20 Things to Know About US Expat Taxes in 2025

January 3, 2024 | Featured | 12 minute read

Expat Tax Blog. Tax Tips for US Americans abroad.

Updated December 27, 2024

All blogs are verified by Enrolled Agents and CPAs

All blogs are verified by Enrolled Agents and CPAs

Updated December 27, 2024

Hold on to your hats expats! We’ve got 20 things to know about US expat taxes in 2025? From tax requirements to treaties, child benefits, and more – it’s that time of year to break open your income slips and bank statements! The IRS has officially opened up tax season 2024, and we have everything you need to know to prepare for it.

Here are 20 things expats need to know about US taxes in 2025:

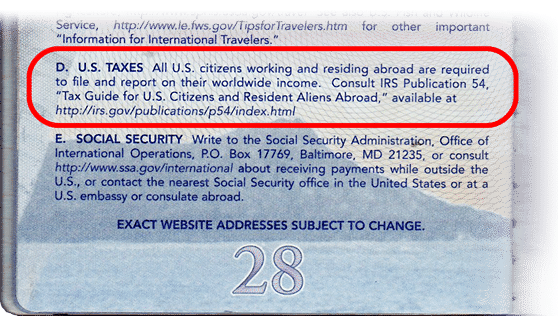

1. Your tax filing obligation starts with your US Passport

If you take a look inside your US passport, you’re going to see a blurb about US taxes.

“All US citizens working and residing abroad are required to file and report on their worldwide income. Consult IRS Publication 54, “Tax Guide for US Citizens and Resident Aliens Abroad.”

IRS

This US passport line may have been something you didn’t know while living abroad as an American. While it may be a shock to some, filing and reporting worldwide income to the IRS is only a necessity if you reach the tax filing requirement (see number 4 below).

2. Expats most likely don’t owe US taxes

One of the most common questions we receive is, “Do expats have to pay US taxes?”

You may be relieved that many expats usually don’t owe taxes to the IRS when living abroad. This reason comes down to a few tax benefits and exclusions that prevent Americans from double taxation on foreign income and owing unnecessary fees.

Some of these mechanisms are:

- The Foreign Earned Income Exclusion (FEIE)

- The Foreign Housing Exclusion

- The Foreign Tax Credit (FTC)

- Tax Treaty Benefits

- The Child Tax Credit and Additional Child Tax Credit

Generally, US expats can offset foreign earned income with the above exclusions and credits. We’ll share more on each of those below.

However, if you do owe tax because your worldwide gross income is more than what the tax exclusions and credits can cover, you’ll need to pay your taxes by April 15th, 2025. If you don’t pay your taxes by then, interest will be charged daily until you settle your IRS bill.

3. You only need to file a US tax return if you meet the requirements

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationThe 2025 tax filing requirements for Americans abroad depend on your filing status and worldwide gross income from the 2024 tax year. Therefore, you must file a US tax return for tax season 2024 (in 2025) if your gross income from worldwide sources is at least the amount shown in the following table for people under 65 years old:

| Filing Status: | 2025 Worldwide gross income amount: |

| Single | $14,600 |

| Married Filing Jointly | $29,200 |

| Married Filing Separately* | $5 |

| Head of Household | $21,900 |

| Qualifying Widower | $29,200 |

*A note on Married Filing Separately: This status applies if you are married to a non-US spouse and don’t want them to be on your tax return. Additionally, it also applies if you are not living with them at the end of 2024 due to separation or divorce. If you have a qualifying dependent, you may qualify as Head of Household.

