15 Things Expats Should Know About US Child Tax Credits

January 9, 2024 | Family Tax Support | 9 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

All blogs are verified by IRS Enrolled Agents and CPAs

All blogs are verified by IRS Enrolled Agents and CPAs

Many American parents benefit every year thanks to US child tax credits, 2024 is no different. However, if you’re a parent abroad this year, you’ll want to know which credits you are eligible for: some being the Child and Dependent Care Credit or Child Tax Credit. Additionally, you should know about the real potential for expat parents to owe money when filing their 2023 tax returns.

As an expat abroad, you may be asking yourself questions like:

- How much can expats claim using the Additional Child Tax Credit?

- How much can expats deduct using the Child & Dependent Care Credit?

- Will I owe US taxes because of Child Tax Credit advanced payments?

- Will I receive a refund because of the US Child Tax Credit or Child and Dependent Care Credit?

MyExpatTaxes has the answers to these questions and more. To help you gain the maximum tax advantage, we’ve put together our guide to Child Tax Credits for parents abroad.

15 things to know when filing your 2023 taxes

Broken into two main categories:

—first, 8 things expats should know about the Additional Child Tax Credit

—then, 7 things expats should know about the Child and Dependent Care Credit

—plus a bonus a bit of ‘Extra Credit’ for Parents with Children Born or Adopted Children

All in all, there are plenty of tax-saving opportunities for expat families!

8 Things to Know About the Additional Child Tax Credit for Expats Abroad

If you spent more than half of 2023 living outside of the US, pay careful attention when filing your taxes. Not much has changed from the previous year with regard to your US Child Tax Credit; however, you might want to take a different approach as an expat.

Applies to Everyone – in the US and abroad

We want to be sure you are getting the most tax savings you can. To help, we’ve put together this list of the eight most important things to know about the Additional Child Tax Credit.

1. The age for qualifying dependents is the same as last year

In 2024, while filing your 2023 tax return (which includes Child Tax Credit), you can claim children who were under the age of 17 by December 31st, 2024.

2. The refundable amount has increased to $1,600 per qualifying child

If you don’t owe any US taxes or you owe less than you plan to deduct via the Child Tax Credit, you can receive the remaining sum as a tax refund. For expats abroad, you can claim up to $1,600 as a tax refund.

3. The deductible amount of the Child Tax Credits remains the same

As Americans abroad, you can deduct the full amount of the child tax credit, which is $2,000 of non-refundable credit for qualifying children 17 years old or younger in 2024.

4. You can’t claim the refundable portion of the Child Tax Credit if you use the FEIE

You read that right, Expats! If you use the FEIE, or Foreign Earned Income Exclusion, you won’t be eligible to receive any portion of the Child Tax Credit as a refund.

This doesn’t mean you have to be double-taxed, however! You can use the Foreign Tax Credit instead. If you claim the Foreign Tax Credit, you are still eligible for the US Child Tax Credit refund!

Not sure if you should use the FEIE or the Foreign tax credit? Choosing the right tax write-offs and exclusions can be complicated for expats. We build MyExpatTaxes specifically for Americans abroad. It’s created by expats, for expats! We designed it to help you get the max possible deduction or refund!

5. What to do if you were denied or received a reduced amount in previous years for child tax credit?

In the past, maybe the child tax credit didn’t work out for you the way you thought it would. Anything could have happened. We know that it’s frustrating, but this does not mean you should completely stop applying to receive this extra help.

Using Form 8862, MyExpatTaxes can help you to regain your footing and not miss out on that much needed credit! Basically, form 8862 is a one off form to correct past issues and help you receive the correct amount. However, there is one important rule: do not file this form if there’s a mathematical error, this form is for any reason beyond mathematics.

EXPAT TAX TIP: If you think you may owe US taxes in 2024, make sure you file by April 15th! File with MyExpatTaxes early to make sure you stay in good standing with the IRS.

6. Make sure your kids are qualifying children

You can claim your children, foster children, step-children, grandchildren, nieces, nephews, or other related dependents. However, they must meet the following qualifications:

- Have a valid SSN by December 31st, 2023

- Live with you for at least 50% of the year

- Do not provide more than half of their own support

- Are not claimed by anyone else

- Are under 17 on December 31st, 2023

7. What to do if my child doesn’t have their Social Security Number?

Worried your child may not have their Social Security Number in time for the April 15th deadline? We recommend you apply for the SSN as soon as possible. Once it’s in the process, there’s no need to stress because as long as you don’t have any outstanding taxes to be paid to the IRS, you already get a few benefits as an expat. Being an expat, you get an automatic extension until June 15th BUT if that is still not enough time you can file an extension for October 15th and December 15th.

