Your Guide to Filing Form 1040-NR as a Nonresident Alien

November 22, 2022 | Tax Forms | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated October 27, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated October 27, 2025

If you do business in the United States or earn income from US sources, you may have a tax filing requirement, even if you live outside the United States.

Form 1040-NR is used to report income connected to the United States for individuals who are not US citizens, Green Card holders, or tax residents, known as nonresident aliens. This includes income from US sources such as rental property, investments, or work performed in the US.

This guide explains what Form 1040-NR is, who it applies to, and when it might be required.

Form 1040-NR Fast Facts

- Nonresident aliens file Form 1040-NR to report income earned from US sources.

- The form also lets you claim tax credits, deductions, or treaty benefits that may lower your US tax.

- If you’re not a US citizen or Green Card holder, your tax residency depends on how many days you’ve spent in the US.

Who Does the IRS Consider a Nonresident Alien?

The IRS defines a nonresident alien as anyone who is not a US citizen and not considered a US resident for tax purposes.

You automatically qualify as a US citizen if you were born in the United States, hold a US passport, or became naturalized and received a Certificate of Citizenship.

If you aren’t a US citizen or Green Card holder, the IRS determines your tax residency using the Substantial Presence Test.

The Substantial Presence Test Explained

First, you must determine whether you qualify as a US resident for tax purposes, to know if you should file Form 1040 or Form 1040-NR.

You’re automatically considered a US resident for tax purposes if you’re a US citizen or Green Card holder. If neither applies, the IRS uses the Substantial Presence Test, sometimes called the residency test, to decide your status.

You meet the Substantial Presence Test if you were:

Physically present in the US for at least 31 days during the current year, and a total of 183 days during the current year and the two previous years, calculated as:

- All the days you were present this year,

- One-third of the days of the prior year, and

- One-sixth of the days from two years ago.

If the total equals 183 days or more, you’re considered a US resident for tax purposes and would generally file Form 1040 instead of Form 1040-NR.

Real-World Example

Let’s say you visit the US regularly for work.

- You spent 120 days in the US this year,

- 120 days the previous year, and

- 120 days two years ago.

To see if you meet the Substantial Presence Test, add:

- All 120 days from this year,

- One-third of the 120 days from last year (40 days),

- One-sixth of the 120 days from two years ago (20 days).

Your total is 180 days, less than 183, so you don’t meet the test. You’d be considered a nonresident for tax purposes and would typically file Form 1040-NR instead of Form 1040.

Days That Don’t Count Toward the Test

Some days you spend in the US don’t count toward your total for the Substantial Presence Test. These include:

- Days you can’t leave due to a medical condition that developed while in the US

- Days you were in the US for less than 24 hours while in transit between two foreign destinations

- Days you regularly commute to work in the US from a home in Canada or Mexico

- Days you were an “exempt individual” (teachers, trainees, students, or athletes under F, J, M, or Q visas).

Closer Connection Exception to the Substantial Presence Test

Even if you meet the Substantial Presence Test, you may still be treated as a nonresident under the Closer Connection Exception.

To qualify, you must:

- Be present in the US for fewer than 183 days during the current year

- Maintain a tax home in a foreign country for the entire year

- Have a closer connection to that foreign country than to the US

- Not have taken steps toward obtaining a Green Card or permanent residency

What Qualifies as a Closer Connection?

A closer connection means that your personal, financial, and social ties are stronger to a country outside the United States.

This can include:

- Having your main home and family in another country

- Keeping your bank accounts, business, or employment abroad

- Maintaining social, political, or cultural affiliations in that country

- Holding driver’s licenses, voting rights, or memberships outside the US

In other words, your everyday life, where you live, work, and maintain relationships, shows that your true home is outside the US.

Electing to Be Treated as a US Tax Resident

Nonresidents can choose to be treated as US residents for tax purposes by making a 6013(g) or 6013(h) election. Married couples typically use this option when one spouse is a US citizen or Green Card holder and the other is not.

By making the election, both spouses file a joint return and are taxed as US residents. This approach often simplifies their filing process and makes them eligible for additional credits and deductions.

Form 1040 vs. Form 1040-NR: Resident and Nonresident Tax Returns

When filing US taxes, the form you use depends on your residency status.

Form 1040 is for US residents, who must report all worldwide income and can claim deductions and credits available only to residents.

Form 1040-NR is for nonresidents who need to file a US tax return. They report only US-source income and may claim eligible deductions or treaty benefits to reduce their US tax.

Filing Both Form 1040 and Form 1040-NR

In rare cases, you might need to file both forms in the same year.

This happens when your residency status changes, for example, if you become or stop being a US resident partway through the year.

In that case, you’ll file Form 1040 for the resident period and Form 1040-NR for the nonresident period. This is called dual-status filing.

Who Needs to File Form 1040-NR

If you’re not a US citizen and don’t have a Green Card, you may need to file Form 1040-NR to report income connected to the United States.

You must file Form 1040-NR, US nonresident alien Income Tax Return, if you received income that is subject to US tax, such as wages, tips, dividends, and, in some cases, scholarship or fellowship grants or other US-source income.

You’ll typically need to file Form 1040-NR if:

Effectively Connected Income (ECI):

You earn income through a trade or business in the US, even if a tax treaty exempts it. The IRS classifies this as ECI and taxes it at the same progressive rates that apply to US residents.