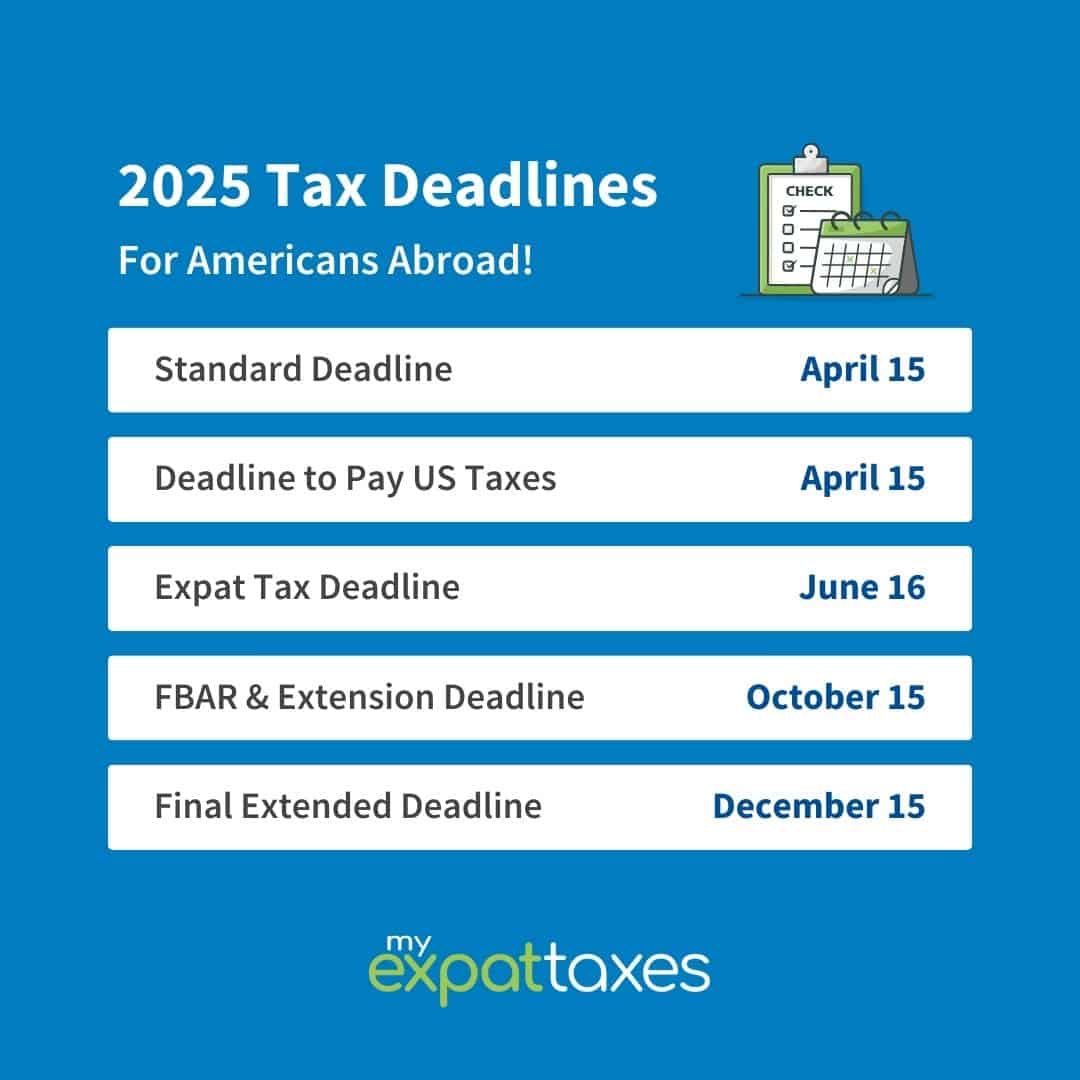

4. US expats get an automated 2-month extension to file

You can see it as a perk that American expats get additional time to file a US tax return yearly.

The IRS allows expats an automatic 2-month extension to file, which gives you time until June 15th to do your tax return. This extension deadline also applies to resident aliens residing abroad and individuals in the military or on duty outside the US.

Expats can avoid scary penalties by filing by the June 15th deadline. However, if you want more time to file, you can file a free tax extension form via the MyExpatTaxes software. This extension gives you until October 15th to file your US tax return.

Note: Due to June 15th falling on a weekend in 2025, the deadline will be moved to the following weekday, June 16th, 2025.

5. This is the last year to claim the third stimulus payment

You cannot receive all of the stimulus payments in 2025, but you can still receive the third payment if you meet the criteria. Stimulus checks were given to Americans as economic relief during the COVID-19 pandemic. You could receive $1,400 as single individual or up to $2,800 if you’re married.

Expats can qualify for receiving stimulus checks by being a US citizen/Green Card holder, having a Social Security number, and filing a 2021 tax return. Plus, you’ll need to have adjusted gross income up to $75,000 for individuals, $112,500 for the head of household filers, and $150,000 for married couples filing joint returns. You’ll have a reduced stimulus check if your AGI is above those thresholds.

6. It’s no longer complicated to file US expat taxes

We understand there are expat tax software companies out there claiming you can file taxes in 10 minutes (which is impossible) or they don’t have some of the most important documents you need, such as the FBAR.

TurboTax, for example, is tax software built for US taxpayers living and working in America. However, it does not offer the FBAR, which is an extremely important form for expats who have had over $10,000 or more in all of their foreign financial accounts at any one time during the year. Penalties for not filing are high.

We designed US tax software for expats that includes all the tax forms needed to file a standard US tax return. For more complicated tax situations, expats can upgrade to higher support levels—but we’ve never turned down an expat because of their complicated situation. We have always built a solution in our software to accommodate all expat tax profiles.

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More Information7. You can extend your tax filing duty for free for October 15th

US expats already receive a two-month extension until June 15th, but if more time is needed, expats can file an extension for free with MyExpatTaxes.

Note that expats do not need to file with us, in order to file an extension.

