Schedule K-1s for US Expats: Partnerships, S Corps, and Trusts

October 17, 2025 | Tax Forms | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated

If you have a partnership interest, are a shareholder in an S corporation, or are a trust or estate beneficiary, you’ll likely receive a Schedule K-1 each year.

Even if you live abroad, income from these entities remains taxable by the IRS, and it may also be taxable in your country of residence, depending on local tax rules.

Understanding how to report this “pass-through” income correctly is essential for US expats to avoid double taxation and stay compliant with US and foreign tax laws.

This guide explains what a Schedule K-1 is, how to read it, and how to report it on Form 1040 while managing it alongside your US expat tax obligations.

Quick K-1 Facts for US Expats

- Who receives one: Partners, S corp shareholders, or trust/estate beneficiaries.

- Why it matters: Reports your share of “pass-through” income, deductions, credits, and other items that must be included on your US tax return, even if you didn’t receive any payments or distributions.

- Typical send date: Usually by March 15, though many entities extend and issue K-1s later.

- If you have foreign business or trust interests: K-1s are issued only by US entities. If you have an interest in a foreign partnership, corporation, or trust, you must report that interest and related income using Forms 8865, 5471, or 3520, respectively.

- MyExpatTaxes coverage: The Reviewed Plan supports up to 3 K-1s, and the Premium Plan supports up to 6 K-1s.

What Is a Schedule K-1?

A Schedule K-1 is a federal tax form that reports your share of income, deductions, credits, and other tax details from certain pass-through entities. These entities don’t pay income tax themselves; instead, they “pass through” the responsibility of reporting and paying taxes to the individuals who own or benefit from them.

Three main types of entities issue a Schedule K-1:

- Partnerships (Form 1065): Partnerships file an informational return with the IRS and provide each partner with a Schedule K-1 showing their share of the partnership’s income, deductions, and credits.

- S Corporations (Form 1120-S): S corporations pass income, losses, and other tax items through to shareholders, who must report those amounts on their personal tax returns.

- Trusts and Estates (Form 1041): Trusts and estates issue K-1s to beneficiaries, outlining the income and deductions allocated or distributed to them.

Each K-1 is prepared and filed with the IRS by the entity, and a copy is sent to you. You’ll use the information it contains to complete your Form 1040 and related schedules when filing your individual US tax return.

Summary of Schedule K-1 Issuers and Recipients:

| Type of Entity | Who Receives the K-1 | What That Means |

|---|---|---|

| Partnership or LLC taxed as a partnership – Form 1065 | Each partner or member | Reports the partnership’s income, deductions, and credits. The entity itself doesn’t pay income tax — instead, it issues Schedule K-1s to each partner. |

| S corporation – Form 1120-S | Each shareholder | Reports the S corp’s total income and deductions. Like a partnership, the S corp passes income through to shareholders on K-1s. |

| Trust or estate – Form 1041 | Each beneficiary | Reports income earned by the trust or estate. Beneficiaries receive K-1s showing their share of income or distributions. |

How to Read Your Schedule K-1

Each Schedule K-1 differs slightly depending on whether it comes from a partnership, S corporation, trust, or estate, but they all include the same key sections. Here’s what to look for when reviewing yours:

