Form 1116: How to Maximize the Foreign Tax Credit

June 20, 2025 | Foreign Earned Income, Foreign Tax Credit | 10 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated September 8, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated September 8, 2025

Avoiding double taxation is a genuine concern for Americans abroad. That’s where the Foreign Tax Credit (FTC) comes in. By filing IRS Form 1116, you can claim the FTC and reduce your US tax bill by the amount of foreign taxes you’ve already paid. If you earn foreign-source income, knowing when and how to use this credit is key. This guide shows you how to maximize this benefit and keep more of your income.

What is the Foreign Tax Credit

The Foreign Tax Credit (FTC) is a US tax provision that helps avoid double taxation for US taxpayers. If your income is foreign-sourced and you pay taxes on the same income to another country, the FTC allows you to reduce your US tax bill by the amount of foreign income taxes paid.

It applies to both earned and unearned income, as long as the income is taxed abroad and also subject to US taxation. This credit in nonrefundable, meaning it can lower your taxes owed to zero but it won’t result in a refund.

What is IRS Form 1116?

IRS Form 1116 allows US citizens and Green Card holders to claim the Foreign Tax Credit. You must file this form to report the type of foreign income received, the foreign taxes paid, and how the credit should apply. Form 1116 separates income by category, like wages or dividends, and calculates the allowable credit based on how much of your income was foreign sourced and how much tax you already paid on it.

When is Form 1116 Required?

Form 1116 is required if:

- You are a US citizen or green card holder with foreign-sourced income, such as wages, dividends, interest, or capital gains, and you paid or accrued foreign taxes on that income.

- You want to claim the Foreign Tax Credit to reduce your US tax liability.

- You paid or accrued more than $300 (single) or $600 (married filing jointly) in foreign taxes.

- You want to claim the credit on income that falls into multiple categories (e.g., passive vs. general income).

- You want to carry over or carry back unused foreign tax credits.

Additional Eligibility Requirements

- The foreign tax must be legally owed and paid by you.

- The tax must be an income tax or a tax in lieu of income tax.

- Your income must be taxable in the US and not excluded under the Foreign Earned Income Exclusion.

- You must properly categorize your foreign income (e.g., passive, general, or treaty income) to calculate the credit.

- Special rules apply for income earned in US possessions (like Puerto Rico or Guam).

The Foreign Tax Credit can’t exceed the portion of your US tax liability that applies to your foreign income. In other words, you can’t use the Foreign Tax Credit to lower the tax you owe on US-based income.

Form 1116 vs. Form 2555: Which One Should You Use?

Form 1116 is often compared to Form 2555, which is used to claim the Foreign Earned Income Exclusion (FEIE). While both aim to reduce double taxation, they do so in different ways:

- Form 2555 excludes a set amount of foreign-earned income from US taxation (up to $126,500 in 2024).

- Form 1116 provides a tax credit for taxes already paid to a foreign government

To qualify for the FEIE under Form 2555, you must meet either the Bona Fide Residence Test (living in a foreign country for an entire calendar year) or the Physical Presence Test (spending at least 330 full days outside the US in a 12-month period).

Form 1116 may offer more advantages if:

- You live in a high-tax country, and the foreign taxes you pay exceed what you’d owe to the IRS, allowing you to reduce or eliminate your US tax liability.

- Your income includes unearned income (such as dividends or interest), which Form 2555 cannot exclude.

- Your foreign income exceeds the FEIE limit

- You don’t meet the FEIE residency tests. Form 1116 doesn’t require you to qualify under the Bona Fide Residence or Physical Presence tests, nor submit details like housing, visa type, or time spent in the US, making it easier to claim in many situations.

Note: You can use both the FEIE and the FTC, but not on the same income. For example, you may exclude earned income using Form 2555 and apply the Foreign Tax Credit (via Form 1116) to unearned income or to any earned income that exceeds the FEIE cap.

Choosing between the FEIE and FTC depends on your income type, foreign tax rate, and how long you’ve lived abroad.

This one decision could mean thousands of dollars in savings. Determining your eligibility and which strategy offers the most tax savings can be complex. Let MyExpatTaxes help you find the best option so you can save money and file with confidence.

FEIE vs. FTC: Which US Expat Tax Benefit Is Right for You?

