Filing US Taxes Abroad in 2025

November 8, 2024 | Expat Tax Deadlines, Featured | 6 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated January 22, 2025

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated January 22, 2025

Happy New Year, expats! It’s 2025, another year of living abroad, and MyExpatTaxes is thrilled to be your trusted tax source for what’s new! Whether you want to claim the Child Tax Credit, maximize your tax benefits, or simply learn the US tax deadlines, we have you covered. Let this article be the beginning of your filing journey in 2025.

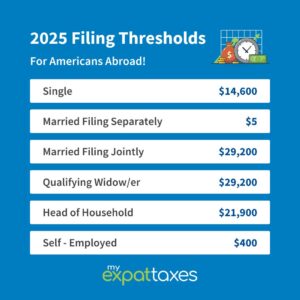

Updated Filing Thresholds

Expat Tax Deadlines for 2025

You may know that US citizens get an automatic two-month extension when filing their taxes abroad, but did you know you still have to pay any taxes owed by April 15th? That’s why being aware of all tax deadlines is so important.

| Automatic Extension for Expats | June 16th, 2025 |

| Extended Deadline for Expats Filing Form 4868 (by June 15th) | October 15th, 2025 |

| FBAR Deadline for Expats | October 15th, 2025 |

| Deadline for Special Cases | December 15th, 2025 |

Additional Child Tax Credit Updates

The Child Tax Credit has a refundable portion (also known as the Additional Child Tax Credit), which has increased to $1,700. To qualify, your child must be:

- Under the age of 17 before December 31st, 2024,

- Have a valid Social Security Number

- Live with their parent for more than half a year

- You must financially support over half the child’s needs

Additionally, you must not owe US taxes if you want to receive this credit as a refund.

Child and Dependent Care Credit Updates

Another way to save money on your taxes this year is via the Child and Dependent Care Credit. This credit is specifically for families who pay for care or services in order to go to work. The credit pays you back, at least in part, for money spent on childcare or dependent-related care.

In 2024, the Child and Dependent Care Credit is a maximum of $3,000 for one qualifying dependent or $6,000 for two or more dependents. With that, the highest credit percentage is 35% for employment-related expenses in 2025. However, if your gross income is over $43,000, the rate is only 20%.

Claiming the Child and Dependent Care Credit in 2025?

The IRS defines a qualifying dependent as a child who was under the age of 13 in 2024, a spouse who cannot take care of themselves, or another dependent or person who cannot care for themselves and lives with you for more than six months out of the year.

Foreign Earned Income Exclusion Updates

In 2025, US expats can exclude up to $126,500 of foreign earned income when using the Foreign Earned Income Exclusion (FEIE). Like in prior years, the FEIE does not apply to all foreign income, such as investments; it can only apply to foreign earned income.

Additionally, the FEIE can eliminate all your earned income while making you ineligible for the Additional Child Tax Credit. Therefore, before using the FEIE, US expats may want to consider whether the Foreign Tax Credit is a better option. Both are good ways to reduce your US tax burden. However, one may be better than the other, depending on your exact circumstances.

MyExpatTaxes specializes in expat tax problems. We offer the only expat tax software that automatically optimizes your return and applies for the best expat tax benefit.

Foreign Housing Exclusion Updates

With the FEIE increased for tax year 2024, so has the Foreign Housing Exclusion. This exclusion only accounts for 16% of the FEIE, but expats can exclude up to $20,240 of housing expenses depending on their location and total housing costs.

The Foreign Housing Exclusion excludes qualifying expenses such as rent, utilities, and other housing costs from your US tax liability. However, the exclusion does not count towards mortgage or labor costs.

Retirement Accounts

The contribution limit for expats contributing to Individual Retirement Accounts (IRAs) has increased to $7,000. For those who are contributing and over the age of 50, the amount has increased to $8,000.

If you’re unsure about how to go about investing, get professional advice from Tax Professionals at MyExpatTaxes. Let us help you!

Let MyExpatTaxes Simplify Your US Tax Filing

US taxes are another added responsibility for expats, but that does not mean it must be daunting. There is much to learn about taxes as a US expat, but the more you file, the easier it gets! So, with that being said, file your US taxes with MyExpatTaxes today!

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

November 8, 2024 | Expat Tax Deadlines, Featured | 6 minute read