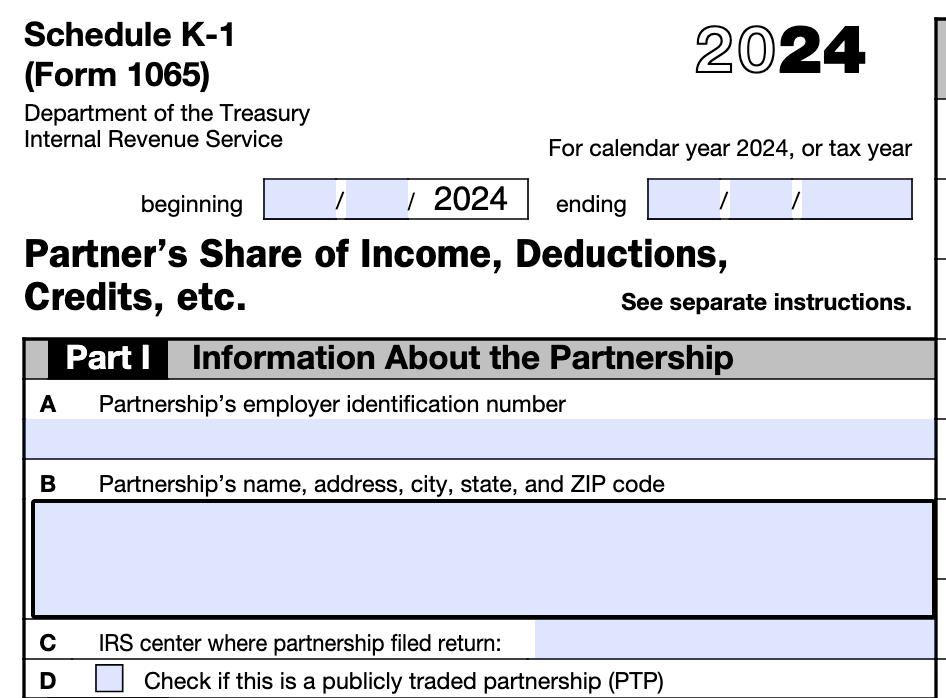

Part I – Entity Information

Lists details about the partnership, S corporation, or trust that issued the K-1, including its name, address, and Employer Identification Number (EIN). Check this section to confirm which entity the form relates to and that all details are accurate.

RS Schedule K-1 (Form 1065) – Part I

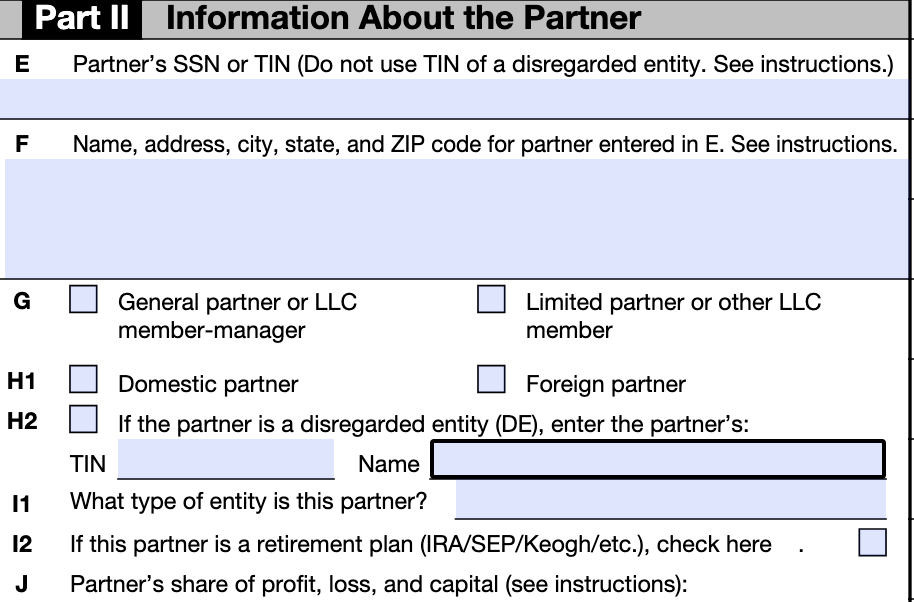

Part II – Partner, Shareholder, or Beneficiary Information

Confirms your personal details, such as your name, address, and taxpayer identification number (SSN or EIN). Make sure this information matches your own records to avoid filing issues.

IRS Schedule K-1 (Form 1065) – Part II

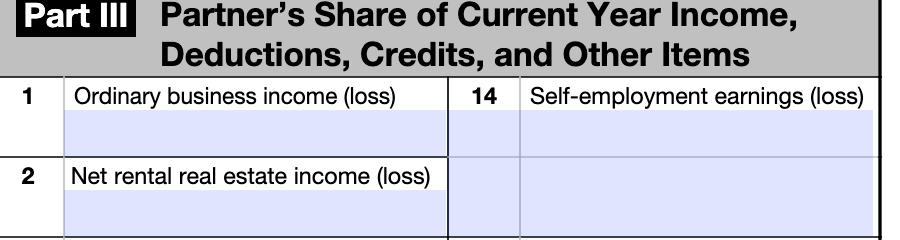

Part III – Share of Income, Deductions, and Credits

This section shows your share of the entity’s income or loss, including items like ordinary business income, rental income, dividends, capital gains, or foreign taxes paid. You’ll use these amounts when completing your personal tax return.