Extra Benefits of the Foreign Tax Credit

Claiming the Foreign Tax Credit can also preserve access to other major tax benefits that are often lost when using the Foreign Earned Income Exclusion (FEIE):

Additional Child Tax Credit (ACTC)

To qualify, you must have more than $2,500 in earned income. If you exclude all of your income under the FEIE, you may lose access to the refundable portion of the Child Tax Credit (also known as the Additional Child Tax Credit, or ACTC). Using the FTC keeps your earned income on record, allowing you to claim the credit.

IRA Contributions

You need earned income to contribute to an IRA. If you use FEIE to exclude all your foreign compensation from your tax return, you’ll be ineligible to contribute With the FTC, your income remains “taxable”, making contributions possible.

Carry forward / back Opportunities

Any unused FTC can be carried forward up to 10 years (or back 1 year), giving you long-term tax planning flexibility. We’ll delve more into how carry forwards work later in this guide.

How Do You Calculate the Foreign Tax Credit?

Step 1: Choose the Income Category

At the top of Form 1116, start by selecting the correct income category. This tells the IRS what type of foreign income you’re reporting.

- If you’re reporting wages, check “general category income.”

- If you’re reporting foreign sourced investment income like dividends or interest, check “passive category income.”

- US dividends and interest don’t usually qualify for the FTC, but if you paid foreign tax on them and your tax treaty allows, you may claim the credit under “certain income re-sourced by treaty.”

Each income category requires its own Form 1116. So if you have both types, you’ll need to complete a separate form for each.

Step 2: Calculate Your Foreign Tax Credit Limit

The Foreign Tax Credit (FTC) is capped by the amount of US tax owed on your foreign income. To find your limit, use this IRS formula, commonly referred to as the limitation formula:

Example 1

Let’s say you earned $45,000 in foreign income and $15,000 in US income, for a total income of $60,000. Your total US tax liability on your foreign source income is $7,000, and you paid $6,000 in foreign taxes.

To calculate your limit:

FTC Limitation Formula = (Foreign Income ÷ Total Income) × US Tax Liability

FTC Limit = (45,000 ÷ 60,000) × 7,000 = 0.75 × 7,000 = $5,250

Using Form 1116, you can claim a Foreign Tax Credit of $5,250 for the portion of your US tax attributable to your foreign income. The remaining $750 in foreign taxes paid can be carried back to the previous tax year or carried forward for up to 10 years.

Example 2: Foreign Earned and Passive Income

Let’s say you earned $70,000 in wages from a job in France (foreign earned income) and received $30,000 in dividends from French investments (foreign passive income). You had no US-sourced income, so your total income for the year is $100,000. Your total US tax liability on this income is $18,000, and you paid $12,000 in French taxes on your wages and $6,000 on your dividends.

Because you have two different types of foreign income, you’ll need to file two Forms 1116, one for each income category:

Form 1116 (General Category – Earned Income)

FTC Limitation Formula = (Foreign Earned Income ÷ Total Income) × US Tax Liability

FTC Limit = (70,000 ÷ 100,000) × 18,000 = 0.70 × 18,000 = $12,600

You can claim a Foreign Tax Credit of $12,000 (the amount of foreign tax paid on your wages), which is within the limit, so no carryover is needed.

Form 1116 (Passive Category – Dividends)

FTC Limitation Formula = (Foreign Passive Income ÷ Total Income) × US Tax Liability

FTC Limit = (30,000 ÷ 100,000) × 18,000 = 0.30 × 18,000 = $5,400

You can only claim $5,400 of the $6,000 in taxes paid on dividends.

The remaining $600 can be carried back one year or carried forward for up to 10 years, depending on your tax situation.

Step 3: Understand Carrybacks and Carryforwards

What happens if your foreign taxes exceed the credit limit? You don’t lose the excess.

- You can carry back unused credits to the previous tax year.

- Or, you can carry them forward for up to 10 years.

Carryovers become especially valuable if your foreign tax rate is high or if your US liability dips in a particular year. Just be aware: the IRS won’t track this for you; you’ll need to keep your own records.

Important: Carrybacks and carryforwards must be applied to the same category of income (e.g., general, passive). You can’t shift excess credits from one category to another in a future year.