8. There are many US tax forms expats need to fill out every year

As a US American expat, you don’t just need to file Form 1040, the Income Tax Return. Living abroad means filing an additional form or two because you have to take foreign-sourced income into account. In fact, there are several tax forms expats should be aware of.

- Form 1040 – US Individual Income Tax Return +

- Form 1040, Schedule 1 (For Foreign Earned Income Exclusion)

- Form 1040, Schedule 2 & Schedule 3 (For Foreign Tax Credit)

- Schedule A – Itemized Deductions

- Schedule B – Interest and Ordinary Dividends

- Schedule C – Business Income

- Schedule D / Form 8949 – Capital Gains Income

- Form 2555 – Foreign Earned Income

- Form 1116 – Foreign Tax Credit

- Form 8812 – Additional Child Tax Credit (For US Tax Refunds for Families Abroad)

- Form 8833 – Treaty-Based Return Position Disclosure (For Tax Treaty Benefits)

- Form 4868 – Application for Automatic Extension of Time To File US Individual Income Tax (If you need the extra time!)

- (FBAR) – FinCEN Form 114 – Report of Foreign Bank and Financial Accounts

- Form 8938 – Report of Foreign Bank and Financial Accounts / FATCA

These forms won’t be intimidating if you use the MyExpatTaxes software, which helps you fill them quickly, step-by-step, in understandable language.

9 & 10. There are two US expat tax benefits to take advantage of (FEIE and FTC)

Double taxation is one of the most critical aspects of an expat’s tax case. The IRS has made an effort to create tax treaties with certain countries worldwide to stop US citizens abroad from getting double taxed.

Additionally, the IRS provides expat tax benefits that limit or completely eradicate double taxation from your tax return:

The Foreign Earned Income Exclusion

Known as the FEIE, expats can exclude up to $126,500 of foreign earned income from their 2024 US expat taxes. You will need to convert your foreign currency into USD when reporting it on Form 2555 (or better yet – use MyExpatTaxes!).

To be eligible for the FEIE, expats can use the Physical Presence Test or Bona Fide Residence Test:

- Physical Presence Test: You were outside of the US for 330 full days in a consecutive 12-month period, beginning or ending in the tax year.

- Bona Fide Residence test: You were a registered resident and subject to local taxes in your host/foreign country for a full calendar year.

Foreign Tax Credit

The FTC is a dollar-for-dollar tax reduction from the IRS that goes toward your foreign earned income. You can avoid double taxation using the FTC by:

- Checking whether your income is passive or falls into another Foreign Tax Credit category

- identifying which income is foreign-sourced

- Keeping records of all unused Foreign Tax Credit for next year.

- Calculating the maximum Foreign Tax Credit amount you can claim on your tax return through Form 1116

Plus, you can look at your country’s tax treaty to determine whether your US-sourced income from business trips could be considered foreign income.

11. American expat parents can receive tax credits even if they don’t pay taxes

Expat families can save money with their US taxes through the Child Tax Credit. So, regardless of where a US citizen’s family lives or works, the US provides financial assistance in tax refunds and credits.

For each qualifying child – under the age of 17 and has a valid Social Security Number – a $1,700 tax credit can be claimed. This credit can go towards any US taxes that are owed. Otherwise, if families don’t owe taxes, then this money becomes refundable. If you lived within the US for more than half of 2024, then you can claim an even higher refundable Child Tax Credit.

Essentially, families can get money back even if they don’t pay US income taxes. Our professional human support team will help you figure out if you can get this refundable credit!

12. Expats may need to file US state taxes

US citizens living abroad may have to file state taxes. The truth is, you’re not automatically excluded from paying taxes if you’re living abroad.

Generally, Americans abroad only need to file a state tax return along with their federal tax return if:

- They are considered domiciled (having a permanent home) in that state

- Have lived in the state for a part of the tax year (January 1st-December 31st)

- They have earned money working in the state – even if temporarily

Most importantly, you will need to review your state’s filing requirements since all US states have their laws. You’ll be able to tell if you need to file state taxes by walking through our software. Otherwise, we suggest you contact one of our friendly support team professionals!

13. You may need to file an FBAR

You are currently viewing a placeholder content from YouTube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationThe Foreign Bank Account Report is a form every US expat may need to file. If you have had at least $10,000 in total in any foreign financial accounts at any one time during the tax year, you need to file the FBAR. Even if you do not need to file a US tax return, you may have to file an FBAR because of this obligation written above.

Therefore, whether you have a foreign bank account, like savings, checking, or investments, you’ll need to file the FBAR. Additionally, you need to file if you have signatory authority over a foreign financial account (e.g., a shared bank account with a spouse).

You must check your bank account statements monthly to determine whether you need to file an FBAR. You also need to convert your foreign money into USD as part of the FBAR reporting requirements.