To learn more check out our blog about filing extensions for US expats!

8. Higher earners will see less of the Child Tax Credit

Overall, the total support offered by the Child Tax Credit has increased for most families in 2024. However, there are still limits if you have a high adjusted gross income (AGI).

The total amount of the Child Tax Credit will not phase out below $2,000 UNLESS their income reaches:

- $400,000 for couples who are Married Filing Jointly

- $200,000 for all other filers

If your adjusted gross income is above the highest thresholds, the Child Tax Credit will continue to phase out by $50 for every $1,000 (or partial $1,000) of earned income. The credit will phase out until it eventually reaches zero.

No difference between expat families vs. US families

The total credit amount has increased:

The Child Tax Credit amounts for 2024:

- $2,000 for children under the age of 17

The refundable portion has also increased

Normally, the max portion of the tax credit was only refundable up to $1,600. Additionally, to qualify, you had to have a minimum earned income of $2,500.

Child and Dependent Care Credit

Despite having a similar name to the Child Tax Credit, the Child and Dependent Care Credit is entirely separate. Better yet, if you’re a parent with qualifying dependents, you can claim both. Saving you even more money on your 2023 US income taxes.

Having ‘Care’ in the title gives away the fact that this credit specifically covers costs that parents and guardians spend on care-giving.

7 Things Expats need to know about the Child and Dependent Care Credit

1. It covers money you spend on care

In contrast to the Child Tax Credit, the Child and Dependent Care Credit is intended to reimburse parents for specific expenses related to care.

Types of qualifying care expenses:

- Daycare/Preschool

- Before and after-school care programs

- In-home Care Providers

- Daycamp

2. It’s a reimbursement of up to 50% of care costs

If you have one qualifying dependent, you can claim a maximum of $3,000 in expenses. If you have two or more qualifying dependents, you can claim a maximum of $6,000 in expenses.

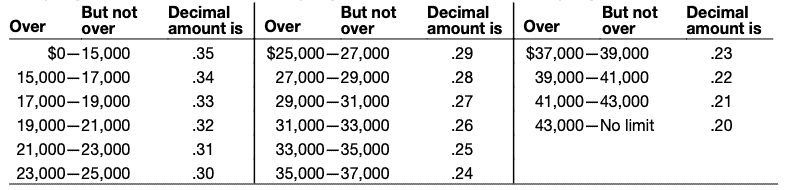

Once you know how much in total expenses you can claim, you need to know what percentage of those expenses you can expect to deduct.

That depends on your income:

3. You cannot be Married Filing Separately

Couples who are Married Filing Separately are not eligible for the Child and Dependent Care Credit. US expats who are married to a non-US Citizen and pay more than 50% of their combined home expenses, can file as Head of Household rather than Married Filing Separately. It is also possible to claim the credit if you are legally separated. Otherwise, you must file as Single or Married Filing Jointly to be eligible.

4. Parents must be working or full-time students

This credit is designed to help families recoup some of the expenses they take on in order to work outside the home. If the couple is Married filing Jointly, both parents must be employed, looking for work, or full-time students.

There is no minimum definition of employment. Working parents can only claim expenses within their earned income. Students are treated as if they make $250 per month with one child or $500 per month with two or more children.

5. Know whose expenses you can claim

Parents and guardians can receive credit for expenses on care for children under 13. Additionally, if a spouse or other adult in the home cannot care for themselves, the credit can also be used to reimburse their care.

6. It’s only no longer refundable.

Yup. You can only claim up to the max as a deduction from your tax bill. You won’t receive any additional amount as a refund back to you though. In tax year 2023, if you lived a majority in the US, you could have actually seen a refund from this credit.

7. Employer-paid expenses must be accounted for

Does your employer offer reimbursement for childcare? If that is the case, you won’t be able to claim that portion of your care costs with the Child and Dependent Care credit. If you could, you’d be receiving reimbursement for that care twice.

Extra Credit – For Parents with Children Born or Adopted in 2024

Pun intended! We know—Dad joke. We just couldn’t help ourselves.

If you welcomed a child in 2024 could be eligible to claim the Child Tax Credit, and The Child and Dependent Care Credit when filing in 2023! That’s a possible additional $1,600 in the bank. So parents, don’t forget to file your taxes to ensure you get these benefits!