IRS Schedule K-1 (Form 1065) – Part III

Income Items

Your K-1 breaks down various types of income allocated to you. The boxes and labels differ slightly depending on the form:

For Partnerships or S Corporations (Forms 1065 and 1120-S):

- Box 1: Ordinary business income or loss

- Box 2: Net rental real estate income or loss

- Box 3: Other net rental income or loss

For Trusts or Estates (Form 1041):

- Box 1: Interest income

- Box 2a: Ordinary dividends

- Box 3: Short-term capital gains

These amounts represent your share of the entity’s income, even if you didn’t receive distributions during the year.

Deductions and Credits

K-1s also report deductions and tax credits passed through to you. Common items include:

- Box 12: Section 179 expense deductions

- Box 13: Other deductions (charitable contributions, health insurance, etc.)

- Box 15: Credits (e.g., low-income housing or foreign tax credits)

You’ll use these figures to claim deductions or credits directly on your Form 1040.

Self-Employment

If your K-1 comes from a business you help run or manage, part of that income may count toward self-employment tax. This is often reported in Box 14 on your form.

- Box 14: Self-employment earnings (or loss)

Note: The Schedule K-1 form looks slightly different depending on the type of entity. Partnerships (Form 1065) issue the most common version, showing business and self-employment income. S corporations (Form 1120-S) and trusts or estates (Form 1041) use slightly different layouts, but all serve the same purpose — reporting your share of income, deductions, and credits to both you and the IRS.

How to Use a Schedule K-1 When Filing Your Tax Return

Once you receive your Schedule K-1, use the information it provides to transfer each item to the correct schedule when completing your Form 1040. The entity that issued the K-1 files it directly with the IRS, so you don’t need to submit it yourself; just be sure to keep your K-1 with your tax records.

Different types of income from your K-1 appear on different schedules:

- Ordinary business income or loss → Schedule E, Part II (for partnerships and S corporations)

- Rental income or loss → Schedule E (for partnerships, S corporations, or trusts holding rental property)

- Interest and dividends → Schedule B (common for trusts and estates; may also appear for partnerships with investments)

- Capital gains or losses → Schedule D (applies to all entity types if they distribute capital gains)

- Credits and deductions → relevant line on Form 1040 or Schedule 3, Part I (e.g., credits from partnership Box 15 or trust Box 13)

- Self-employment income → Schedule SE (typically for active partners or LLC members; not for S corp shareholders or passive investors)

You’re Taxed on Allocated Income, Not Just Distributions

Even if you didn’t actually receive a distribution, the income shown on your K-1 is usually still taxable and must be reported.

Additional Considerations

Don’t double-count: Some income, such as qualified dividends or long-term capital gains, may appear on both a Form 1099 and a Schedule K-1. If you believe the same income has been reported twice, contact your financial institution for a corrected form. It should only be reported on either the 1099 or the K-1, not both.

Passive vs. active income: If you don’t materially participate in the business (i.e., you’re not actively involved in its operations on a regular, continuous, and substantial basis), your income or loss may be treated as passive, which limits how much you can deduct in the current year.

Understanding Your Partnership Basis

Your basis in a partnership (or S corporation) represents your investment or ownership stake in the business. It starts with what you’ve contributed, cash, property, or equipment, and changes over time as income, losses, and distributions are allocated to you.

- Increases: capital contributions and your share of income

- Decreases: withdrawals and your share of losses

Example: Suppose you contribute $40,000 in cash and $20,000 in equipment, and your share of income for the year is $8,000. Your basis would increase to $68,000, minus any withdrawals you’ve taken.

You can find your basis details in the “Partner’s Capital Account Analysis” section of your Schedule K-1. See the official IRS instructions for Schedule K-1 (Form 1065)

When Should I Receive My Schedule K-1?

Schedule K-1s are often issued later than most other tax forms because partnerships, S corporations, and trusts must first finalize their own returns.

They’re generally due by March 15, but many entities file for an extension, meaning it’s common for K-1s to arrive well into the summer, or even by September.