IRS Form 1116 Instructions: Part-by-Part Overview with Key Lines to Know

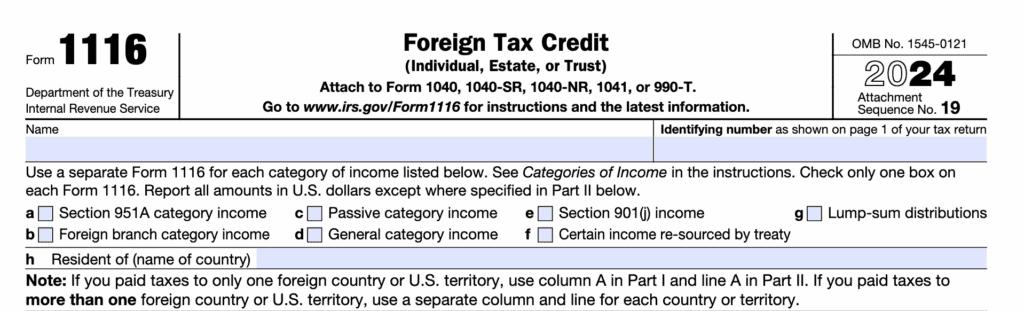

Top of IRS Form 1116 – Choose your income category before filling out the rest of the form.

Part I – Taxable Income or Loss From Sources Outside the United States

This section reports your gross foreign income and allocates deductions to determine your foreign-source taxable income.

Key lines to know:

- Line 1a: Enter gross income from foreign sources that matches the income category you’re reporting (e.g., wages, dividends). Remember not to include any FEIE-excluded income in this total. Qualified dividends and long-term capital gains are subject to adjustments as well.

- Line 3g: Calculates how much of your deductions (standard or itemized) apply to this foreign income, based on your total income split (US vs Foreign)

- Line 7: Your final foreign-source taxable income after deductions, this number flows into Part III, Line 15.

Use columns A, B, or C to separate foreign income by country. If you have multiple countries, list each one separately. If you have different types of income, file a separate Form 1116 for each category.

Excerpt from Part I of Form 1116 – Reporting Foreign Income & Deductions

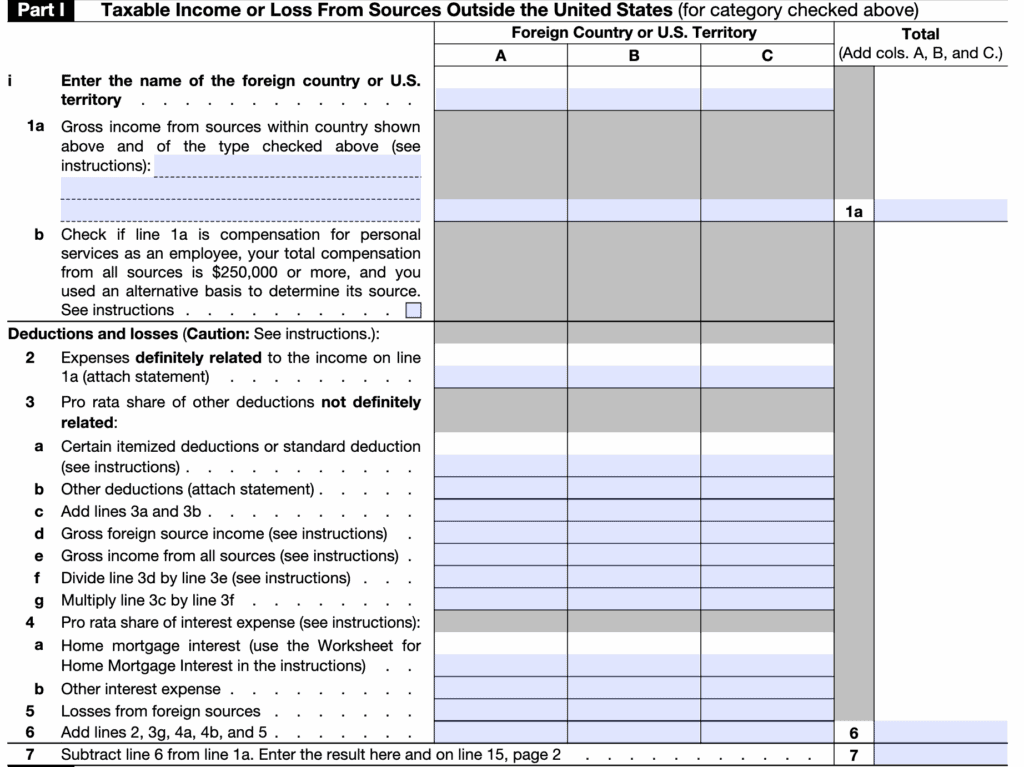

Part II – Foreign Taxes Paid or Accrued

This section is where you list the actual amount of foreign taxes you paid or accrued, converted into US dollars.

