US Expat Stimulus Check Survey Results

May 28, 2020 | Stimulus Checks | 4 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 24, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 24, 2025

Do us expats get stimulus check? When the United States government passed the stimulus check law in late March, it was off to the races for US taxpayers to receive their funds.

MyExpatTaxes, the leading US Expat Tax Software, wondered how successful Americans Abroad were in actually receiving this promised aide? They sent out a survey in mid-May, and hundreds of US expats shared their feedback to give you a quick snapshot of what is really happening outside the 50 states.

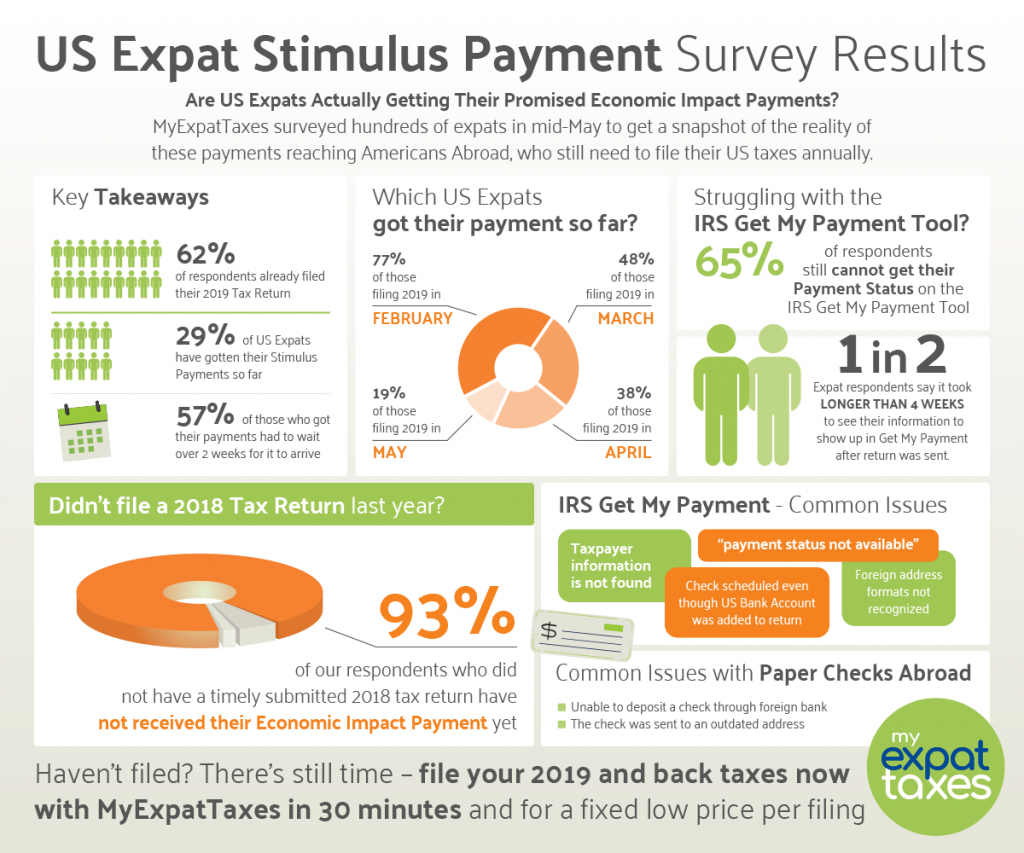

Key Takeaways from Survey Participants

- 62% already filed their 2019 tax return.

- 29% have received their stimulus payments

- 57% of those who received their stimulus payment reported that it took more than two weeks after filing their 2019 tax return to get it, with the majority stating it took at least four weeks or longer.

Are US Expats Actually Receiving Their Stimulus Payments from the IRS?

- Less than one-third of US expats received their stimulus check to date (29%).

- The results are even grimmer for Americans Abroad who are not filing their annual tax returns timely every year. 93% of US expats that did not already have a 2018 tax return on file are still waiting for their financial assistance fund.

