MyExpatTaxes offers an affordable and transparent fee for The Streamlined Procedure. Let the Tax Professionals help you file all the necessary tax returns and FBARs required and sign off on your final submission!

The Streamlined Procedure is a tool the IRS uses to lighten its burden of chasing down accidental “tax evaders.” Doing so encourages compliance from those who did not realize their obligation to report their income and foreign assets.

Do You Need to File US Taxes for Your Family Abroad?

Determining which filing status to use can be complicated, but here is a simple way to find the best status.

Are you married to a US citizen or a Green Card holder? The best option will likely be to file under Married Filing Jointly. As a couple, the IRS sees that you are earning money or owning assets together. Your country of residence makes little to no difference.

Are you married to a non-US citizen? If your spouse is not required to file US taxes as they are neither a US citizen nor a Green Card holder, you will usually file under Married Filing Separately. By using this filing status, your spouse’s financial information will not be questioned by the IRS. Just keep in mind joint bank accounts still need to be disclosed!

Do you pay more than half to maintain your home or household with a qualifying child? If yes, you can claim the Head of Household status rather than MFS. It is important to note that you must have paid more than half during the qualifying tax year.

If you do not qualify as married to the IRS but have dependent children, you may also be able to file as Head of Household.

Child Tax Credits for Families Abroad

If you are a parent abroad, regardless of your filing status, the Child Tax Credit is something you are probably wondering about. While living and working in the Czech Republic as a US citizen, you can claim up to $1,700 per child. More money for your family to spend on day-to-day needs or for a little treat.

For new expats that have spent at least half of the prior tax year in the US before moving abroad, you may qualify for the new, higher Child Tax Credit. Let’s find out if you qualify for this Child Tax Credit and how much you may be able to receive. MyExpatTaxes software can automatically calculate if you are eligible for a refund. If you still have questions, you can always speak with one of our Tax Professionals to review your prior US tax returns to see if they may be amended.

Tax Forms Expats in the Czech Republic Should Know

As an US Citizen living and working in the Czech Republic, you should get more comfortable with a couple of forms before filing your expat taxes. These new forms come into two categories:

- Forms that help expats avoid double taxation such as:

- FEIE, Foreign Earned Income Exclusion

- FTC, Foreign Tax Credit

Secondly, forms that allow you to report your foreign assets, such as:

You should also be aware of The Foreign Housing Exclusion. The Foreign Housing Exclusion is another way to decrease your US tax bill while living abroad. This exclusion considers foreign housing expenses such as rent, utilities, property insurance, etc.

US taxes as a Self-Employed Person in the Czech Republic

We are proud of everyone who manages to move abroad and settle their feed in the proverbial sand. We are even more proud when we hear Americans fulfilling their dreams as self-employed people abroad! However, you will have time to celebrate after reading the following section.

There are three things you need to know about filing US self-employment tax from the Czech Republic:

- You will need to file a US tax return if you earn $400 or more per year from self-employment income.

- You may have to pay the US government 15.3% net profit in Self-Employment taxes.

- The Czech Republic and the US have a totalisation agreement; you can use the treaty to help offset US Self-Employment taxes.

A widespread mistake for US expats filing their taxes abroad is US-based tax software misidentifying and charging US citizens the wrong self-employment taxes. Let us help you avoid this headache; file with MyExpatTaxes today!

Investing as an American in the Czech Republic

The Czech Republic has a stable political and social system and is considered a safe place for foreign investors to well… invest! There are a few more rules Americans abroad need to be aware of when it comes to investing, but here are three simple ways to get you started:

- Property: just as in the US, property is almost always a great way to invest money while abroad, for personal use or not

- US-Based Stocks & Bonds: if you are looking to invest but want to keep things simple while avoiding high fees and taxes, keep your portfolio US-based.

- IRAs/Roth IRAs: Did you know that US expats can invest up to $7,000 in a retirement account annually? Now you do! They need to take care that they meet the requirements to contribute.

If you have decided to take a turn investing in the Czech Republic, MyExpatTaxes can help you report these investments to the IRS using Form 8621 (PFICs).

Why File Your US Expat Taxes with MyExpatTaxes?

MyExpatTaxes is made by expats, for expats. We understand the difficulties that come when it is time to file your US expat taxes. Let us help you make it easier. Our transparent pricing will never leave you wondering what you are paying for; we are open about how our pricing works and what we charge.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

September 6, 2024 | Country Guides | 7 minute read