Fixed, Determinable, Annual, or Periodic Income (FDAP):

You receive passive income such as dividends, interest, or rental payments. The IRS classifies this as FDAP and generally taxes it at a flat 30% rate, unless a tax treaty lowers it.

Filing Form 1040-NR ensures you correctly report these types of income and can claim any tax treaty benefits or deductions available, which may reduce your overall tax bill or even result in a refund.

Form 1040-NR Schedules Explained

At first glance, Form 1040-NR may look complex, but it’s straightforward once you understand the sections. The form is two pages long, followed by a few optional schedules for specific situations.

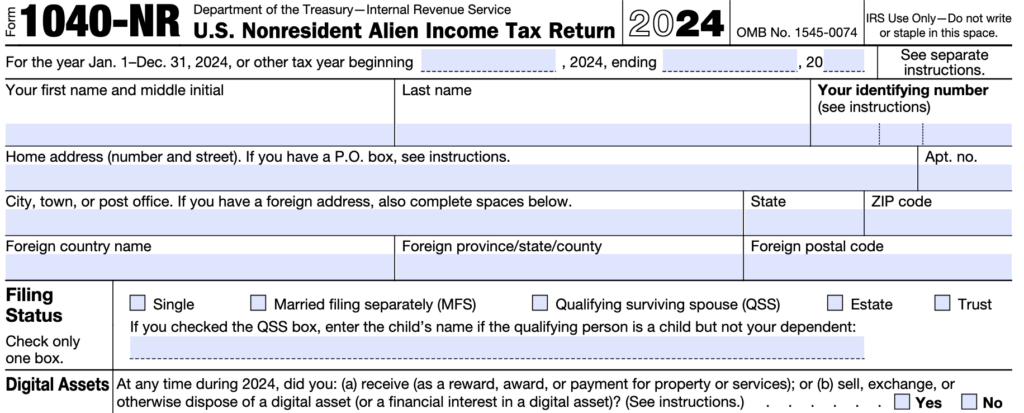

IRS Form 1040-NR – The US Nonresident Income Tax Return (2024 edition)

Here’s what each schedule covers:

- Schedule A: Used for itemized deductions, such as state and local taxes paid or charitable donations made to US organizations.

- Schedule NEC: Reports Not Effectively Connected Income (NEC), passive income not tied to a US trade or business, like dividends, interest, or royalties.

- Schedule OI: Lists other information, including your country of residence, travel dates to the US, and any income that’s exempt under a tax treaty.

Filing may look technical at first, but each section has clear guidance in the official Form 1040-NR Instructions, and most nonresidents only need to fill out a few parts of the form to complete their return.

Tax Withholding

Tax withholding means your employer deducts US income tax from your paycheck and sends it directly to the IRS on your behalf. This helps cover your tax liability throughout the year.

For nonresidents, withholding often applies to wages, investment income, or other US-source payments. However, the amount withheld may not always reflect your exact tax obligation, especially if you qualify for a tax treaty benefit or other adjustment.

You may still need to file Form 1040-NR to verify your withholding, claim eligible deductions or treaty benefits, or request a refund for taxes your employer withheld.

Form 1040-NR is generally due by April 15 if you received wages subject to US income tax withholding, or by June 15 if you did not.

Penalties for Not Filing Form 1040-NR

The IRS imposes penalties and interest when taxpayers don’t file Form 1040-NR as required.

The failure-to-file penalty starts at 5% of the unpaid tax for each month your return is late, up to a maximum of 25%. The IRS charges interest on any unpaid tax and penalties until you pay the balance in full.

Failing to file can cause problems later, such as losing eligibility to claim a refund or tax treaty benefits, even if you don’t owe tax.

Filing Form 1040-NR is Easy with MyExpatTaxes!

Filing US taxes as a nonresident can feel overwhelming, but it doesn’t have to be. Our team of experienced expat Tax Professionals makes the process simple and stress-free.

Whether you need help filing Form 1040-NR, claiming tax treaty benefits, or catching up on past filings, we’ll guide you through every step.

Let us handle the paperwork so you can focus on what matters most. Get started today and file your Form 1040-NR with confidence.

Frequently Asked Questions

Content of the Accordion Panel

Yes. If you earned income from US sources, such as wages, investments, or rental property, you may need to file a federal tax return, usually Form 1040-NR.

Content of the Accordion Panel

Income earned while physically in the US or tied to US-based assets counts. This includes wages, freelance work done in the US, rental income, and some investment earnings.

Content of the Accordion Panel

Most nonresidents file Form 1040-NR, which is specifically designed for tax purposes for individuals who are not US residents.

Content of the Accordion Panel

Possibly. You may also need to file a state tax return if you earned money in a state with an income tax.

Content of the Accordion Panel

Working with expat tax professionals like MyExpatTaxes ensures your filing is accurate, stress-free, and compliant with IRS rules, even if you’re living abroad or temporarily in the US.

Content of the Accordion Panel

Form 1040 is used by US citizens and resident aliens to report worldwide income. In contrast, Form 1040-NR is used by nonresident aliens to report only their US-sourced income, that is, money earned in or from the US.

- Form 1040 is for residents and citizens and reports global income. Form 1040-NR is for nonresidents reporting only US income.

Content of the Accordion Panel

Yes, if your home country has a tax treaty with the US. These treaties can reduce or eliminate taxes on certain types of income. You must include Form 8833 with your Form 1040-NR to claim a treaty benefit.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

November 22, 2022 | Tax Forms | 6 minute read