You can file your FBAR easily through the MyExpatTaxes software in as fast as 15 minutes. If you are not sure you need to file one, you should be safe because penalties can range in the thousands!

14. Amending previous tax returns is possible

The amended tax return expats can use to amend their tax return is Form 1040-X. This form allows you to file an amended tax return of up to 3 years after the date you first filed. Or, if you paid taxes, you can file it within two years from the date you paid your taxes.

Furthermore, amending a tax return can put you on the IRS audit list. Therefore, we give expats checks to make sure they add the correct information, and if something doesn’t seem right, they can contact us.

15. Don’t miss the deadlines, or you may get penalties

The 2025 tax deadlines and extensions include June 15th (June 16th, 2025) as the filing deadline and October 15th as the expats’ extension deadline.

If expats don’t meet the filing and/or tax payment deadlines, penalties and fines can happen:

Common penalties include:

Failure to file – when you don’t file your tax return by the return due date, April 15th, or extended due date if an extension to file is requested and approved

Failure to pay – when you don’t pay the taxes reported on your return in full by the due date, April 15th. An extension to file doesn’t extend the time to pay

Failure to pay properly estimated tax – when you don’t pay enough taxes due for the year with your quarterly estimated tax payments, or through withholding, when required

Dishonored check – when your bank doesn’t honor your check or other form of payment

IRS

As you can see, it’s encouraged to pay and file US expat taxes on time to avoid these hefty finances.

16. Expats need to limit travel to the US to 35 Days

If you want or have to file under the Foreign Earned Income Exclusion, expats may need to limit US travel to less than 35 days a year.

Traveling to the US too much can cause expats to fail the Physical Presence Test and, therefore, not claim the Foreign Earned Income Exclusion.

Therefore, those who cannot pass the Bona Fide Resident or use the Foreign Tax Credit approach because they do not pay income taxes to their host country should not be more than 35 days in the US. If you can use the Foreign Tax Credit, then no such restrictions apply!

17. Expats can make up years of late taxes penalty-free

As long as you are innocent, meaning you forgot or did not know you had to file US expat taxes while living abroad, you can apply for the Streamlined Procedure. The IRS creates this tax amnesty program to help Americans make up years of non-filing without penalties.

To be eligible for the Streamlined Procedure:

- You did not live in the US with a home for the last three years

- Were physically residing outside the US for more than 330 days

- Have not filed a US tax return in 3 years

- Have not filed amended or delinquent tax returns

- In the last six years, did not file an FBAR

MyExpatTaxes offers the Streamlined Procedure for one-third of the price compared to other tax companies.

18. Renouncing US citizenship is difficult

Renouncing your US Citizenship is irrevocable. It is generally advised not to state that tax avoidance is why you are renouncing your US citizenship, as this may cause issues down the road. You also need to be tax compliant – having filed and paid all due US expat taxes before you can renounce citizenship.

Expats who want to renounce their US citizenship must do three things:

- Appear in person at a US Embassy or Consulate

- Sign an oath of renunciation

- Pay a fee of about $2,350.

Additionally, you’ll also need to give up your US passport.

19. Self-employed expats have different responsibilities

As a self-employed expat, you’ll need to pay a self-employment tax separately after calculating your net profit. Therefore, Social Security taxes and Medicare taxes will be for you, and the process will be similar to wage earners in the US who withhold from their pay.

Therefore, you’ll need to figure out your self-employment taxes yourself or with a MyExpatTaxes professional. The 2024 self-employment tax rate is 15.3% of your net profit. The Schedule SE on Form 1040, which is found on our app, can be used.

Since you are your boss, you’ll need to figure out self-employment taxes by yourself. You can use the self-employment tax (SE tax) Schedule SE on Form 1040 or 1040-SR. Or better yet, our app. Furthermore, you also need to deduct your employer-equivalent portion of your self-employment tax.

Have a US business, but living abroad? In general, if you have a (single member, disregarded) US business, you will need to report your business income on Schedule C. From there, you can either look to use FEIE (2555) or FTC (1116) to reduce your US income taxes owed. Watch out for a self-employment tax of 15.3% on your net profit.

MyExpatTaxes will see if you are eligible to opt out of that tax via the Totalization Treaty.

20. MyExpatTaxes Specializes in Tax Software for Expats

We are the most trusted US tax software company for expats to date. We have happily helped more than 3,000 customers. Check out Google, Facebook, and Trustpilot for proof. File with a company that knows your struggle as a US expat!

Sign up for free and start filing your US taxes with MyExpatTaxes.

Written by Nathalie Goldstein, EA

Nathalie Goldstein, EA is a leading expert on US taxes for Americans living abroad and CEO and Co-Founder of MyExpatTaxes. She contributes to Forbes and has been featured in Forbes, CNBC and Yahoo Finance discussing US expat tax.

January 3, 2024 | Featured | 12 minute read