US Expats Who Filed 2019 US Taxes Between February and May

Here are the current survey results regarding Americans abroad filing between the months of February and May. Plus, whether they received their US expat stimulus check or not:

- US Expats who filed in February: 77% of US expat respondents who filed in this period already received their stimulus payment.

- US Expats who filed in March: 48% of US expat respondents who filed in this period already received their stimulus payment.

- US Expats who filed in April: Only 38% of US expat respondents who filed in this period already received their stimulus payment.

- US Expats who filed in May: A mere 19% who filed in the first two weeks of May already received their stimulus payment.

Stimulus Check Issues for Expats

Still, checking the IRS Get My Payment to find your scheduled payment date? Join the majority of 65% of US expats who have yet to see their information available in the IRS tool. Here is more feedback from stimulus check process:

Top Concerns from US Expats Using IRS Get My Payment Portal:

- Seeing ”payment status not available’’ after putting in personal information.

- Missing options to input correct data (ie: foreign address, bank account details).

- The portal was not accepting foreign addresses due to different foreign zip codes and lettering (ie: ö, ä).

- Receiving the payment via direct deposit or paper check without being able to confirm their payment details on the IRS portal.

Top Concerns from US Expats Regarding Their Stimulus Check:

- Unable to deposit the check through a foreign bank account

- The check was sent to an address from the 2018 tax return, and not the recipient’s current address.

- The IRS says the check was sent but the recipient didn’t receive it

- Recipients are unsure of what to do having a check with no US bank account

Additionally, others were claimed accidentally as a dependent and thus couldn’t receive the check.

Eligibility for US Stimulus Checks

The United States government continues to issue stimulus checks (Economic Impact Payments) to US citizens and Green card holders during the pandemic.

They are payments of $1,200 or more and are only for individuals that fall within a certain monetary threshold:

U.S. residents will receive the Economic Impact Payment of $1,200 for individual or head of household filers, and $2,400 for married filing jointly if they are not a dependent of another taxpayer and have an eligible Social Security number with adjusted gross income up to:

$75,000 for individuals, $112,500 for head of household filers and $150,000 for married couples filing joint returns.

Taxpayers will receive a reduced payment if their AGI is over $75,000.

The amount of the reduced payment will be based upon the taxpayers specific adjusted gross income.

IRS.gov

Additionally, American family members qualify to receive an additional $500 per qualifying child. This is an extra bonus that can help during these trying times.

Additional Information To Be Eligible:

From our blog, Stimulus Payments for US Expats:

- You need a 2018/2019 tax return on file for the IRS to know your eligibility and where to deliver the funds (US bank or mailing address for paper checks).

- If your worldwide income was under the filing threshold and you didn’t file, you will still need to file a tax return. This is so the IRS has your information for the payments.

- Eligibility to receive the $1,200+ payments depend on your income and if you had a valid US social security number in time.

Social Security recipients who are not typically required to file a tax return do not need to take any action. They will receive their 1200 dollar checks directly to their bank account by paper check. Just as they would normally receive their benefits.

Get Your IRS Stimulus Payment ASAP

The deadline to file US taxes for this year is July 15th, 2020. If you as a US citizen abroad or green card holder and need to catch up on back taxes, make sure to take advantage of the Streamlining Foreign Compliance Procedure outlined here.

E-file your 2019 taxes with MyExpatTaxes! Add your foreign address or US bank details to your return to ensure you get the $1,200 Stimulus Payment you are entitled to.

Need to file for an extension? You can do so for free via our expat tax software. Just sign in, give us consent to file on your behalf, and then fill in the appropriate information. It’s that easy!

Filing taxes for stimulus check is the way to go. We are the most efficient and affordable expat tax software. We will make sure you as an American expat file quickly to receive your stimulus check.

Ready to get started?

See Why US Expats From Around the World Love Us!

Easily file regardless of how complex your US expat tax situation is.

Been here before? Sign in!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

May 28, 2020 | Stimulus Checks | 4 minute read