Key lines to know:

- Box (j) or (k): Indicate whether you’re reporting taxes on a paid or accrued basis. This choice must be consistent across tax years.

- Column (u): Enter the total foreign taxes paid or accrued (in US dollars) for each country and income type.

- Line 8: Total of all foreign taxes paid or accrued — this carries over to Part III, Line 9.

Use IRS-accepted exchange rates when converting to US dollars.

Excerpt from Part II of Form 1116 – Reporting Foreign Taxes Paid or Accrued

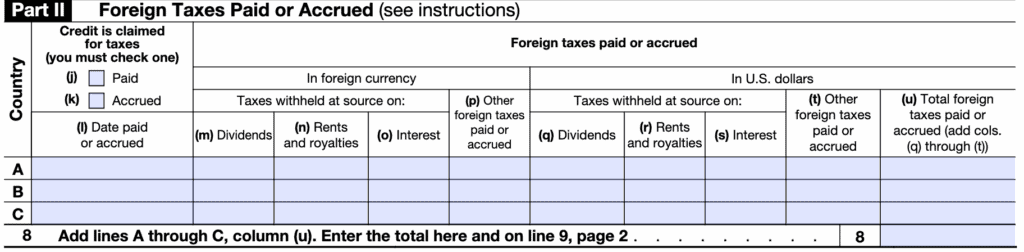

Part III – Figuring the Credit

Here, you calculate how much of your foreign taxes can actually be credited against your US tax bill; this is where the FTC limitation formula comes in.

FTC Limit = (Foreign Income ÷ Total Income) × US Tax Liability

Key lines to know:

- Line 10: Report any unused Foreign Tax Credit carried forward from previous years or carried back from the following year.

- Line 12: If you claimed the Foreign Earned Income Exclusion (Form 2555), this reduces your available credit.

- Line 19: The foreign income ratio: Foreign taxable income ÷ total taxable income.

- Line 21: Multiply your US tax liability by the foreign income ratio to calculate your FTC limitation.

- Line 24: The final allowable credit is the lesser of your foreign taxes available (Line 14) or your FTC limit (Line 23).

If this is the only Form 1116 you’re filing, Line 24 becomes your final Foreign Tax Credit.

