Filing US Taxes in Argentina – A Guide for Expats

October 10, 2024 | Country Guides | 7 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 20, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 20, 2025

Argentina is the home country of famous football player Messi and the birthplace of the Tango. As an American living in Argentina, you have picked a place full of beautiful landscapes and rich history. Besides catching a soccer game or learning to tango, have you thought about the responsibilities that follow you as a US citizen? Yes, it’s time to talk about filing your US taxes from Argentina.

What are the First Steps to Filing US Taxes in Argentina?

The first step in filing is always determining whether or not you need to file. To start, you need to determine if you’re making over the tax threshold. Your threshold status could exempt you from filing just because you do not meet the minimum amount requirement.

What is a US Tax Threshold?

A tax threshold is the amount of money you’ll need to exceed before you have an obligation to file US taxes. Certain amounts vary depending on your marital status or your overall finances for a household.

- Single: You are legally unmarried

- Married Filing Jointly: You’re married and filing together

- Married Filing Separately: You’re married but deciding to file separately

- Head of Household: You’re the sole provider for your household, paying more than paying more than half of all expenses during the year.

- Qualifying Widower: You receive two years of married filing jointly status after your spouse has passed, but only if you have a dependent child.

Tax Resident Argentina

The odds are that if you’re living in Argentina, you’re already a tax resident, but let’s go more into specifics. By Argentinian law, any person who has been in Argentina for more than 183 days (around half a year) is considered a tax resident. Therefore, you will likely have to file an Argentinian tax return on not only Argentinian income but worldwide income as well.

However, if you have not been in the country for longer than 183 days, technically, you are not considered a resident, and only your Argentinian-sourced income can be taxed.

Income Tax Rates in Argentina

Argentina is one of those countries with a progressive income tax system. This means your income will determine where you fit in the tax bracket. There are nine different categories, with tax percentages ranging from 5% to 35%.

Did you know there is a special tax percentage for temporary foreign workers in Argentina? Yes, there is a base rate of 24.5% just in income taxes; other taxes could be applied. So, if you’re working in Argentina for less than six months temporarily, your income taxes are special.

Fun fact: you do not need to manually file your taxes because it is up to your Argentinian employer to file your Argentinian Taxes! If you have other income sources though, you may need to check your tax return filing requirements.