If your K-1 hasn’t arrived close to your filing deadline, you can request an extension using Form 4868, giving you until October 15 to file your return accurately.

How to Report Income from Foreign Entities

If you own part of a foreign company, you typically won’t receive a Schedule K-1, because K-1s are only issued by entities that file US tax returns (like US partnerships, S corporations, or trusts).

Instead, US expats who own shares in foreign businesses must report their ownership and income using other IRS forms:

- Form 8865 – for interests in foreign partnerships

- Form 5471 – for ownership in foreign corporations

- Form 3520 / 3520-A – for foreign trusts

These forms serve a similar purpose to a K-1: they report your share of the entity’s income and activity to the IRS. The key difference is that you file these yourself, since foreign entities don’t send them automatically.

Common Expat Scenarios Involving K-1s

Here are a few common scenarios where US citizens living abroad might receive a Schedule K-1.

1. Co-owning Property Through a US LLC

Emma, a US expat living in Spain, co-owns a rental property through a US LLC taxed as a partnership. Each year, she receives a Schedule K-1 showing her share of rental income and expenses. Emma must report this income on her US tax return, and it may also be taxable in Spain under local residency rules.

2. Owning a Share in a US Partnership or S Corporation

David lives in Germany and owns a share in a US partnership. Each year, he receives a Schedule K-1 reporting his share of the business’s income, even if he doesn’t take any distributions. This income must still be included on his US tax return.

3. Trust Beneficiary Living Abroad

Sophia, who now lives in Portugal, is a beneficiary of a US trust. Each year, she receives a K-1 (Form 1041) reporting her share of dividends and capital gains. This income remains taxable in the US and may also be reportable in Portugal, depending on her residency status and the terms of the US-Portugal tax treaty.

Reporting Foreign Accounts Linked to Your US Entity

If your partnership, S corporation, or trust holds money in foreign accounts and you have signing authority or a financial interest, you may need to report those accounts personally.

- FBAR (FinCEN Form 114) is required if the total value of your foreign accounts combined exceeds $10,000 at any time during the year.

- FATCA (Form 8938) is required if your foreign financial assets exceed IRS thresholds, which vary by filing status and residency.

Avoiding Double Taxation

As a US expat, your country of residence may also tax this income, even if it’s from a US source, since many countries tax residents on their worldwide income. Your K-1 income remains taxable by the IRS, but the Foreign Tax Credit (Form 1116) or a tax treaty may help prevent double taxation.

The Bottom Line

Schedule K-1 can feel complex at first, but it’s simply how the IRS tracks your share of income, deductions, and credits from a partnership, S corporation, or trust. Reviewing it carefully ensures you report everything correctly on your US tax return, even while living abroad.

Let MyExpatTaxes Help

If you’re unsure how to report your K-1 or how it fits with your expat filing, MyExpatTaxes can help you get it right. Our software guides you step-by-step in applying your K-1 information to your Form 1040 and claiming valuable tax benefits like the Foreign Tax Credit to offset any foreign taxes paid on your K-1 income.

FBAR and FATCA reporting are included in both our Reviewed Plan (which supports up to 3 K-1s) and Premium Plan (up to 6 K-1s), with no extra forms or hidden fees. So you can file your complete expat tax return quickly, accurately, and confidently. Get started today!

Frequently Asked Questions

Content of the Accordion Panel

No, you don’t file the K-1 yourself. The entity (partnership, S corp, or trust) files it with the IRS and sends you a copy. However, you are required to report the income shown on the K-1 on your US tax return, even while living abroad.

Content of the Accordion Panel

Yes. You are taxed on your allocated share of income, not just on income you physically received. The IRS considers this pass-through income taxable, and it must be reported regardless of whether a distribution occurred.

Content of the Accordion Panel

K-1s are typically sent by March 15, but many entities file extensions, meaning you may not receive yours until August or September. If it’s delayed, consider filing for an extension (Form 4868) to avoid late penalties. The Extension gives you until October 15 to file.

Content of the Accordion Panel

You can claim a Foreign Tax Credit on your US tax return for the foreign taxes paid on that same income. This credit helps avoid double taxation by reducing your US tax liability dollar-for-dollar based on the taxes you paid abroad.

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 17, 2025 | Tax Forms | 4 minute read