Excerpt from Part III of Form 1116 – Calculating Your Foreign Tax Credit Limit

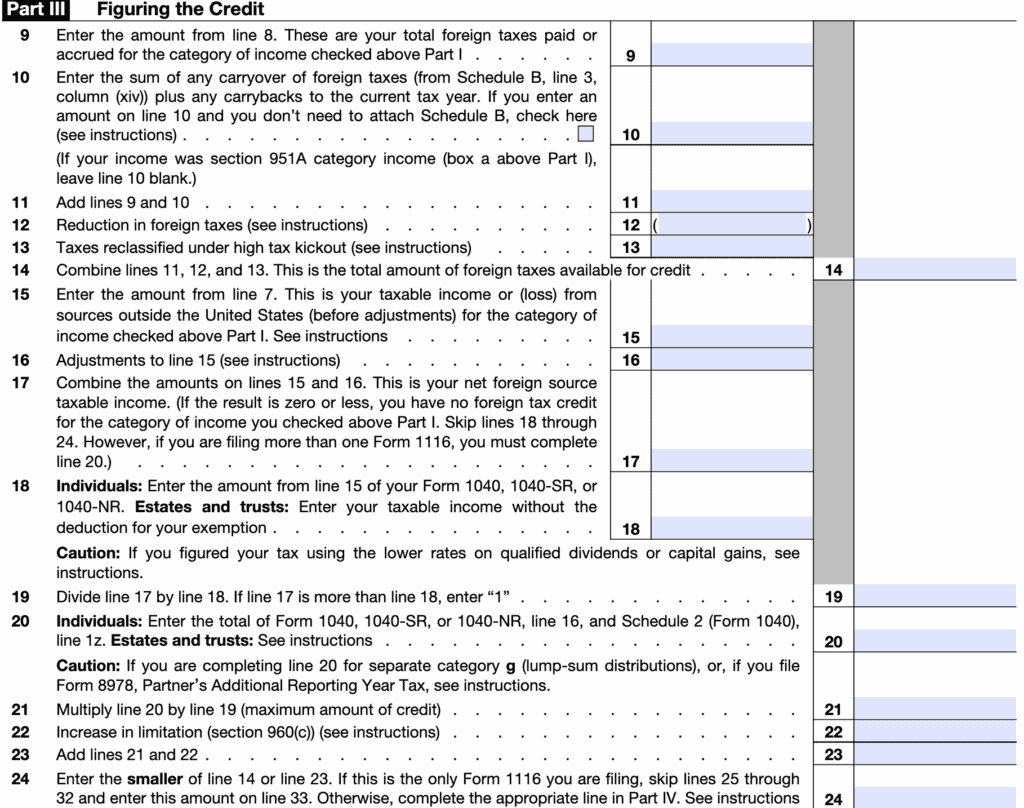

Part IV – Summary of Credits From All Forms 1116

If you filed more than one Form 1116 for different income categories, this section totals them.

Key lines to know:

- Lines 27–31: Report credit amounts by category (general, passive, etc.).

- Line 33: Total credit allowed for the tax year, enter the smaller of your total US tax or total FTCs.

- Line 35: Final credit amount to report on Schedule 3 (Form 1040), Line 1.

If you have excess credit, you may be eligible to carry it back one year or carry it forward for up to 10 years. Keep good records on Schedule B of Form 1116; the IRS won’t do it for you.

Excerpt from Part IV of Form 1116 – Totals from Multiple Credit Calculations

Filing Form 1116 Doesn’t Have to Be Complicated: MyExpatTaxes Can Help

Form 1116 can feel complex when you’re managing multiple currencies, income categories, and countries. Work with expat tax professionals who can help simplify the process, ensure accuracy, and maximize your Foreign Tax Credit savings.

MyExpatTaxes award-winning expat tax software makes filing fast and accurate, and if you need personalized help, our trusted Tax Professionals are here to guide you one-on-one.

Whether you want to file confidently on your own or work directly with a trusted Tax Professional, we’ll help you get it done right, ensuring you’re compliant and not paying more than you owe.

Start your return with MyExpatTaxes today, and take the stress out of expat taxes.

Frequently Asked Questions

Content of the Accordion Panel

IRS Form 1116 is used by US taxpayers to claim the Foreign Tax Credit (FTC), which helps reduce or eliminate double taxation on income earned abroad. It reports the amount of foreign taxes paid and calculates the credit you can claim on your US tax return.

Content of the Accordion Panel

Form 1116 gives you a credit for foreign taxes paid. Form 2555 lets you exclude up to the annual limit of foreign earned income (up to $126,500 in 2024). Use Form 1116 if you pay high foreign taxes or have passive income; use Form 2555 if you’re under the limit and meet the residency or presence test. You can use both, but not on the same income.

Content of the Accordion Panel

No, but you must keep all documentation. You’ll need proof of foreign taxes paid, payee statements like 1099s, foreign tax returns, and exchange rate records. Keep these on file, as the IRS may request them.

Content of the Accordion Panel

If you revoke the FEIE by not filing Form 2555 when you had eligible foreign earned income, you cannot claim it again for 5 years without IRS approval. So be sure before switching to FTC-only.

Content of the Accordion Panel

Use IRS-approved yearly average or daily rates. It’s important to be consistent throughout the form and not mix methods.

Content of the Accordion Panel

No, there’s no fixed dollar limit on the Foreign Tax Credit. However, you can only claim it up to the portion of your US tax that applies to your foreign income. If your foreign taxes are higher, the unused credit can be carried back one year or forward up to 10 years.

Content of the Accordion Panel

You can choose either, but once you do, you must stick with that election every year unless the IRS approves a change.

Content of the Accordion Panel

Yes. Each category of income (e.g., wages, dividends) requires its own Form 1116. The IRS treats different income types differently, so combining them on one form can lead to errors or rejections.

Content of the Accordion Panel

The form has four parts: reporting foreign income, listing taxes paid, computing the credit limit, and summarizing credits from all categories. Each income type, such as passive or general, requires a separate form.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

June 20, 2025 | Foreign Earned Income, Foreign Tax Credit | 10 minute read