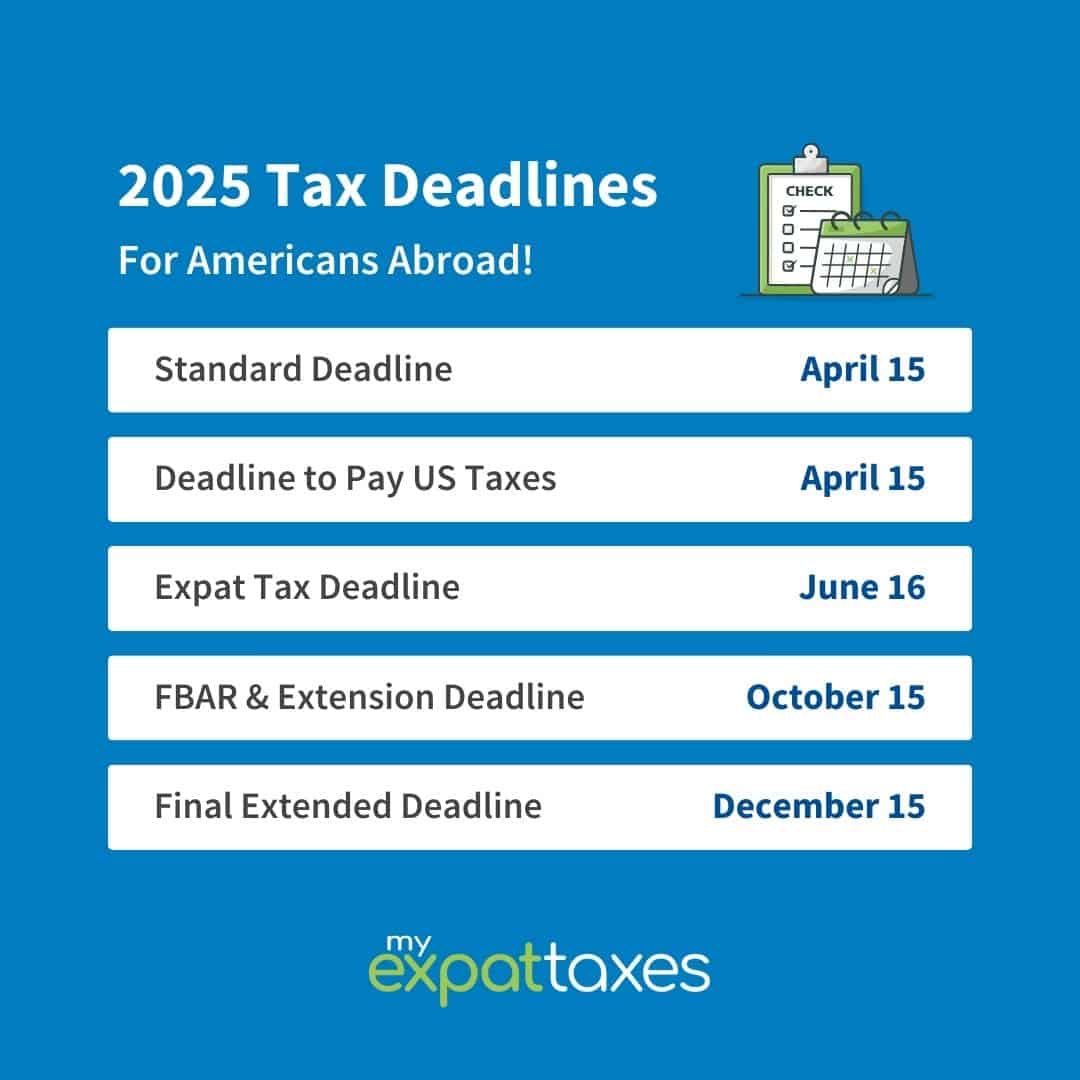

US Tax Deadlines

Most Americans are familiar with the April 15 deadline, but did you know that as an expat living abroad, you have four deadlines you should know about? Not all of them are useful, but it’s good to know you have some great filing options!

As these deadlines are just for filing your tax returns, you need to be aware of the FBAR deadlines as well. There are only two, but make an extra note for April 15 (suggested date) and October 15 (automatic extension). The general advice is to file all tax-related documentation before April 15, but know that there is extra time for expats!

No US-Argentina Tax Treaty

The purpose of a tax treaty is to ensure people are not taxed twice on the same income. Therefore, Argentina’s lack of a US tax treaty means that there is the potential for double taxation. However, Argentina is not the only country without a US tax treaty, so there are credits and exclusions that can lessen the potential for double taxation.

Foreign Tax Credit

Introducing the Foreign Tax Credit (FTC), the first benefit that can be used to replace the tax treaty. The FTC could be your best friend in Argentina as it’s used to offset or reduce your US tax liability by the amount of income tax paid to a foreign government on foreign-sourced income. You can claim foreign tax credits on foreign income without a treaty in place, the issue will only arise if you need to claim foreign tax credits on US sourced income.

If you plan to attempt this mathematical equation, you’ll need to file Form 1116. Just keep in mind that if you plan on doing this yourself, you cannot include any US-sourced income. However, when it comes to this lovely part of filing US taxes, MyExpatTaxes (MET) recommends filing using the MET software.

Foreign Earned Income Exclusion

The second benefit to potentially avoid double taxation is the Foreign Earned Income Exclusion (FEIE). The FEIE is so much easier for the average person to claim as it allows you to exclude over $100,000 of foreign earned income from your tax return. Be aware that it’s only on earned income such as wages, salaries, bonuses, etc.; you cannot claim this on passive income like dividends or rental income.

Another aspect to consider is whether or not you qualify. Using the physical presence test or the bona fide residence test, you can determine if you are eligible to claim this tax exclusion.

Additional Forms: Form 8938 and FBAR

If you have not been introduced to Form 8938 or the FBAR (foreign bank account report), this is your intro. These forms are incredibly important for someone living abroad – even in Argentina. Overall, Form 8939 and the FBAR look very similar in purpose; however, one will go to the IRS, and the other will go to FinCEN (Financial Crimes Enforcement Network).

Form 8939 is attached to your normal tax return to the IRS, but it’s for any foreign assets over $200,000 for single people and $400,000 for married couples.

When it comes to the FBAR, it’s mandatory to report any foreign financial accounts over $10,000 to FinCEN, not the IRS.

Foreign assets and financial accounts are basically one in the same for both forms.

Self-Employment

Look at you, entrepreneur or planning on being an entrepreneur in Argentina! You understand just how much work goes into building your business, especially as a US expat. However, for those who do not know yet, here is what the people at MyExpatTaxes have gathered about owning a business in Argentina as a US expat.

Starting a business in Argentina

If you are more on the planning side of things, you’ve made a good choice. Argentina has 45 million people and a growing middle class, which provides a strong consumer base. When you want to hire a workforce, the people have an excellent education, plus with labor costs, it’s less expensive. There are many other aspects that can be discussed, like how strategic it could be to enter other markets in, say, Brazil or how the government is offering programs to support entrepreneurs.

To not mislead you, Argentina does have economic instability, so although it has an opportunity to succeed, it’s also a risk.

Self-employment from the US tax side

Being self-employed in Argentina has many aspects in regards to US taxes, but here is a short list of some of the basics

- If you’re self-employed, earning over Default String, you need to file US taxes.

- You’ll need to become familiar with Form 5471 or Form 8865 if you start a limited liability company or partnership there

- Double taxation is entirely possible with no tax treaty between the US and Argentina

Self-employment Basics for Argentina

- Monotributio System: this is a simplified tax and social regime for small businesses and self-employed individuals in Argentina. It helps to meet tax obligations and minimize administrative burdens.

- Social Security Contribution: You must make monthly contributions to Argentina’s Social Security system, which includes retirement, healthcare, and other social benefits.

- Business Registration: Self-employed individuals must register with the Federal Administration of Public Revenues (AFIP) to obtain a tax identification number (CUIT) and enroll in the Monotributo system.

Are you an Accidental American?

If you have a parent who is a US citizen, meaning you have the right to a US passport, even if you have lived in another country your entire life, you likely fall into the category of an Accidental American. Unfortunately, you could have to file US taxes because of your lovely parent. However, you can also claim tax benefits like the FEIE or the FTC so don’t fear.

However, if you just found out you needed to file and did not know, you can use the Streamlined Procedure to help settle your US taxes. Just keep reading to learn more about this procedure!

Haven’t filed yet?

Have you found yourself in a sticky situation after not knowing that you needed to file US taxes from abroad? Luckily for you, back in 2012, a procedure known as the Streamlined Procedure was introduced to allow people to catch up on their US taxes from abroad—PENALTY FREE.

No matter how many years it’s been since you last filed US taxes, you will only have to file for the last three years plus the current year. You also have to file your past FBARs, but there is a maximum of 6. With the Streamlined Procedure, you can stop worrying about getting in trouble with the IRS or FinCEN. However, if the IRS is in direct contact with you regarding your US taxes by the IRS, you cannot use this procedure. Therefore, if you have not yet, this is a good year to start.

The streamlined procedure has more benefits than what you know. You can apply to receive all prior Stimulus Checks and any Child Tax Credits you have not claimed.

Property in Argentina

When it comes to purchasing property in a foreign country, it can be super tricky! However, if you’re looking in Argentina, foreigners like yourself have very few restrictions. You don’t even need to be a resident to own property in Argentina, but it is simply the process. You do, however, need to get yourself a tax identification number (or, in other words, a CUIL or CUIT) from the Argentine Tax Authority.

Pros of Purchasing

- Way lower prices than in the US

- Both urban and rural properties are widely available

- Property rights are the same as an Argentinian

- Larger homes

Cons of Purchasing

- Currency fluctuation and Inflation have an effect on property value

- Legal procedures can be difficult to navigate

- The real estate market is not completely transparent

Retiring in Argentina

Are you thinking about retiring to Argentina? It’s a great time to practice your Spanish, meet with some fellow expats and overall, just enjoy the beautiful Argentinian culture. However, even as a retiree, you still need to remember to keep up with US taxes if you meet the threshold. Also, keep in mind that Argentina requires you to have a special visa called the Pensionado Visa. Otherwise, you can enjoy free public healthcare and affordable housing for as long as you want!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

October 10, 2024 | Country Guides | 7 minute read